2024-5-20 07:00 |

Amid Bitcoin’s Price Volatility, BlockDAG’s Dashboard Adds $1M Daily in Sales—Are Polygon Whales Secretly Snapping Up Shares?

The cryptocurrency market is marked by sharp contrasts. Bitcoin has experienced highs recently, yet it confronts significant resistance with price fluctuations. Polygon is seeing a downturn in investor sentiment, characterized by notable sell-offs and decreased engagement.

On a positive note, BlockDAG Network shines with its dashboard upgrade, increasing transparency and user engagement. This enhancement features live transaction monitoring and detailed leaderboards, emphasizing BlockDAG’s commitment to enhancing user experiences during unpredictable market conditions.

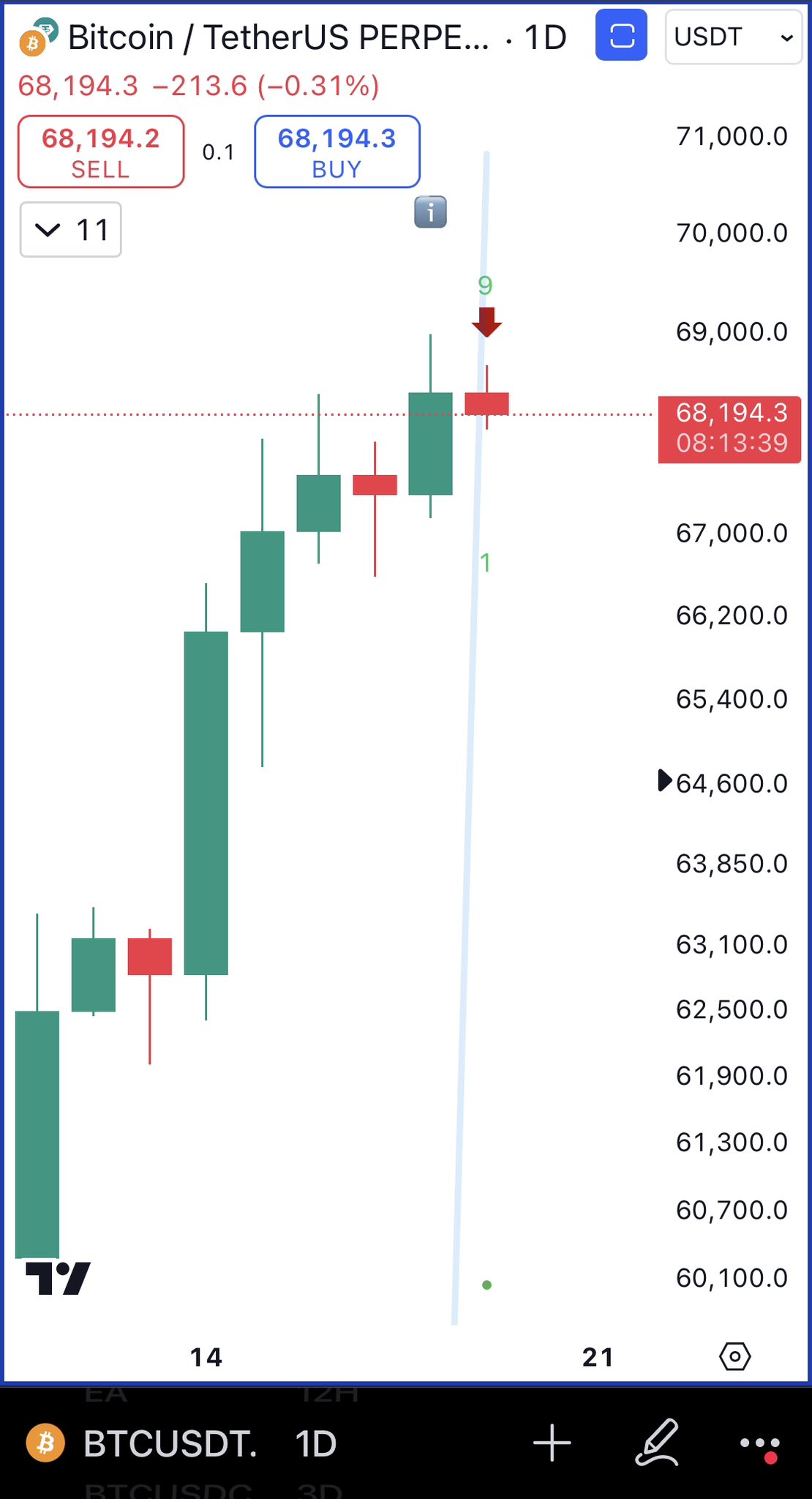

Bitcoin Holds Strong at $66.9K, Casting Doubt on a ‘Deep Correction’Bitcoin’s price remains solid above the crucial $65,000 support level, leading some analysts to question the likelihood of a significant correction. Pseudonymous trader Yoddha, with 49,000 followers on X, expressed confidence that a deep correction is unlikely, citing Bitcoin’s strong price stability.

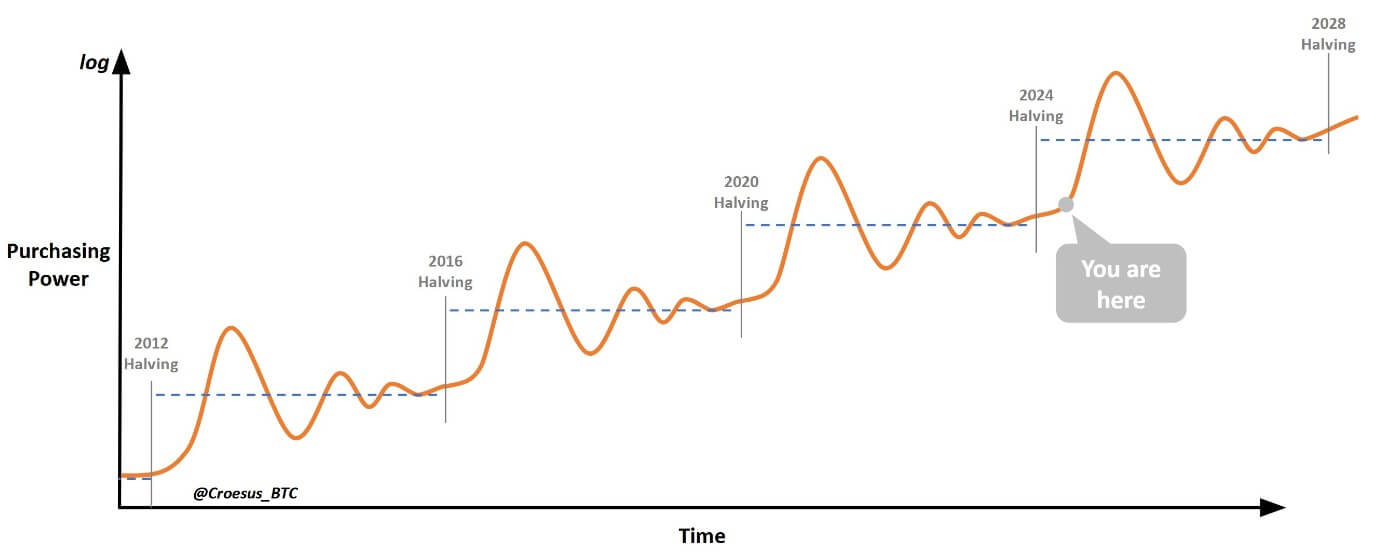

Bitcoin has risen 8.95% over the past 30 days, and some traders view its quick rebound above $65,000 on May 6 as typical during bull runs. The market is now closely watching for signs of further correction, especially following the recent halving event. However, analysts suggest focusing on long-term trends and waiting for a breakout past $70,000.

Polygon Investors Pull Back, Hitting a Three-Month LowInvestor confidence in Polygon is diminishing, as indicated by recent whale transactions. In the last week, accounts holding 1 million to 10 million MATIC have sold off over 21 million tokens, decreasing their stakes to a three-month low. This $14.7 million sell-off reflects large holders’ efforts to mitigate losses amidst a stagnant recovery, prompting them to secure profits.

Additionally, retail investors are retreating, evidenced by a significant drop in transaction volumes. Many are waiting for more compelling reasons to re-engage with the network, as average transaction volumes have recently fallen from $77 million to $21 million. This decline in network activity suggests bearish trends due to lower liquidity.

Moreover, Polygon’s price has been stable between $0.65 and $0.75 over the past month. If the bearish trends persist, the price might drop to $0.60. Conversely, a resurgence in investor activity could drive the price up to $0.80, overcoming the $0.75 resistance.

Enhanced User Experience: BlockDAG’s Dashboard UpgradeBlockDAG has significantly improved its dashboard, greatly enhancing transparency and user interaction. The “My Transactions” feature allows users to track their buying history, detailing the amounts, phases, and currencies used. Eight different currencies, including BTC, ETH, and USDT, are supported.

The “Live Transactions” feature lets users view real-time purchases and ranks them by USD amount spent, with categories ranging from Crab ($0 – $99) to Whale ($50,000+). The Leaderboard showcases the top 30 buyers, and the Referral Screen tracks referral bonuses.

Celebrating its listing on CoinMarketCap, BlockDAG hosted an event at London’s Piccadilly Circus, highlighting its market success and strong presale performance. Each presale batch has seen price increases, with Batch 12 currently at $0.008.

Early investors from Batch 1 have realized significant returns, and with 45 batches planned, more price increases are expected. BlockDAG has raised $28.3 million through these sales, selling over 9.2 billion BDAG coins and 5,500 miners, indicating strong market confidence.

Furthermore, BlockDAG’s X series devices, particularly the X10 miner, have contributed significantly to this success. The X10 provides a 100 MH/s hash rate and is capable of mining up to 200 BDAG daily, equivalent to $30 at the initial price. It is designed for efficiency and low noise, making it suitable for both beginners and experts. It offers easy setup and blends performance, convenience, and efficiency.

Final ThoughtsThe current landscape in cryptocurrencies shows varied fortunes. Bitcoin deals with resistance and price instability; Polygon struggles with declining investor confidence and activity. In contrast, BlockDAG’s upgraded dashboard enhances transparency and interaction, providing a solid tool for navigating the market. With features like real-time transaction tracking and extensive leaderboards, this update underscores BlockDAG’s focus on user experience, distinguishing it in a fluctuating crypto environment.

Join BlockDAG Presale Now:

Website: https://blockdag.network Presale: https://purchase.blockdag.network Telegram: https://t.me/blockDAGnetworkOfficial Discord: https://discord.gg/Q7BxghMVyuDisclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) íà Currencies.ru

|

|