2020-3-19 19:05 |

By Amy Luo

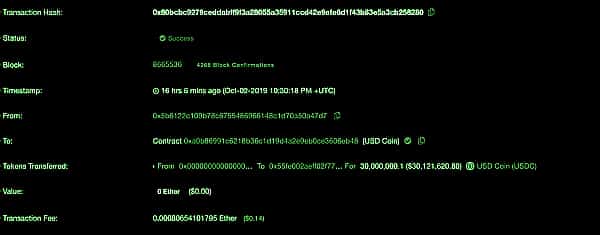

USDC is a fully collateralized US dollar stablecoin, created by the CENTRE Consortium, an open source technology project co-founded by Coinbase and Circle. Since its launch in 2018, USDC has seen its market share steadily climb to become the second largest stablecoin in the world by market capitalization, in direct correlation with increased consumer demand for a stable, secure, and transparent digital dollar.

USDC surpasses $600 million in market capitalization

As we’ve written before, USDC can be used for send and receive functions (e.g. cross-border transactions and remittances), to facilitate transactions in dapps and exchanges (e.g. buying, selling, lending, investing, and trading), and as a programmable dollar (for developers and fintech companies alike). USDC allows the unbanked and underbanked anywhere in the world to hold a US dollar backed digital asset with a mobile phone. In recent volatile market conditions, we’re also seeing more and more consumers and institutions turn to USDC as a trusted means to weather the turbulence. Each USDC is backed by one US dollar that’s held in an established US bank and its reserve balances are attested to by top-five accounting services firm Grant Thornton LLP. It’s free to buy USDC with a bank account, and Coinbase customers can convert their USDC into any supported cryptocurrencies on Coinbase.com or convert and withdraw in US dollars anytime. Further, eligible consumers can also earn rewards for the USDC that they hold.

MakerDAO adopts USDC as collateral

MKR governance token holders voted on Monday night to introduce USDC as an alternative form of collateral, which means that USDC can now be used to open Vaults to generate DAI. The vote was in response to recent events surrounding DeFi application MakerDAO when ETH dropped from $194 to $124 in a few short hours resulting in over $4MM of CDP positions being liquidated. The move is expected to increase DAI liquidity and stability. For more information, please see MakerDAO’s blog.

USDC is available on Coinbase.com, Coinbase Pro, Coinbase Wallet, Coinbase iOS and Android apps, as well as the following platforms here. To learn more about USDC please see https://www.coinbase.com/usdc.

USDC is not legal tender. USDC is a digital currency and Coinbase has no right to use any USDC you hold on Coinbase. The information provided above is not intended to constitute legal advice, but for general informational purposes only.

USDC surpasses $600 million in market capitalization and MakerDAO adopts USDC as collateral was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

origin »Bitcoin price in Telegram @btc_price_every_hour

USCoin (USDC) на Currencies.ru

|

|