2019-6-27 16:07 |

Coinspeaker

Could Coinbase’s Brusque Market Disruption Be the Reason for Bitcoin’s Sudden Price Dip?

As of Wednesday, the 26th day of June, at around the 4:45 ET circa 20:45 UTC, Coinbase, US leading crypto exchange recording over $1 million Bitcoin trading volume, reported a server outage within its ecosystem which resulted into a shut down of its websites, mobile dApps, and APIs. Although the internal functionalities of the system weren’t compromised.

According to an interview by Coindesk, a Coinbase spokesman asserted that the site, was fully functional after a system upgrade 15 minutes later:

“We’re back up.” At 5:17 ET, the exchange’s status page noted: “A fix has been implemented and we are monitoring the results.”

Subsequent to these developments, a sister trading dApp – Robinhood, also confirmed outages in its crypto trading features.

Meyer Multiple Bitcoin Price AlgorithmThe Top trading Podcast host, Tracey Mayer’s Bitcoin Mayer Multiple is one rule that finds the multiple of the average price of Bitcoin over the spacing of a 200-day consecutive period.

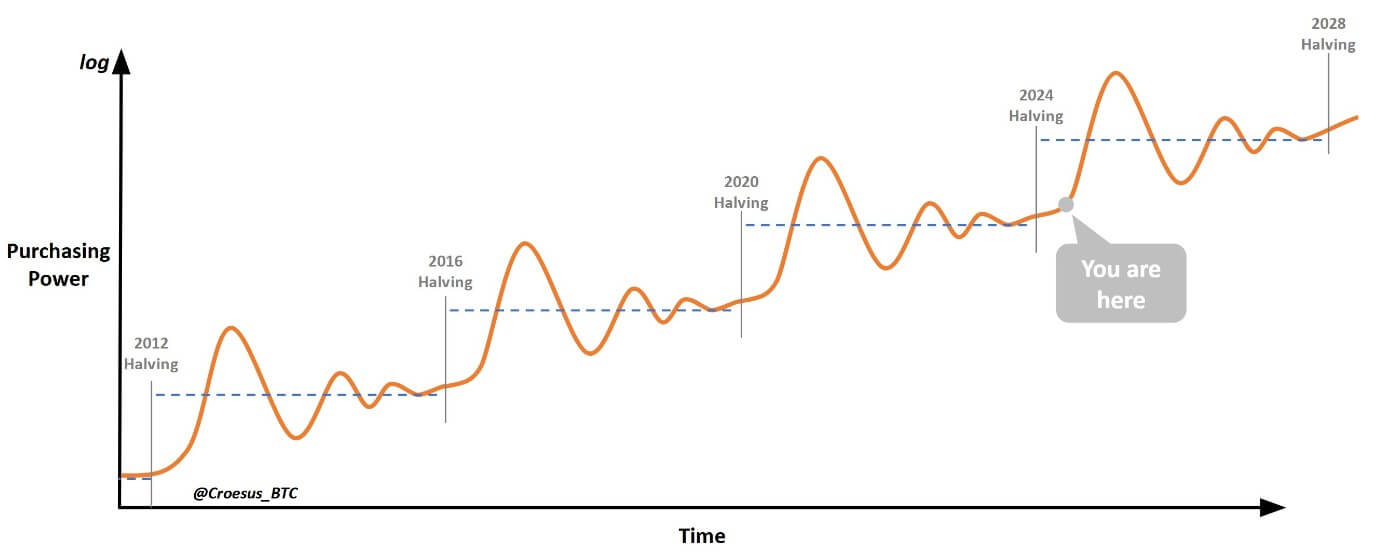

This algorithm projects a favorable market condition whenever the price of Bitcoin rises well above the long term moving average (MA), which was well around $3,000 – $4000 USD over the span of 17 months. The reverse becomes the case when the price or this cryptographic asset falls below this same moving average (MA).

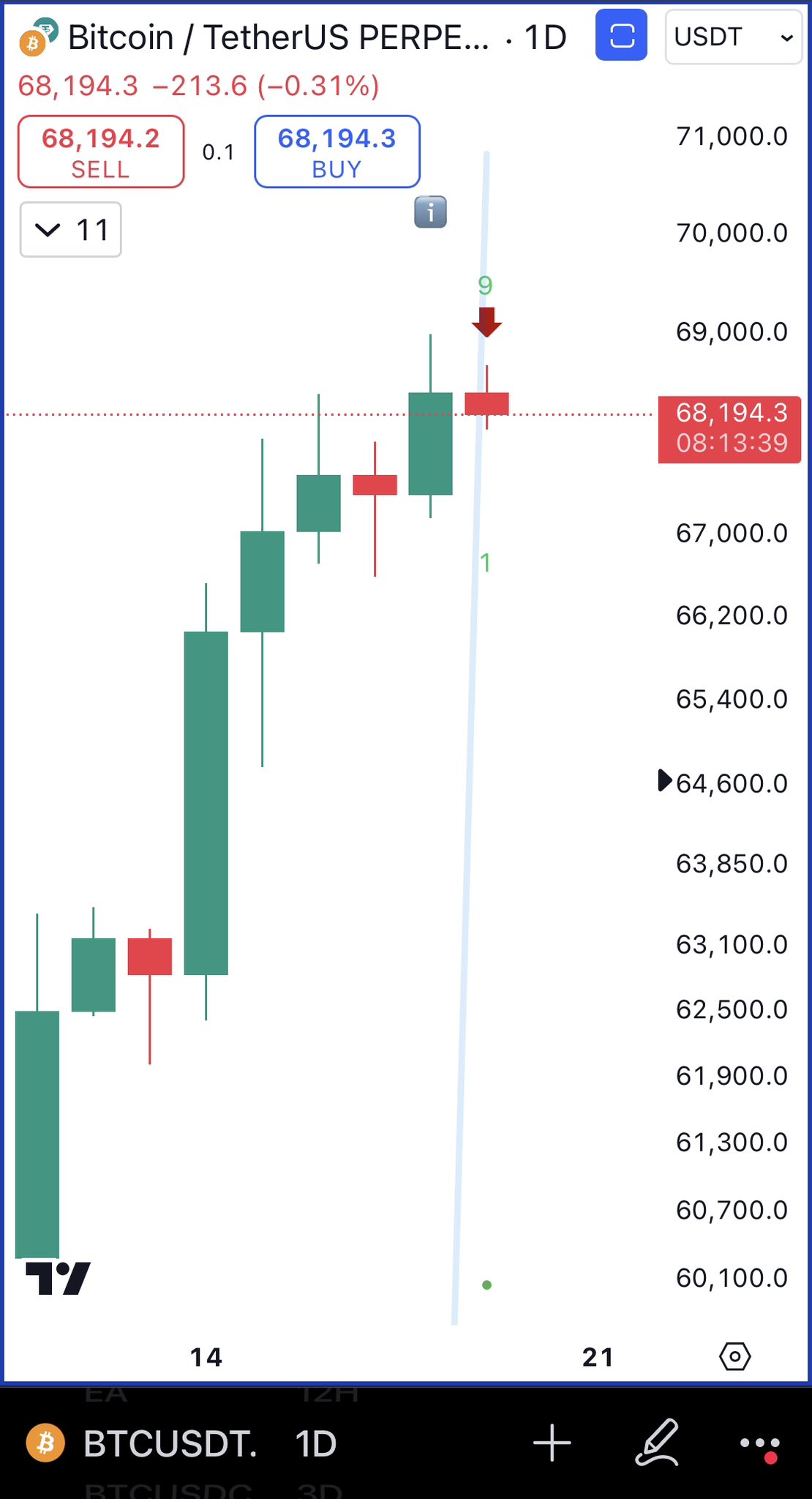

Bitcoin’s Abrupt Plunge in PriceGiven the current trend of events, even a newbie in the crypto-sphere could easily understand the reason for the upsurge. Nonetheless, what appeared to be the awakening of cryptocurrencies turned out to be sourish. Right in the middle of the contemporary hike, the price of bitcoin as at Wednesday, the 26th of June, soared to yet greater heights. Bitcoin price amounted to a whopping $13,796.49 from $11,778.58 in a single day only for it to plummet to $11,914 within the timeframe of 24 hours to date according to CMC.

However, this abrupt plunge over a day span has set expert analysts as well as seasoned investors in an uneasy state. While most trading specialists predict this to be a case of common human factors with regards to emotions, others single this as an after-effect of the Coinbase blackout. Our experts at Coinspeaker are relating this to be as a result of a countermeasure mechanism in preparation for tomorrow’s cease of CME June’s Bitcoin Futures.

If you are an ardent crypto fanatic, you should be well aware of the total market capitalization been propagated by CMC on a real-time basis. By means of the graph-like web-app provisioned by CMC, it is possible to view daily monthly and yearly high. Obviously, the overall total market capitalization of the 2290 digital tokens currently trading globally (including and not limited to BTC, ETH, XRP, LTC, DASH and BNB) has risen from a little over $100 billion to an excess of $350 billion in less than a year.

Could Coinbase’s Brusque Market Disruption Be the Reason for Bitcoin’s Sudden Price Dip?

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|