2021-2-11 16:59 |

Decentralized Finance (DeFi) fever is getting on everyone. As we reported this week, the Federal Reserve of St. Louis published a report on DeFi, which it said may bring the paradigm shift in the financial infrastructure.

The $600 billion asset manager, AllianceBernstein, explains the importance of DeFi protocols to its clients. Back in December only, the investing giant changed its mind on Bitcoin’s role in asset allocation. Now, it is covering the “value proposition of DeFi.”

According to the research note intended for clients, “DeFi competes with banks and financial institutions through DeFi is nowhere close to their size yet.”

The burgeoning sector provides the same core functions as financial institutions with advantages in cost reduction, speed, transparency, and accessibility. The asset manager notes that DeFi cuts the middleman and offers a nominal fee by principle and design. Also, cryptocurrency transfers through DeFi are much faster than traditional services, with the smart contracts underlying the entire system self-executing.

In the traditional system, the financial institutions' mechanisms and formulas and government regulatory choices can seem like black boxes, not to mention the concern regarding a centralized point of failure with banks, such as the Lehman Brothers collapse, notes the report.

According to the asset manager, dApps are much more transparent by design with a governance model that is decentralized and more democratic. Furthermore, it is accessible to anyone with an internet connection.

Currently, 5.4% of U.S. households that is about 7 million, are “unbanked” while many more (about 1.7 billion people) are under underbanked globally, where “DeFi is an attractive potential set of solutions for accessibility and transparency reasons, as well as the more obvious store of value use case to hedge against inflation,” reads the report.

With Bitcoin is making its way to the balance sheet of major US companies, the DeFi sector is also making its presence known among the mainstream financial institutions.

As we have been seeing, Shark Tank's Mark Cuban has been endorsing DeFi for some time now. Cuban, who used to find more utility in bananas, attributed his change of mind to DeFi as he explained,

“That was pre de-fi. DeFi and many other dapps changed everything. Now Btc is more than a SOV because of its swap utility.”

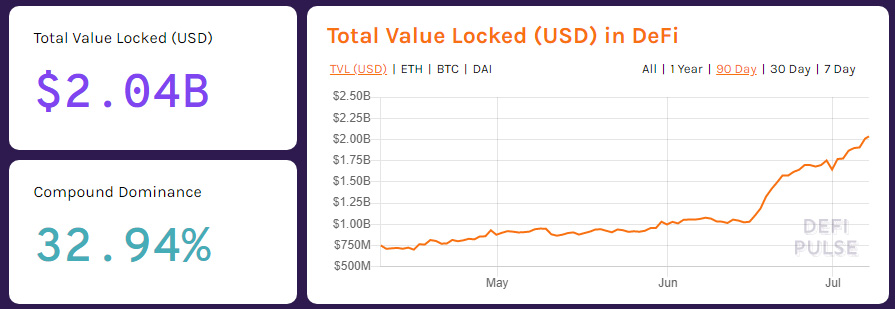

Interestingly, the entire DeFi sector only has just under $40 billion locked in it.

The post 0B Investing Giant Talks DeFi’s Value Proposition; Competes with Banks But Nowhere Close to their Size Yet first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Circuits of Value (COVAL) на Currencies.ru

|

|