2019-2-11 11:20 |

CoinSpeaker

Bitcoin Price Analysis: BTC/USD Trends of February 11–17, 2019

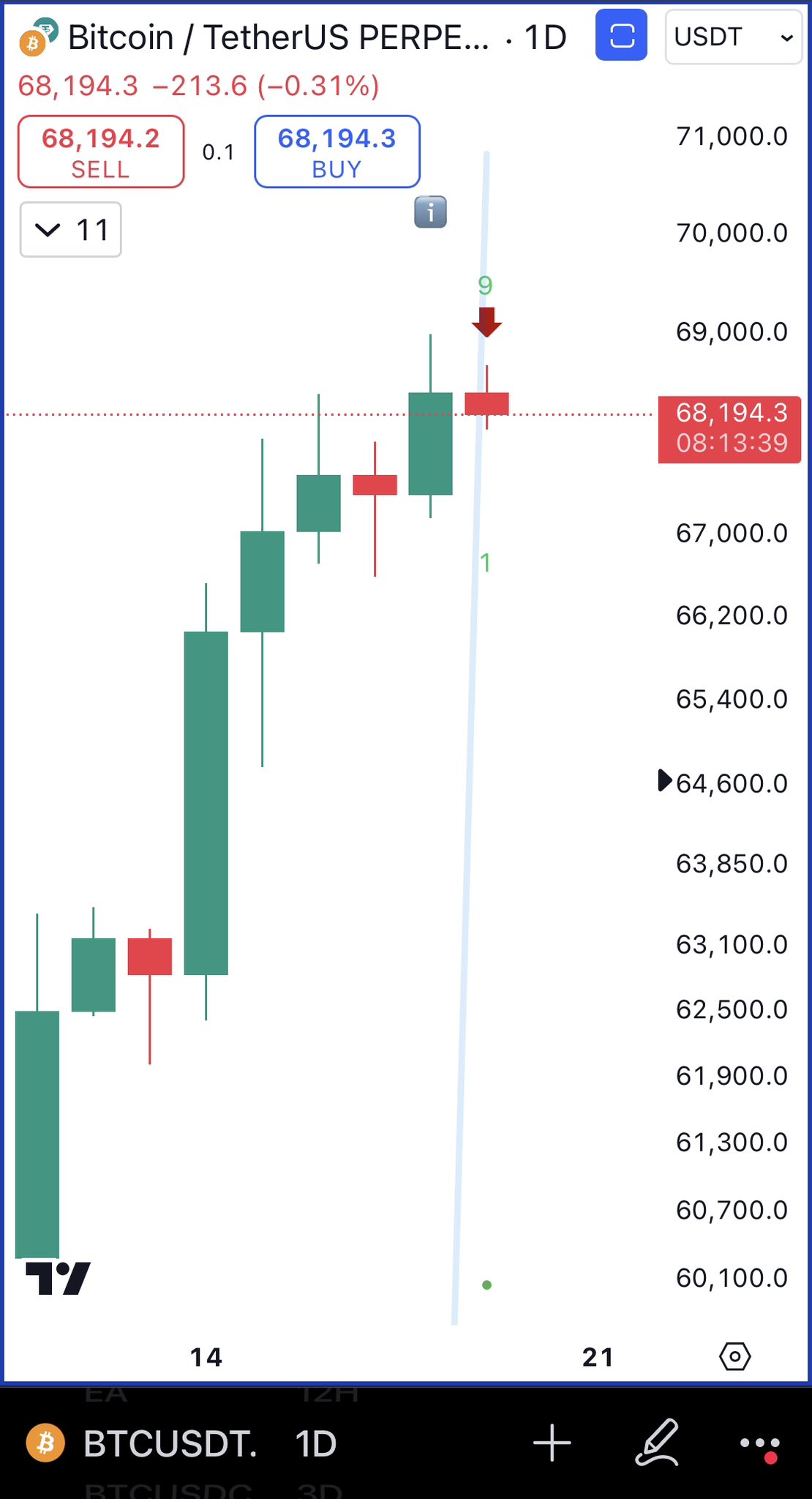

Resistance levels: $4,237, $4,692, $5,600

Support levels: $3,679, $3,247, $2,765BTC/USD continues its bearish trend on the long-term outlook. The crypto was on the downtrend towards the previous low demand level of $3,247 and its lower lows movement could not reach the targeted price level. On February 8, the bulls gained certain momentum which pushed Bitcoin price up and penetrated the supply level of $3,679 but unable to break up the 50-day EMA dynamic resistance and the coin started consolidating above the $3,247 price level.

BTC price is currently trading in between the 21-day EMA and 50-day EMA and the two EMAs were gradually coming closer to each other as an indication that consolidation is ongoing on the daily chart in the BTC market. However, the Stochastic Oscillator period 14 is at 80 levels and the signal lines pointing down which implies sell signal.

The coin is in between tight barriers which require strong bearish or bullish momentum for it to rally. In case the demand level of $3,679 holds and the Bulls gained enough momentum, then, there will be a bullish rally towards the resistance levels of $4,237 – $4,692. Alternatively, the breakdown of the $3,679 price level will return Bitcoin price to the previous low of $3,247.

BTC/USD Medium-term Trend: BullishOn the medium-term outlook, BTC/USD is on the bullish trend. Shortly after the ranging movement of Bitcoin price on the 4-Hour chart which ended on February 5, the bearish pressure pushed the coin down to $3,426 price level and consolidated for a few days.

There was a sudden bullish breakout of the coin in which the BTC price rallied towards the resistance level of $3,679 after broken up the two dynamic resistances. The BTC price penetrated the resistance level upside and commenced consolidation.

The 21-day EMA has crossed the 50-day EMA upside and the BTC price is above the two EMAs which confirms the change in trend from bearish to bullish. Nevertheless, the Stochastic Oscillator period 14 is at 40 levels with its signal line pointing down indicate sell signal.

Bitcoin Price Analysis: BTC/USD Trends of February 11–17, 2019

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|