2018-11-30 23:43 |

AZTEC is a new startup in the crypto industry with an important mission – making Ethereum transactions private. Their efforts would allow financial institutions to use the blockchain without concern of security and maintaining anonymity.

To do so, the startup was announced to be involved in a $2.1 million seed round, led by ConsenSys Labs. Other investors that contributed included Entrepreneur First, Samos Investments, Jeffrey Tarrant (Mov37) and Charlie Songhurst.

The startup was developed by Tom Pocock, a mathematician, and Zachary Williamson, a nuclear physicist. With the use of zero-knowledge proofs (zk-SNARKs), the duo makes it possible to improve the protection of privacy on the otherwise transparent ledger.

However, they boast that it is “twice as efficient as other known technologies on the network,” most likely referring to how ZCash currency already uses the technology. Banks are the subject of the protocol, and a partnership with CreditMint will make it possible to use the technology when they issue corporate debt and trade. Pocock noted,

“We have been talking to more than 20 leading financial institutions, specializing in corporate private debt, among which are global top-10 banks.” “The first group of users that can access the new technology will not be announced until January next year. However, one of the other benefits to the AZTEC tech is the speed of settling loans.”

Right now, the blockchains that typically appeal to the bigger banks are private and permissioned, like what CLS launched only days ago, naming Goldman Sachs and Morgan Stanley as the first users. However, public blockchains offer a lot to established financial institutions, according to Pocock. He added,

“Immutability, single-source data and elimination of settlement risk are strongest on public chains — but clearly, financial institutions demand full transaction privacy.”

So far, this opportunity has not been made available on the Ethereum public chain, “and therefore, capital markets activity has been restrict to private blockchains,” he said. Before the discussions with ConsenSys began, AZTEC graduated from a London tech accelerator called Entrepreneur first in March of 2018.

Min Tea, the executive director for ConsenSys Labs Investments Europe, said,

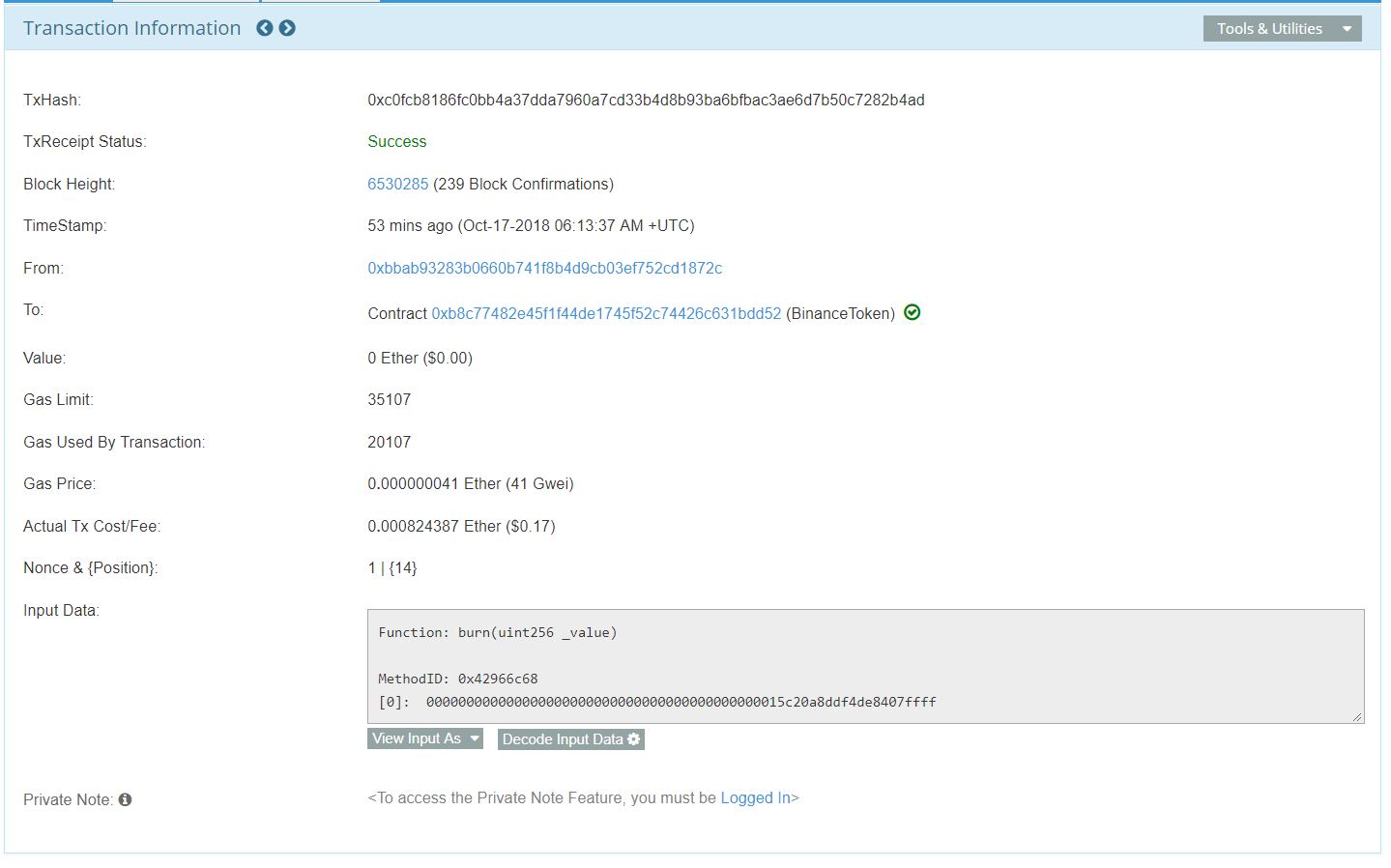

“We were impressed with the resilience of the zero-knowledge proof technology that AZTEC created. Based on what we’re seeing, AZTEC is the closest to production and the most efficient in sense of gas cost.”

The gas cost is a reference to the ether than is required to power a blockchain transaction. Founder of ConsenSys, Joe Lubin, said that,

“This Ethereum design studio of his is proud to support this breakthrough from AZTEC and CreditMint, bringing zk-SNARKs-based privacy, confidentiality and scalability to a wide variety of asset transactions on public Ethereum.”

Right now, the only thing to do is wait to see if a zero-knowledge, proof-based system has the ability to surpass the scalability of the Ethereum blockchain, seeing if it meets the needs of enterprises. Pocock believes that the protocol is prepared. He said,

“Without scaling we can put one transaction per second through the public network – this will be orders of magnitude faster with upcoming scaling to the network. Even today, it is more than sufficient for CreditMint to move the private corporate debt markets onto the public blockchain. It takes milliseconds to both construct and verify AZTEC zero-knowledge proofs.”

Ethereum founder Vitalik Buterin commented in September that the use of zk-SHARKs (“Zero-Knowledge Succinct Non-Interactive Argument of Knowledge”). These protocols require no interaction between prover and verifier, but he believes that it would boost Ethereum’s scalability to 500 transactions per second.

There have been multiple attempts in the industry to improve the Ethereum protocol’s privacy with zero-knowledge proofs, including:

JP Morgan, adding it to Quorum (October 2017) EY, integrating it into the Ops Chain Public Edition prototype to sell “product and service tokens” (October 2018) Adhara, for a payments mechanism in the South African Reserve Bank (October 2018)The protocol, which stems from Zcash company, was featured in a video last month. Jack Gavigan, the head of product and regulatory relations for Zcash Company, believes that the technology is still young, but should solve scalability as it grows over the next “12 to 18 months.”

Pocock believes that AZTEC is set apart from these projects because of their use of the Ethereum MainNet, and because it is “significantly more efficient in terms of gas costs. Over the next few months, AZTEC will continue to add other features to increase scalability and raise additional funds.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|