2022-10-13 14:00 |

Hovering at a range between $18,800 and $19,500, the Bitcoin price is chopping out short and long positions. The current dynamics in the market have been determined by macro forces leading BTC to extreme as it approaches a major economic event.

The Consumer Price Index (CPI) for September is poised to operate as one of these events. In the past months, these reports, used by the U.S. Federal Reserve (Fed) to benchmark inflation, have been followed by spikes in volatility.

At the time of writing, the Bitcoin price trades at $19,100 with sideways movement in the last 24 hours and a 6% loss in the past week. BTC’s price action has been dragging the crypto market down with it as market participants for digital and traditional assets brace for volatility.

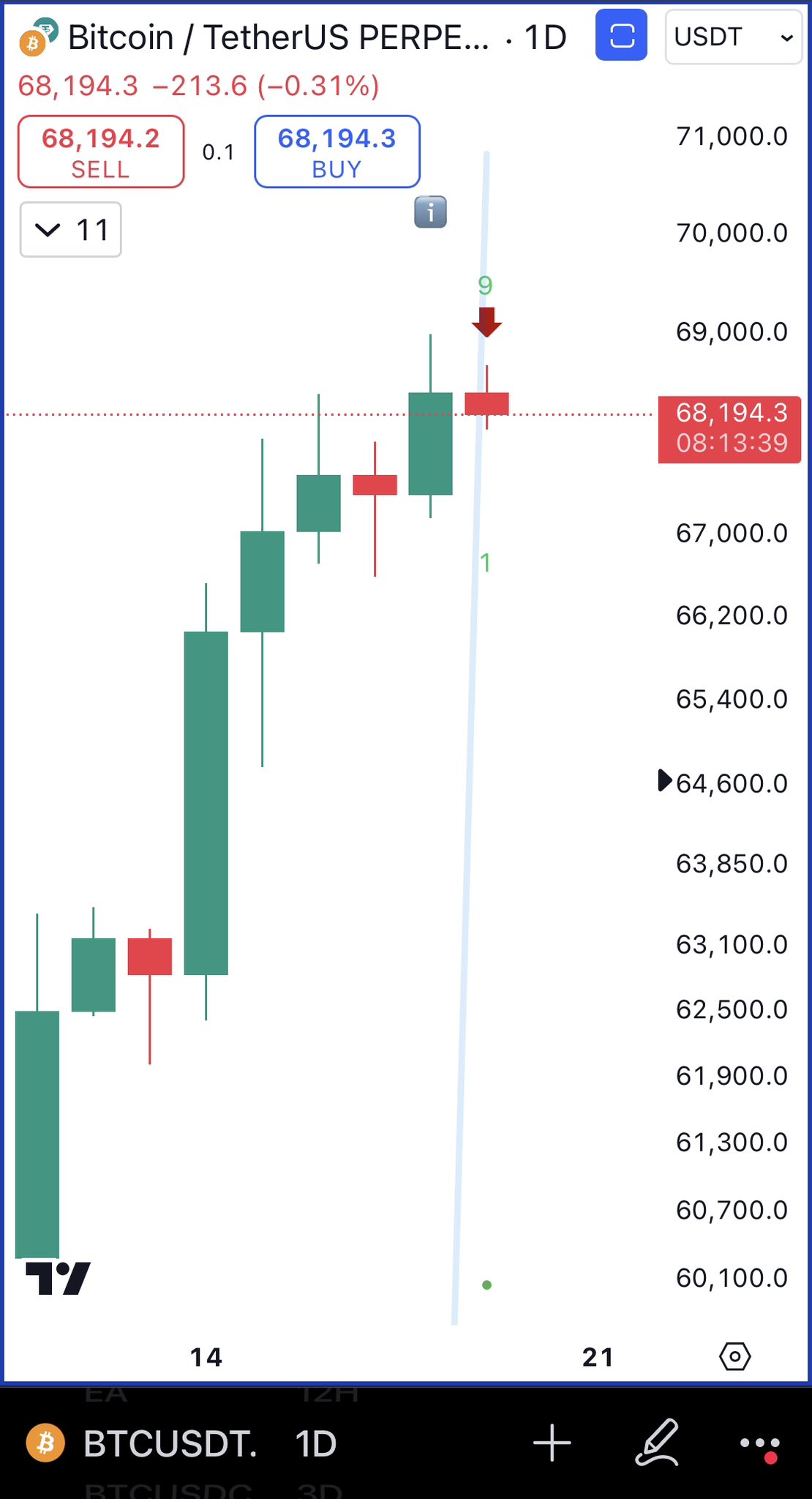

BTC’s price compressing as volatility declines on the daily chart. Source: BTCUSDT Tradingview Bitcoin Price Squeeze Incoming? CPI Print Will Be DecisiveSenior market analyst at Cubic Analytics, Caleb Franzen, shared his thoughts on the upcoming CPI report. Today, the U.S. government published its Producer Price Index, one of the most important inflation benchmarks in this country.

The PPI has been accelerating, Franzen said, from 6.5% in August to 6.8% in September, beating expectations and hinting at higher inflation reflected by the upcoming CPI print. The PPI is far from its yearly low at 9.2%, but as the analyst said, the upside trend reflects the “stickiness” in inflation and might signal the U.S. Fed to adopt a more aggressive monetary policy.

PPI Final Demand Services accelerated on a YoY basis in the latest producer price index data.

For Aug.’22, the YoY change was +6.5% For Sept.’22, the YoY change was +6.8%

It’s down considerably from the March 2022 peak of +9.2%, but highlights the stickiness & impact of wages. pic.twitter.com/zrlzfS3SNT

— Caleb Franzen (@CalebFranzen) October 12, 2022

In that sense and taking a deeper look into the factors contributing to high inflation, Franzen notes a “tug-of-war” between inflationary and deflationary forces. Overall, the reduction in energy prices, and the dropped in the price of oil and fossil fuels, might turn the tide in favor of mitigating inflation.

But this scenario is currently uncertain, thus influencing the decision of the Fed, which in turn negatively impact the Bitcoin price and the performance of legacy financial assets. This upcoming CPI might reflect this uncertainty, the analyst argued:

I expect to see month-over-month CPI be relatively unchanged, almost certainly ±0.2%. On a YoY basis, I think +8.0% or greater is near certain; though I expect to see core CPI, median CPI, & trimmed-mean CPI accelerate relative to their August results.

Will High Inflation Become The New Normal?This could allow the Bitcoin price to experience a relief rally on low timeframes dissipating the current uncertainty in the nascent asset class. If this happens $20,500 is bound to continue operating as critical resistance and short-term headwind.

After the CPI Print, the upcoming Federal Open Market Committee is bound to bring more volatility to the market. As noted by the trading desk QCP Capital, these events have led the Bitcoin price to positive performance.

In the chart below for the BTC/USD trading pair during the FOMC, there has been a short-term rally followed by major crashes. However, as the market prices in a more hawkish Fed and more inflation, these sudden price action become less powerful.

Will BTC finally be able to break out of its current range or will simply see another short-lived rally?

Source: QCP Capital via TwitterSimilar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|