2021-8-25 17:23 |

Breaking above $50k, Bitcoin price has recovered from the $29,760 low in July. As of writing, BTC/USD is trading around $47,500, about 26.7% down from its peak four months back.

Just like price, other data metrics suggest that the leading cryptocurrency is on a path to recovery after the market-wide sell-off just three months ago when the government’s crackdown caused Chinese miners to suddenly shut down their operations.

As miners and investors sold their BTC amidst the news of crackdown and further regulation, BTC’s price crashed by more than 50% and altcoins between 60% to 95%.

Besides price, mining operations moving out of China caused the Bitcoin hash rate to plummet to its lowest level since 2019. But as we reported, it started to recover in July and August and is already back near 150 Th/s.

CryptoQuant's data shows that Bitcoin's hashrate reached 152EH/s on August 23, the highest since June 8. pic.twitter.com/BGTydF99RD

— Wu Blockchain (@WuBlockchain) August 25, 2021

The recovering hash rate is a signal that mining operations are starting to come back online in new locations overseas and that the worst of the crackdown is over.

Bitcoin’s usage is also climbing, growing 4.6% week-over-week. Additionally, BTC SOPR (7-day average) has turned positive yet again in August, “a sign that the capitulation period has ended and that the market is back on more solid ground.” Back in June, it turned negative, meaning investors were selling at a loss.

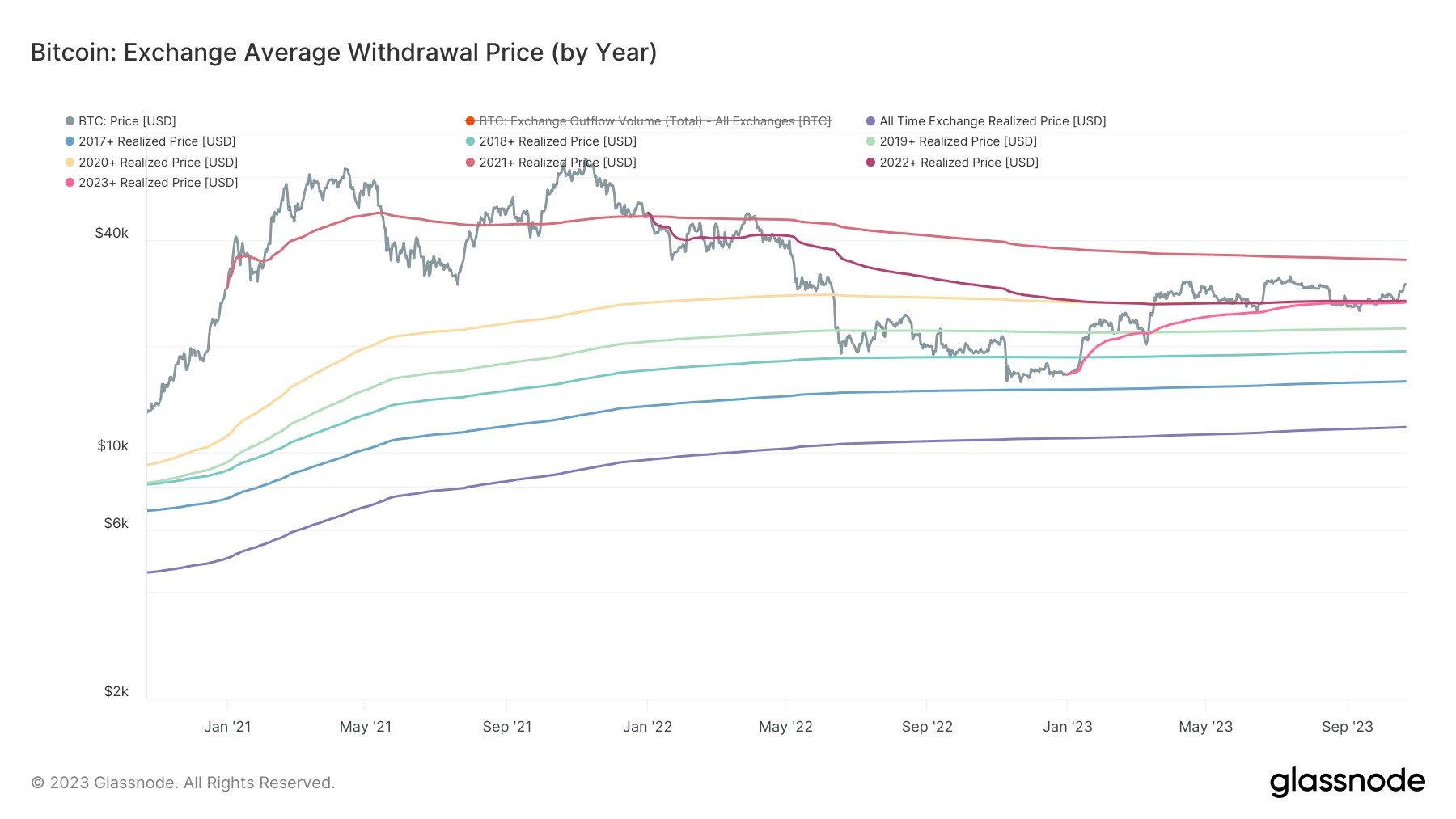

Last week actually saw some minor profit realization on-chain by long-term holders, according to the Exchange Net Flow metric, which showed net inflows to exchanges, not dissimilar to that seen through Dec 2020 to April 2021 bull market period, as per Glassnode data.

According to glassnode insights, the number of bitcoins held by long-term holders reached an all-time high, reaching 12.69 million bitcoins, exceeding the previous peak in October 2020. pic.twitter.com/ATqUCxcaaG

— Wu Blockchain (@WuBlockchain) August 25, 2021

In the meantime, open interest for Bitcoin perpetual futures has started to climb back up and returned to May levels. OI which is a measurement of the total number of active futures contracts, currently indicates that additional money is coming into the market.

Open interest can also serve as a proxy for measuring leverage, and high OI means there’s a good chance there’s a high amount of leverage in the futures market as contracts are usually opened using leverage.

Based on the funding rate, the highest currently at 0.0691% on Bybit, speculators have yet to ape in. Meanwhile, Binance and FTX reduced their maximum amount of leverage to 20x last month, down from the previous max of over 100x.

In the options market as well, OI is at multi-month highs, rising by 150% from late June low to $9.06 billion now.

“Although open interest is rising the overall amount of leverage is likely lower than seen in April and May. Lower leverage should help reduce the risks of the extreme liquidation cascades that occurred during May’s crash,” said CoinMetrics.

Bitcoin/USD BTCUSD 48,909.4589 $929.28 1.90% Volume 32.78 b Change $929.28 Open$48,909.4589 Circulating 18.8 m Market Cap 919.36 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Additional Money Is Coming into Bitcoin as Capitulation Period Ends and Hash Rate Climbs to Early June Level first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|