2019-9-24 20:23 |

The wait is over, folks. Bakkt’s bitcoin futures trading is officially live.

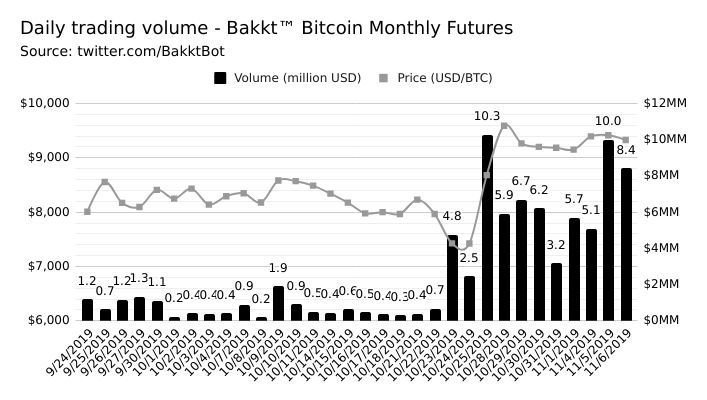

Trading for the Intercontinental Exchange’s (ICE) Bakkt bitcoin futures product launched on September 22, 2019, at 8:00 p.m. EST. As of this writing, 57 monthly futures contracts (1 contract = 1 bitcoin) have been sold on the platform, 29 of which changed hands in the first 12 hours. However, but there’s no available data on the daily futures volumes (perhaps because no one is trading these yet).

Source: ICEBakkt broke onto the Bitcoin scene last year in a flurry of hype and media attention. After a series of delays and regulatory hiccups, the futures offering, which was originally slated to launch a few months after it was announced, is now open to accredited investors.

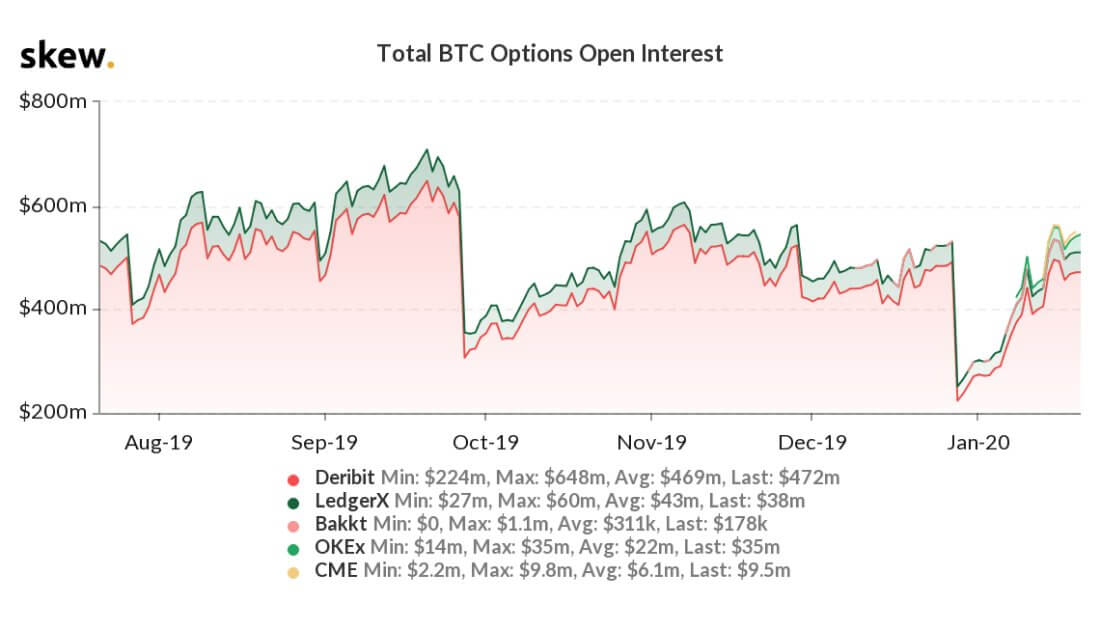

This offering comes almost two years after Cboe/CME bitcoin futures debut. The first institutional-grade bitcoin products of their kind, these futures were welcomed as a means to open the market’s floodgates to institutional liquidity. They were also launched at the peak of the market’s manic growth spurt at the end of 2017, right when bitcoin was cresting its $20,000 all-time high (we all know what went down next). When bitcoin futures launched on the CME, the exchange processed just over 1,000 contracts on the first day of trading (Cboe has since suspended its bitcoin futures offering).

Bakkt is a bit different than its predecessors — both in how its futures operate and in the other features the platform offers. For its own futures, Bakkt settles in physical bitcoin, while CME and Cboe settle in cash. In-kind settlement for bitcoin futures is another first for the industry and comes with its own spate of complications, such as custody (an issue that was partly responsible for Bakkt taking so long to get its futures product off the ground). This custody is available to institutions irrespective of trading, as well, and was launched on September 9, 2019, while the platform also entered a closed beta in July 2019.

In addition to monthly futures, Bakkt also offer daily futures. Instead of paying out in a month’s time, these futures pay out the next day. While one-day contracts are rare for commodities, ICE offers this settlement option for silver and gold.

The platform is also more than a mere futures hub. Bitcoiners will remember last year’s fanfare when errant headlines announced Starbucks would soon be accepting bitcoin through the platform. Well, yes and no. Obviously, you can’t buy your venti, pumpkin spice, double pump, no-fat, oat milk latte through the Bakkt’s platform yet, but the all-in-one exchange and merchant portal does have vendor adoption on its to-do list. The coffee retailer is reportedly a large shareholder in Bakkt and is developing a card that will allow users to buy store products with bitcoin through the platform.

As Bakkt began trading, bitcoin’s price backslid below $10,000 overnight.

The post Bakkt Opens Bitcoin Futures Trading, Clocks 29 Contracts in First 12 Hours appeared first on Bitcoin Magazine.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|