2018-7-26 23:42 |

Bitcoin Price Could Crash Again Before July Ends

The crash in price of Bitcoin last month plagued the market with signs of significant uncertainty. Though few saw the massive bear market coming, many saw the negative effects of the downturn in price. In addition to the major currencies like Bitcoin, Bitcoin Cash, and Ethereum, seeing a decrease in value, the altcoin markets suffered a tremendous hit. Even well-liked coins such as Ripple saw their prices plummet, Ripple specifically falling to a low of around 40 cents per token.

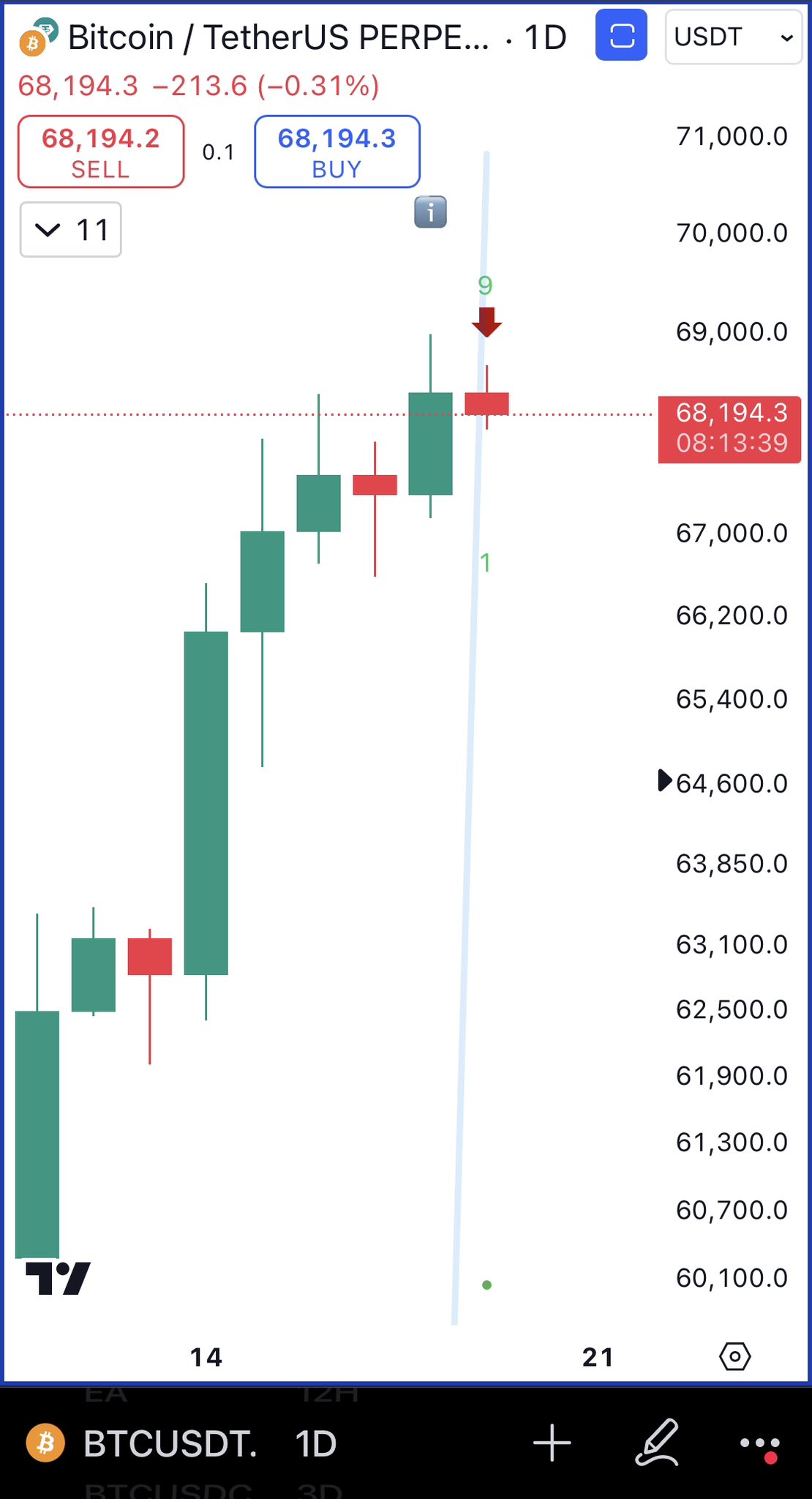

Things have been looking up for the main coins, though, within the past week. Bitcoin was able to surpass the important $8,000 line, marking an increase that had not been seen for quite some time within this market. Though other coins are lagging slightly, their prices have been generally favorable, with Ethereum, Bitcoin Cash, and Ripple all seeing increases overall in the last seven days. However, the uncertainty in the market means that analysts look ahead—not behind—to determine whether this market is a true bull, or merely a bull trap.

One prediction is that the market will experience a significant correction, falling in price, in the coming week. This is because a key Bitcoin futures contract with a major firm is set to expire, meaning that the price is likely to experience a drop reminiscent of previous trends following the expiration of a futures contract within the Bitcoin market.

Bitcoin Futures Contract ExpirationThe contracts are being held by the massive derivatives trading company CME Group. Several contracts will expire on Friday, which is July 27th. Contracts are financial products which give institutions the ability to either long (predict growth) or short (predict fall) for the cryptocurrency. When these contracts expire, the cryptocurrency trading market typically takes a significant hit.

Trends show that, when a major contract expires, Bitcoin experiences a price decrease of over 7% around five days before the contract expires. This means that there are approximately two days before the contract expires in which a market crash could happen.

But some analysts remain bullish. Pointing to additional factors, many optimists within the crypto markets argue that Bitcoin may either remain the same in price, or even increase after the contracts expire.

Outside FactorsBitcoin futures average daily volume in Q2 grew 93% over previous quarter, while open interest surpassed 2,400 contracts, a 58% increase. Learn more about trading #Bitcoin futures: https://t.co/adjWVWXBPQ pic.twitter.com/UQWC3nGGrI

— CMEGroup (@CMEGroup) July 20, 2018

The biggest additional factor regarding the price of Bitcoin this month is the increase to overall interest in the Bitcoin futures market. CME’s futures market for Bitcoin grew significantly last quarter, setting a record for the highest volume for Bitcoin futures contracts last Tuesday, boasting an incredibly total value of over $530 million USD.

Some, however, still argue that the expiration of this set of Bitcoin futures contracts from CME Group will have negative consequences for the Bitcoin market—and for the rest of the altcoins as well. These analysts point to previous statistical trends as evidence that the market may not be as bullish as some predict.

This next week will be a telling sign for the overall health of the Bitcoin futures market.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|