2018-10-17 10:19 |

Binance Torches $17 Million In BNB For 5th Quarterly Burn

When Binance’s whitepaper was first released in early-2017, many investors were immediately drawn to the startup’s proposed quarterly buyback policy, in which Binance would allocate 20% of its profits to buy back its in-house digital asset (BNB) at market values in an apparent bid to please investors.

Since the platform’s launch and the surge in the price of BNB, the project’s buyback policy has been an event for crypto enthusiasts to mark down on their calendars. But amid the recent tumultuous market conditions, with feelings of confusion flying every which way, many investors forgot that Binance was slated to burn more of its tokens yet again.

But now, as made clear by a tweet from CEO Changpeng Zhao, who is widely regarded as a golden child of the crypto world, Binance’s fifth ever burn has just occurred and was arguably rather successful.

Burn completed. Fastest way to spend money. https://t.co/JcWekT1bHf

— CZ Binance (@cz_binance) October 17, 2018

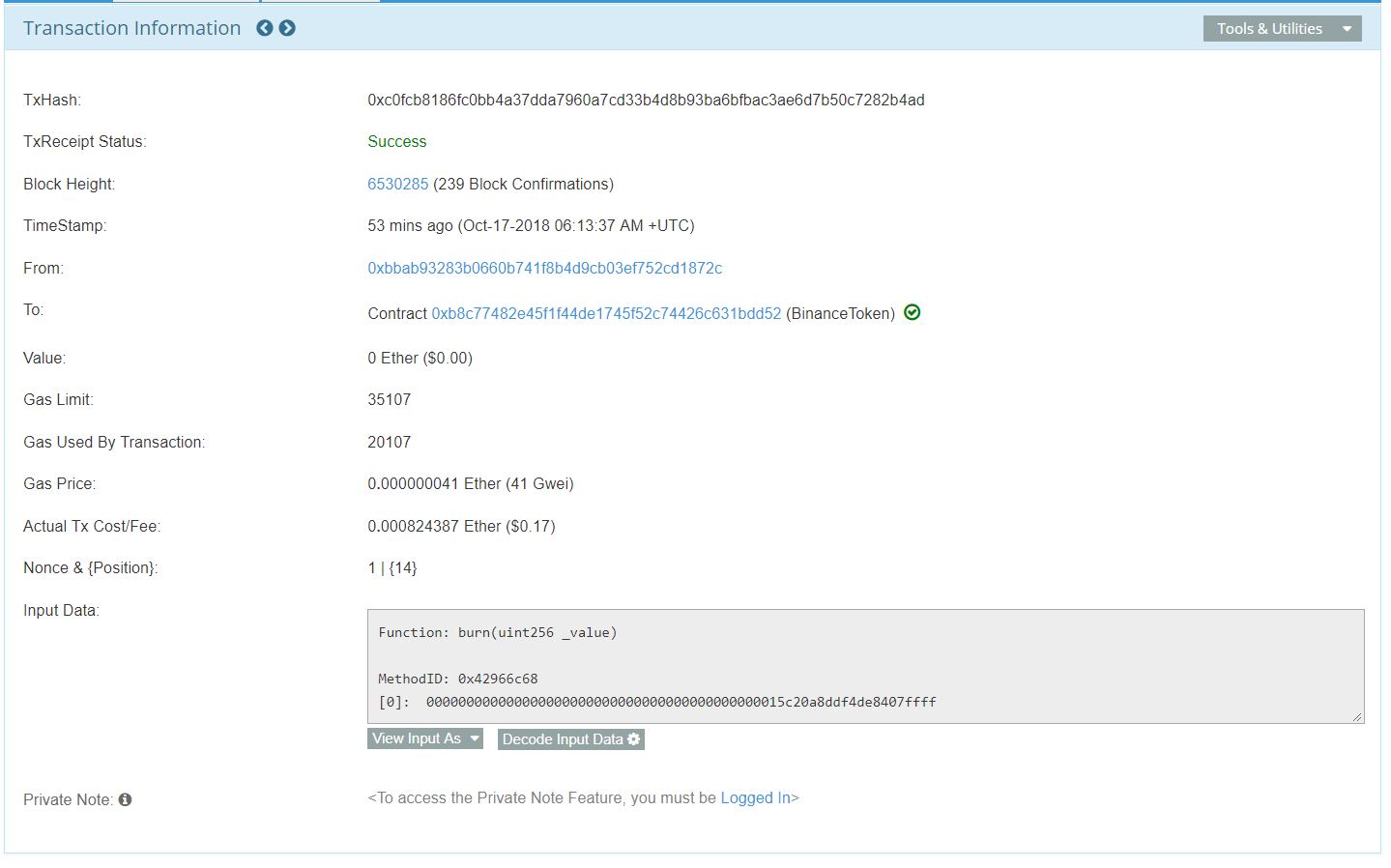

Per the official announcement from the ‘unicorn’ crypto startup, “in accordance with its whitepaper,” it had burned 1,643,986 BNB, roughly valued at the U.S. dollar equivalent of $17 million. Along with divulging the specifics of the buyback, Binance also linked the Etherscan-based transaction log of the burn in a bid to stay transparent.

The burn of $17 million worth of tokens indicates that Binance raked in $85 million in the 3rd fiscal quarter of 2018, which came as a surprise to pessimists, who expected for crypto platforms to see profits all but evaporate. Although $85 million is no amount of money to scoff at, it is important to note that the exchange burned $32.7 million worth of BNB in Q2 of 2018, indicating that Binance’s profits have seen a 50 percent haircut, so to speak.

So while the firm is far from a state of financial disrepair, for the first time, the startup’s profits have shrunk quarter-over-quarter, likely indicating that 2018’s bear market had some negative effect on Binance’s operations.

Despite Shrinking Profits, Binance Continues ExpansionIn spite of shrinking profits, Binance has continued its global expansion plan. which continues to gain steam at a breakneck pace. Just recently, as reported by Ethereum World News, the multi-billion-dollar startup launched its first-ever fiat-to-crypto exchange in Uganda, adding support for Bitcoin (BTC) and Ethereum (ETH) to be traded against the Ugandan Shilling.

Along with publicly unveiling Binance Uganda, along with two other fiat-supported platforms in Singapore and Liechtenstein, the world-renowned startup has also made moves towards opening a decentralized exchange (DEX), which will free the shackles placed upon the common consumer by centralized platforms. Zhao, the aforementioned CEO, recently revealed that a beta version of Binance DEX could go live as early as the end of 2018, which further brings credence to the point that the firm’s shrinking profits have had no effect on company morale.

Due to the fact that Binance’s quarterly burn reduces the circulating supply of a crypto asset, many investors have long seen this predictable action as a bullish indicator for BNB from a price standpoint. For now, however, BNB has yet to move on the back of this news. But, as seen with previous token burns, a strong, yet slow move to the upside could be in the cards.

Photo by Marek Szturc on UnsplashThe post Q3 2018: Binance Rakes In $85 Million, Burns 1.6 Million BNB appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) íà Currencies.ru

|

|