2020-5-7 16:22 |

Bitcoin’s latest rally is breathing new life into proponents’ overall outlook. The crypto-asset has firmly surmounted resistance level after resistance level, recently breaching $9,300.

As the halving draws closer, bulls are making their prognostications about where they expect the bitcoin price to go in the coming months. Some like Fundstrat’s lead strategist David Grider are giving conservative targets of around $14,350 per BTC twelve months from now. Then, there’s this popular analyst who believes bitcoin is primed to shutter $100,000, whether you like it or not.

Bitcoin Will Hit $100K: AnalystBitcoin is currently valued at $9,297.03. A valuation of $100K would mean that the top-ranked cryptocurrency by market capitalization registers a staggering 1,075% price increase. According to analyst Bitcoin Macro, this is bound to happen whether you presently believe it or not.

In a tweet on May 6, the analyst shared his bullish forecast for BTC, noting that the crypto-asset will surge to $100,000. He did not, however, mention the timeline when he expects BTC to eclipse the elusive $100K level.

Most of his followers agreed with his prediction, some even suggesting that he was low-balling the BTC price target.

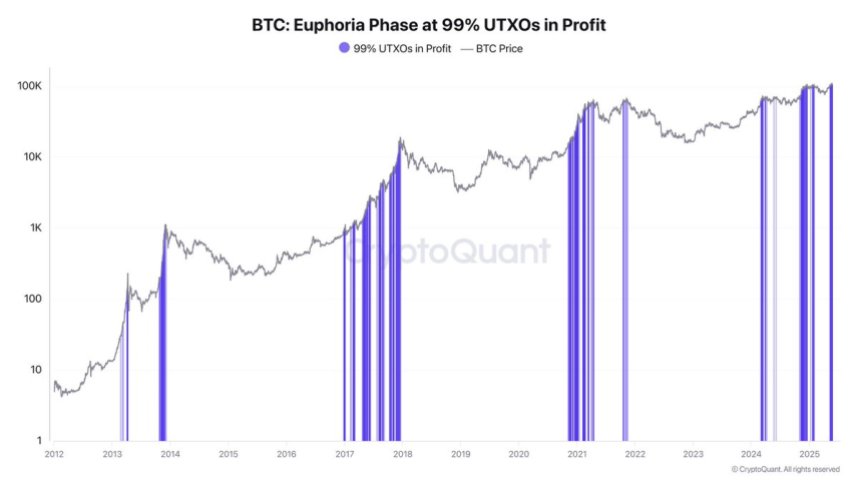

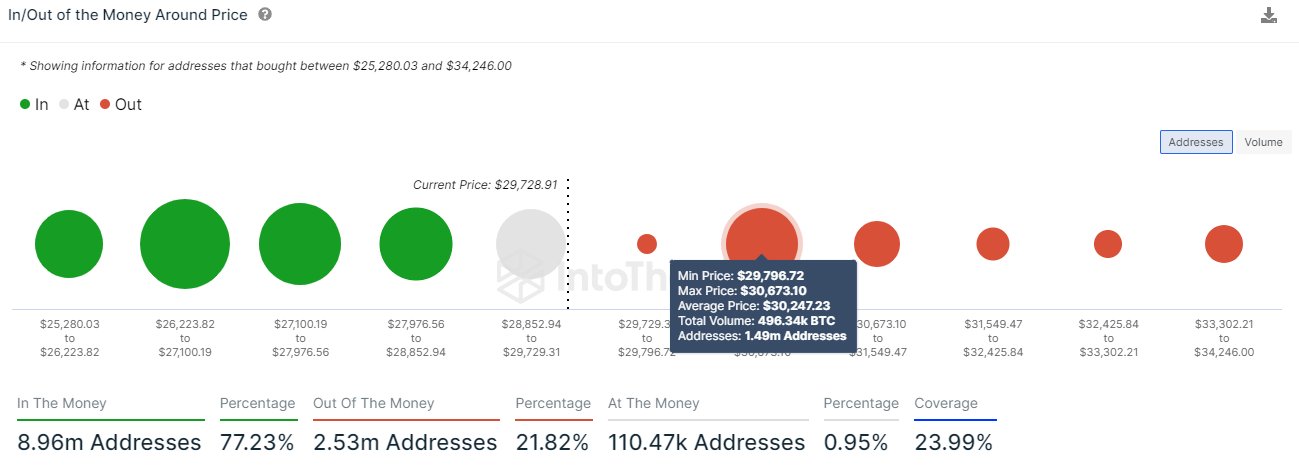

Is $100,000 Achievable?A closer look at historic market data and the performance of bitcoin after previous halvings shows us that Bitcoin Macro’s prediction is not inconceivable after all.

The bitcoin price has historically rallied hard after halving. For instance, after its first halving in 2012, BTC skyrocketed 10,000%. The top cryptocurrency posted a 2500% gain after the second halving in 2016.

However, history doesn’t always repeat itself. But as Mark Twain stated, it often rhymes. As such, many crypto enthusiasts expect bitcoin to stage a monster rally after the halving that is now only 4 days away.

That said, gains of over 1,075% as suggested by Bitcoin Macro are certainly attainable based on how bitcoin has performed post-halving.

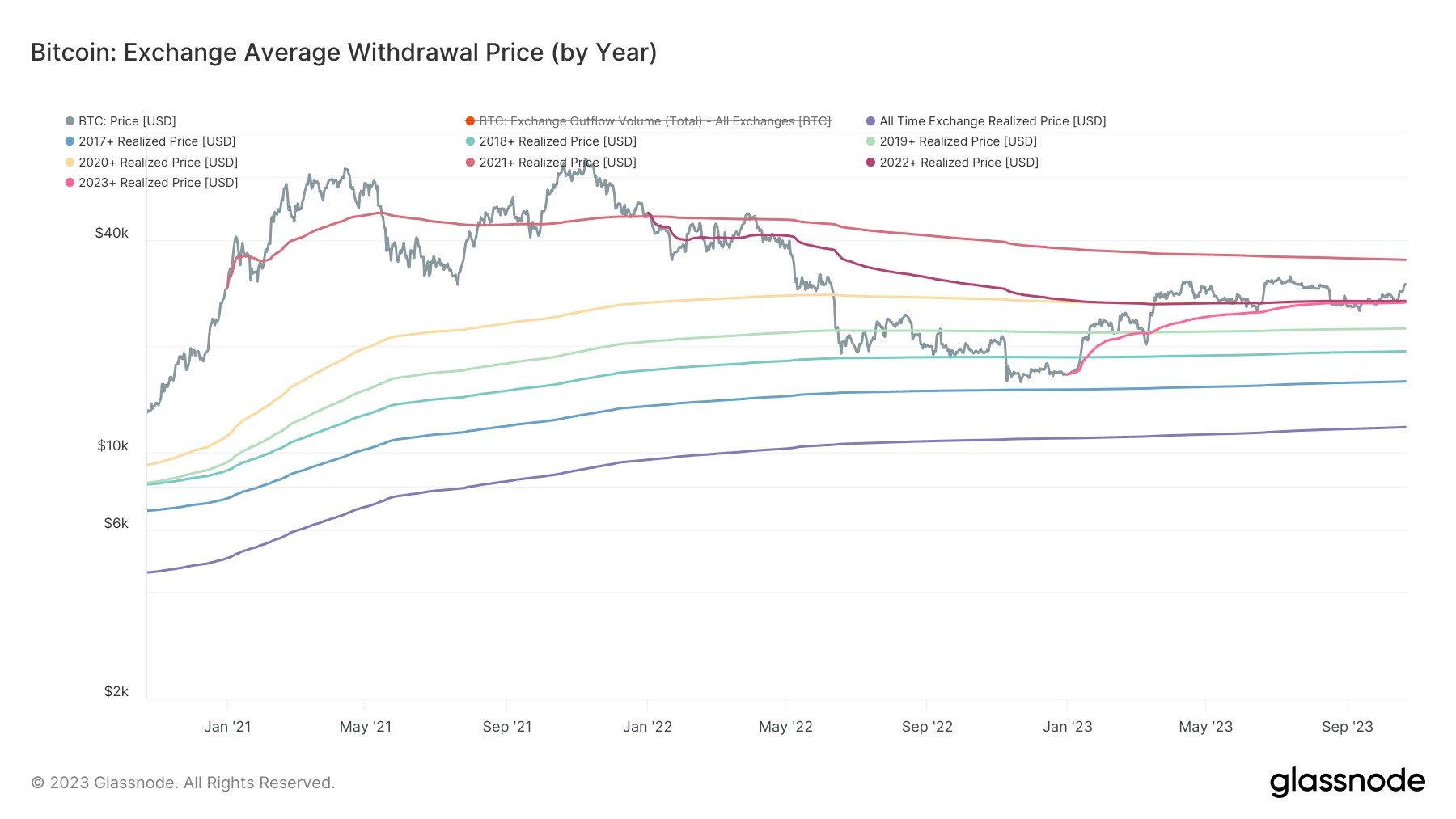

Far From The Only BTC BullSeveral analysts share a similar bullish outlook for bitcoin after the halving event. As ZyCrypto reported earlier, Pantera Capital’s Dan Morehead sees bitcoin crossing the $115,000 mark by August 2021.

Other market pundits believe the growing US debt coupled with the unlimited quantitative easing that has been unleashed is only strengthening BTC’s bullish case. The US national debt recently surpassed $25 trillion and the Treasury promised to borrow another $3 trillion in this quarter to bolster the flailing economy.

Many are of the opinion that these actions by the US government will have dreadful consequences on the global economy, and most people will turn to bitcoin which is resistant to debasement – unlike fiat currency. Top BitMEX trader going by the online alias TheBoot believes that a cocktail of these fundamental factors is likely to push bitcoin above $20,000 this year.

Meanwhile, the latest Stock-to-Flow model reimagining, S2FX, puts the bitcoin price at $288K by 2024 as a result of the reduction in bitcoin’s issuance rate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|