2024-11-6 04:00 |

Bitcoin recent price movements amid the US presidential election 2024 have led to its price currently standing at around $69,092, following a drop below the $70,000 level last week.

This relatively low volatility has marked a calm period for Bitcoin, allowing it to stabilize in the $68,000 to $69,000 range over the past few days.

The steady price trend has prompted analysts to forecast possible upward movement, pointing to various technical patterns and indicators suggesting a potential rally.

30% Bitcoin Rally In PlayAmong the analysts forecasting bullish momentum for Bitcoin, a renowned crypto analyst known as Captain Faibik recently shared insights on X regarding a technical pattern called a “Descending Broadening Wedge.”

Faibik highlighted that Bitcoin has completed a breakout from this pattern on a weekly chart and is now in a “retest” phase. A Descending Broadening Wedge is typically considered a bullish reversal pattern in technical analysis.

The pattern forms as price action creates lower highs and lower lows within diverging trendlines, implying that the downward momentum may weaken.

If the price breaks upward through the resistance, it can indicate that the asset will likely see a price surge. Faibik expects a successful retest of the recent breakout of this pattern from BTC and has set a midterm target of $88,000, forecasting a potential 30% increase in Bitcoin’s value by the end of the year.

Bullish Divergence And Long-Term Holder BehaviourAlongside Faibik’s observations, another well-known analyst, Javon Marks, pointed to signs of bullish divergence on Bitcoin’s chart.

In technical analysis, bullish divergence occurs when an asset’s price makes lower lows while a technical indicator, such as the Relative Strength Index (RSI), creates higher lows. This divergence can suggest a potential reversal as buying momentum begins to build.

According to Marks, this divergence indicates that Bitcoin’s bulls may be preparing for a move, which could translate to regained dominance in the market. Marks’ view supports the possibility of an upward trend in the medium term, even if the short-term market conditions seem uncertain.

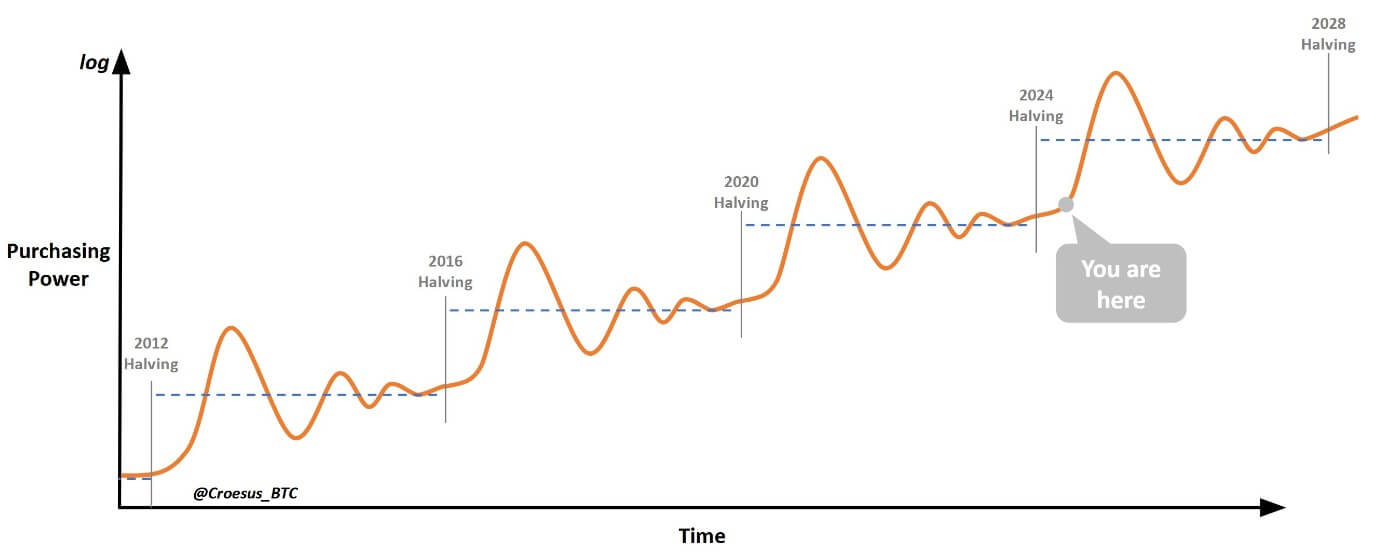

Meanwhile, IntoTheBlock, a prominent blockchain analytics firm, recently reported interesting trends in Bitcoin’s holder’s balance metrics.

According to their data, while long-term Bitcoin holders are currently selling, the scale of these sell-offs appears moderate compared to previous bull cycles. In prior cycles, long-term holders often sold more aggressively, signaling a peak in market sentiment.

This time, however, the selling trend among long-term holders has been more restrained, which may reflect a cautious approach amid Bitcoin’s current market conditions. IntoTheBlock speculates that this cautious behavior could signal a shift in the cycle dynamics, potentially pointing to a new market phase for Bitcoin.

Featured image created with DALL-E, Chart from TradingView

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|