2022-5-3 13:10 |

The Bitcoin (BTC/USD) price remained in a tight range as investors reacted to the relatively resilient US Treasury yields. Bitcoin is stuck at $38,500, where it has been in the past few days. This price is substantially lower than its all-time high of near $70,000 while its total market capitalization has declined to about $732 billion.

Rising bond yieldsAmerican bond yields continued rising on Tuesday as investors waited for the upcoming interest rate decision by the Federal Reserve. On Monday, the 10-year bond yield crossed the important resistance level at 4% for the first time in years. The 30-year yield also rose to above 3% while the 2-year is about 2.7%.

The bond sell-off happened as investors waited for the upcoming interest rate decision by the Federal Reserve that is scheduled for Wednesday. Economists polled by Reuters and Bloomberg expect that the Fed will sound a bit hawkish in its decision this week. This view reflects the fact that the country’s inflation has surged to the highest level in years.

Read more on how to buy Bitcoin with PayPal.

The Bitcoin price action mirrors that of other assets like stocks and commodities. Futures tied to the Dow Jones have fallen by more than 14% from their highest level in March. The same is true with other indices like the Dow Jones and the S&P 500 index. Bitcoin has had a strong correlation with stocks in the past few days.

Further, the BTC price is reacting to signs that demand for the coin is waning. On-chain data shows that inflows from both small and large investors have been a bit muted in the past few weeks.

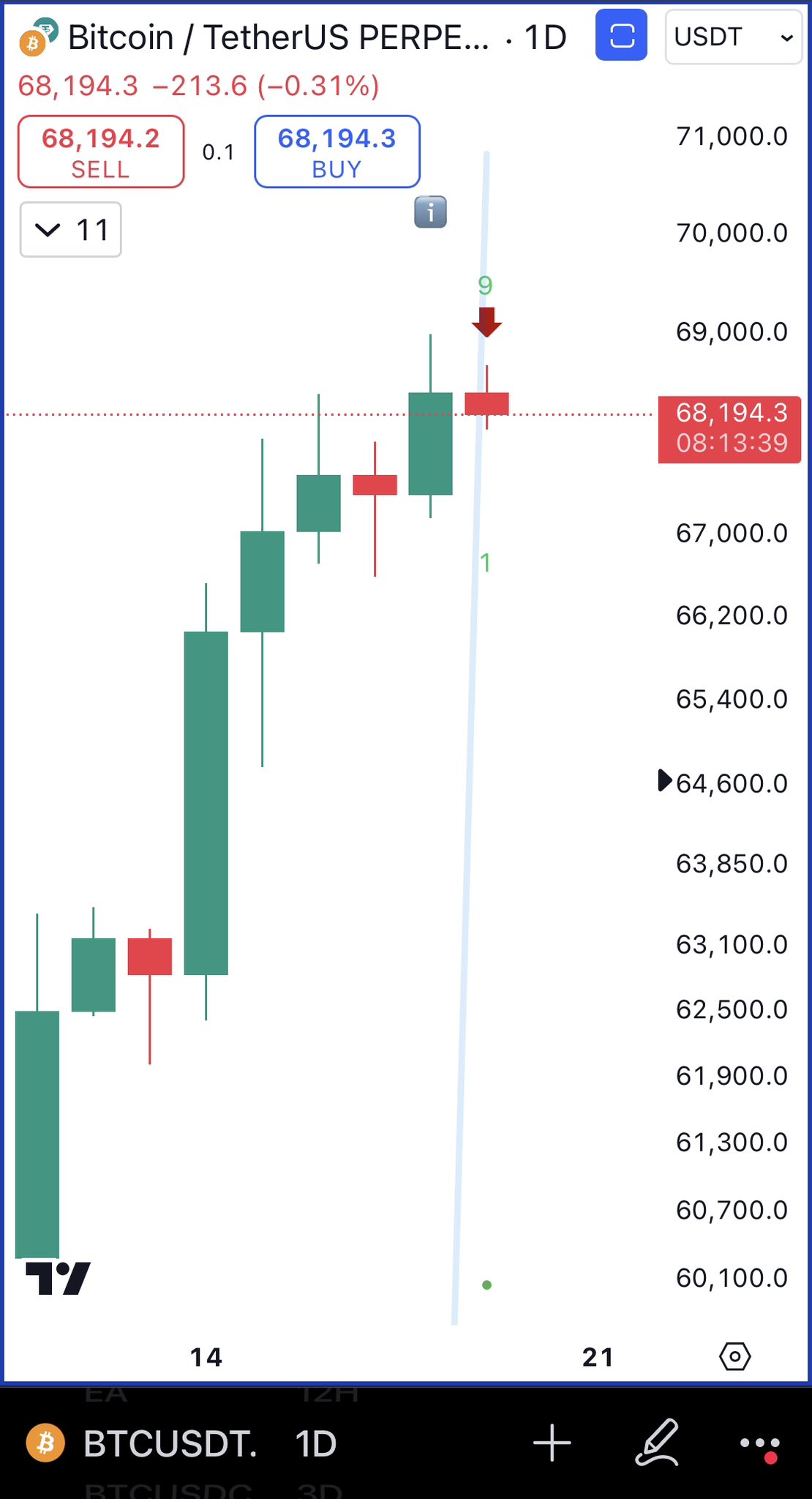

Bitcoin price predictionThe daily chart shows that the BTC price has been in a strong bearish trend in the past few days. It has moved below the 25-day and 50-day moving averages. At the same time, the price has moved slightly above the lower side of the ascending channel shown in purple. Also, it remains slightly below the lower side of the oversold level.

Therefore, the outlook of Bitcoin at this price is neutral. A move below the lower side of the trendline will send a signal that bears have prevailed and push it much lower. On the other hand, a move above the resistance at 40,000 will mean that bulls have prevailed.

The post Bitcoin price prediction as US bond yields surge appeared first on Coin Journal.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|