2018-10-23 20:48 |

Coinbase Adds Circle's USD Coin (USDC) Stablecoin

San Francisco-based cryptocurrency giant Coinbase just announced that it has added support for USD Coin (USDC), a stablecoin designed by competing crypto exchange Circle, the owner of Poloniex.

Coinbase is launching support for the USDC stablecoin. Starting today, Coinbase customers in supported jurisdictions can buy, sell, send, and receive USDC at https://t.co/bCG11KveHS and in our mobile apps. Learn more here: https://t.co/ZPKaIUAAsW pic.twitter.com/z8fFd8mDYp

— Coinbase (@coinbase) October 23, 2018

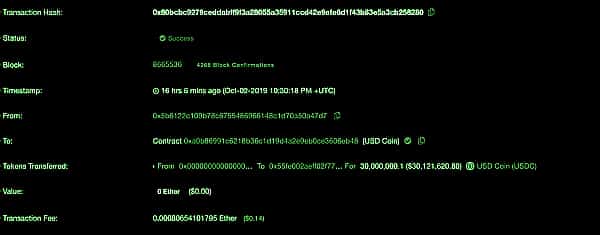

One USDC is a 1:1 representation of a US dollar on the Ethereum blockchain. Each USDC is 100% collateralized by a corresponding USD held in accounts subject to regular public reporting of reserves. The underlying technology behind the USDC was developed collaboratively between Coinbase and Circle.

“Coinbase and Circle share a common vision of an open global financial system built on crypto rails and blockchain infrastructure, and realizing this vision requires industry leaders to collaborate to build interoperable protocols and standards,” Circle co-founders Jeremy Allaire and Sean Neville said

Distinctly, USD Coin will be the first stablecoin supported by Coinbase. Circle was the first issuer of the coin in September. The consortium, called Centre, will serve as a platform for users to make deposits from traditional bank accounts, convert fiat currency into tokens issued by members to facilitate transactions and provide the ability to shift back to the greenback.

Use cases of USDCTo start off with, two Ethereum wallets can quickly send and receive any amount of USDC at any time of day. Large transfers for business purposes become as easy as small e-commerce payments. Consumers can use the Coinbase app to send USDC to someone while remaining confident the value is stable.

There is a burgeoning ecosystem of crypto dApps, exchanges, and blockchain-based games. A USDC follows the ERC20 standard, which means it can be used with any app that accepts tokens based on that standard. The USDC can thus be used as a stable digital dollar to buy items in the crypto ecosystem, from Cryptokitties to tickets for blockchain-based games.

Additionally, for developers and fintech companies, a digital dollar like USDC is easier to program with. For example, given the private keys for USDC, a program can easily send and receive them back and forth using the public Ethereum blockchain.

Final TakeRecently, there has been a large amount of new issuance of stable coins recently as industry enthusiasts try to find more uses for crypto. Tether is the largest of the bunch but is plagued by doubters amid concern as the company has refused to be audited and won’t disclose its banks. Critics of Tether have called into question whether that cryptocurrency is truly backed by the equivalent amount of U.S. dollars.

Similar to Notcoin - Blum - Airdrops In 2024

CK USD (CKUSD) на Currencies.ru

|

|