2024-5-10 00:05 |

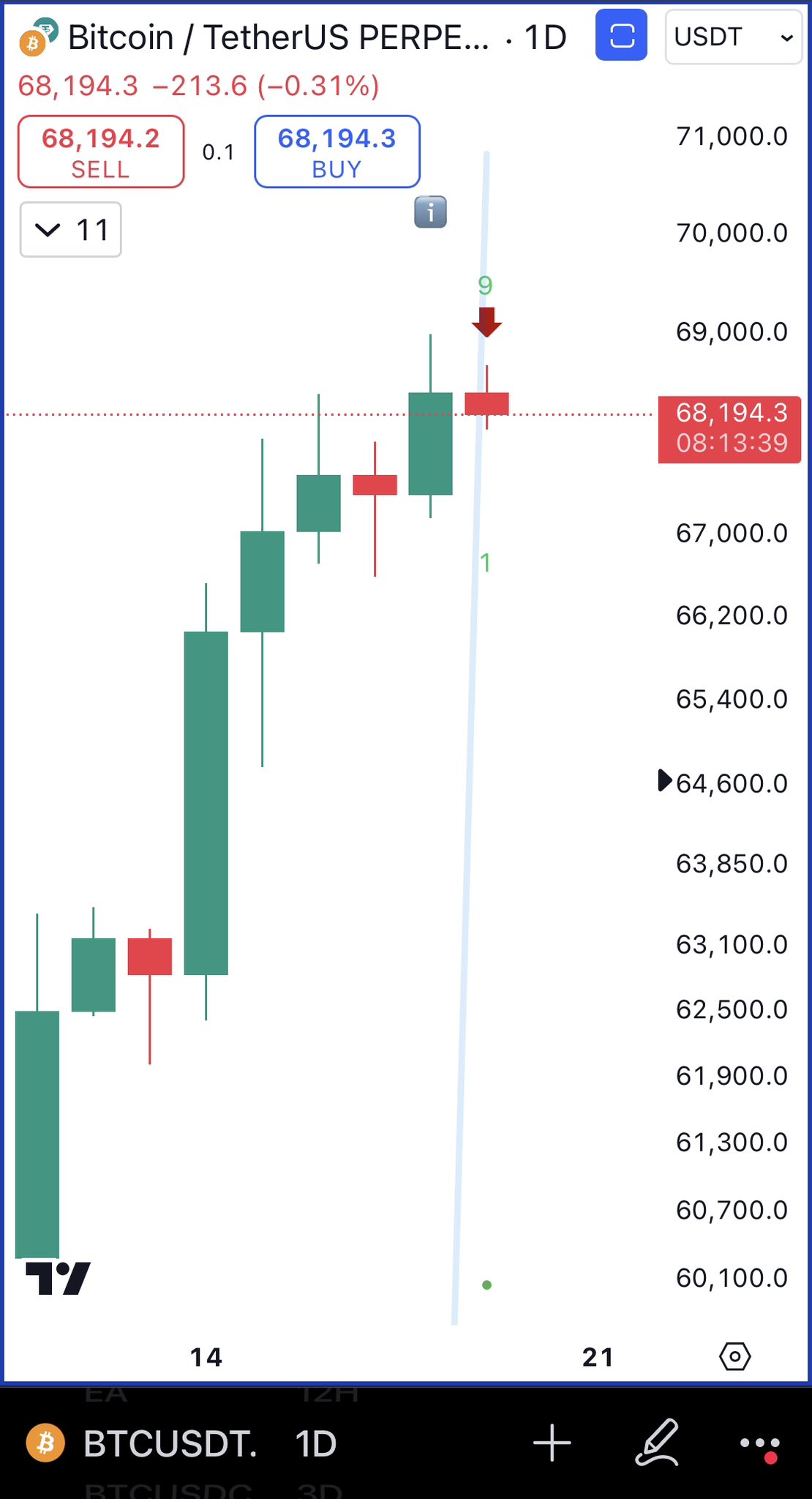

Bitcoin has shown remarkable resilience amidst a history of price fluctuations in recent weeks. Notably, on 14th March, Bitcoin surged as high as $71,827 ahead of the halving event. However, since the beginning of May, the leading crypto asset has faced a notable downturn, dropping to as low as $57,000 towards the end of last month.

Nevertheless, despite this volatility, Bitcoin appears to have entered a phase of relative stability. Its price hovers between $61,000 and $64,000, showing minimal volatility compared to its past erratic movements. This period of price stagnation hints at a temporary balance in the market, with neither bullish nor bearish sentiments dominating.

That said, while some investors interpret this as a precursor to a potential price swing, others see it as an opportunity for strategic accumulation. On Wednesday, popular crypto analytics platform Santiment highlighted how Bitcoin whales have made significant accumulation moves following the recent price dip.

“As Bitcoin ranges tightly between $61,000 and $64,000, large whales have made some accumulation moves over the past 24 hours. Wallets with 1,000-10,000 BTC have collectively accumulated $941 million worth of coins, rebounding to their highest holding level in 2 weeks,” tweeted Santiment.

Notably, Santiment’s late finding aligns with previous reports indicating a similar trend. On May 3, Santiment reported how Bitcoin whales accumulated over 47,000 BTC (over the past 24 hours), demonstrating resilience amidst market fluctuations. The consistent accumulation by large holders amidst market uncertainty underscores their confidence in Bitcoin’s long-term viability and resilience.

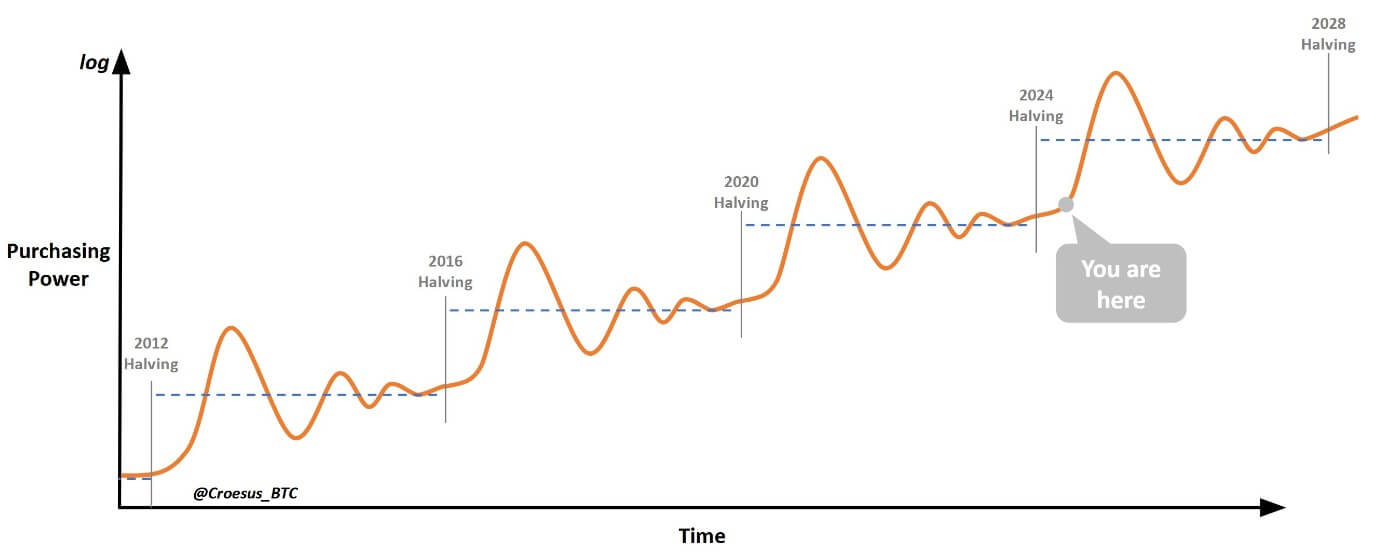

That said, indicators like the MVRV 90-Day Ratio technically suggest that Bitcoin remains in an attractive buy zone, further bolstering investor sentiment. Ki Young Ju, CEO of Cryptoquant, also chimed in on Bitcoin’s current state, highlighting Bitcoin’s robust network fundamentals and suggesting a potential market cap three times its current size.

“Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top, potentially sustaining a price of $265K,” wrote Ju.

Elsewhere, Glassnode analysts “Negentropic” also echoed optimism, suggesting that Bitcoin is primed for further upward movement. According to the experts, last week’s “reversal candle,” coupled with its movement back into the Pennant Structure, indicates a potential breakout.

“BTC still looks like it is about to BLOW higher! Last week’s candle was a Reversal Candle – a Hammer with a long Wick. Price moved back into the Pennant Structure. This candle still dominates the structure. This week’s pullback hence seems like healthy Correction before higher. Correction often pulls back either 50% or 61.8% of the previous Impulse move.” They wrote on Thursday.

Bitcoin was trading at $62,623 at press time, reflecting a 1.85% surge over the past 24 hours.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|