2024-11-13 17:39 |

The last Bitcoin halving took place in April when the block reward dropped from 6.25 Bitcoin to 3.125 Bitcoin Jesse Myers said Bitcoin’s price needs to go higher for a “supply-demand price” balance to happen When that occurs, the market will “flywheel into mania and a bubble,” which happened in the 2012, 2016, and 2020 Bitcoin halving events

Donald Trump’s re-election into the White House isn’t “the main story” for Bitcoin’s recent price rally, says Onramp Bitcoin’s co-founder.

In a post on X, Jesse Myers said the main reason is that the market is at the “6+ months post-halving” mark.

Taking place every four years, the last Bitcoin halving occurred in April when the block reward dropped from 6.25 Bitcoin to 3.125. As a result, each new block becomes harder to solve with a lower reward.

A reduction in Bitcoin supply typically means an increase in the price of Bitcoin. The next Bitcoin halving is expected to occur sometime in 2028.

According to Myers, a “supply shock has accumulated,” meaning “there’s not enough supply available at current prices to satisfy demand,” adding that a “supply-demand price equilibrium must be restored.”

However, the only way Myers believes this will happen “is for the price to go higher, which will flywheel into mania and a bubble, but that’s how this thing works.”

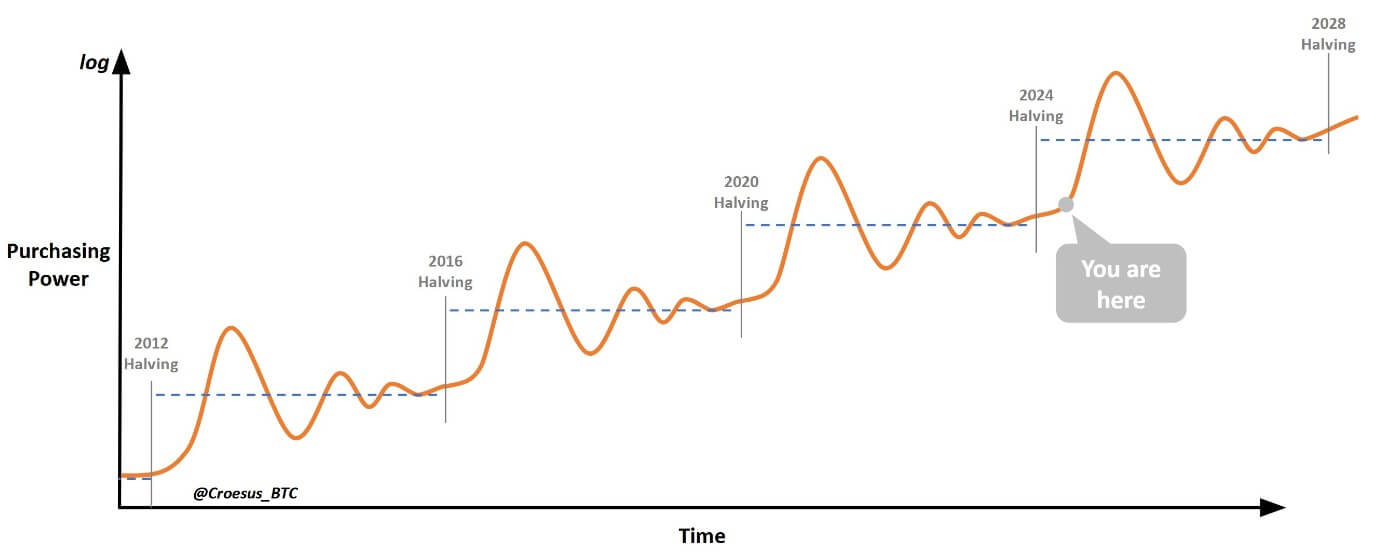

Post-halving bubblesSupplying a chart, Myers indicated that the market is currently at the start of the post-halving bubble. Based on his data, Bitcoin’s price will continue its upward trajectory before peaking to new highs and dropping to current levels.

Jesse Myers’ Bitcoin post-halving chart. Source: Jesse Myers“It sounds crazy to say there will be a reliable, predictable bubble every 4 years,” said Myers. “But then, there’s never been an asset in the world where new supply creation is halved every 4 years.”

Post-halving bubbles happened in the 2012, 2016, and 2020 Bitcoin halvings, said Myers.

The recent Bitcoin price rally comes amid Trump’s re-election into the White House. Based on his campaign trail in the lead-up to election day, Trump came across as pro-crypto compared to current Vice President Kamala Harris.

Last week, Senator Cynthia Lummis also reaffirmed plans that the US is going to build a strategic Bitcoin reserve. If passed, the senator’s Bitcoin Act would propose directing the US Treasury to buy one million over the next five years.

The post Post-halving 2024 market is pushing Bitcoin’s price, not just Trump, says Onramp Bitcoin co-founder appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|