2019-10-25 00:22 |

Bakkt announced on October 24, 2019, that it would be rolling out regulated options contracts on its bitcoin futures on December 9, 2019, a first in the crypto asset industry.

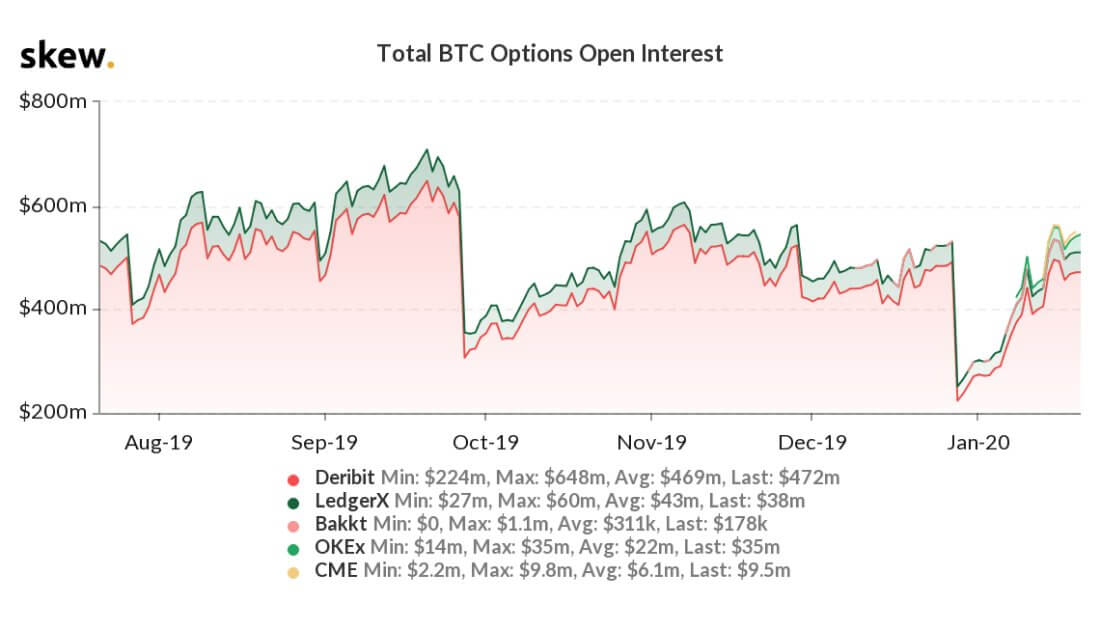

Bakkt claims that this expansion is “based on customer feedback and is designed to hedge or gain bitcoin exposure, generate income, and offer cost and capital efficiencies,” and that these options contracts have been cleared with the Commodity Futures Trading Commission (CFTC), making these new options regulatory-compliant.

Expansion of Bakkt Bitcoin FuturesIn addition to several new quality-of-life features, such as an on-platform chat function with other Intercontinental Exchange (ICE) buyers and sellers, reduced fees, increased options for contract design, block trades and others, forthcoming updates to Bakkt’s bitcoin futures product also promise the ability to receive payouts in fiat instead of bitcoin, as many competing products in the space offer.

Bakkt, a subsidiary of ICE, was launched in late 2018 as a cryptocurrency payment system for various retailers. Offering a variety of services in this vein, it promised the eventual development of a market for bitcoin futures trading, a coveted field of new money making potential in the cryptocurrency space.

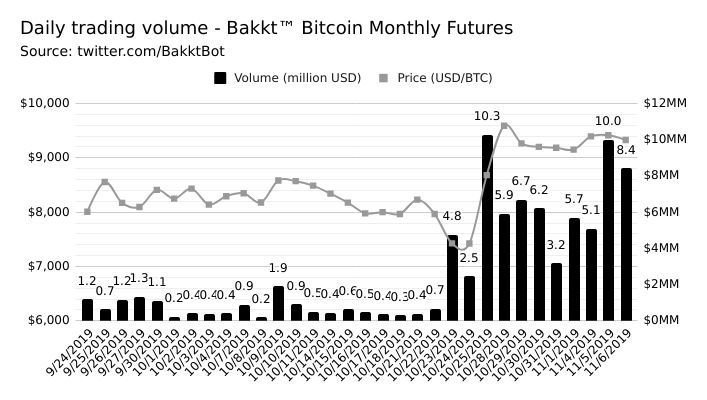

After several regulatory hurdles, Bakkt was able to fulfill this promise in late September 2019, opening futures trading to much fanfare. Within a week of this initial launch, however, it had become clear that this development was somewhat disappointing.

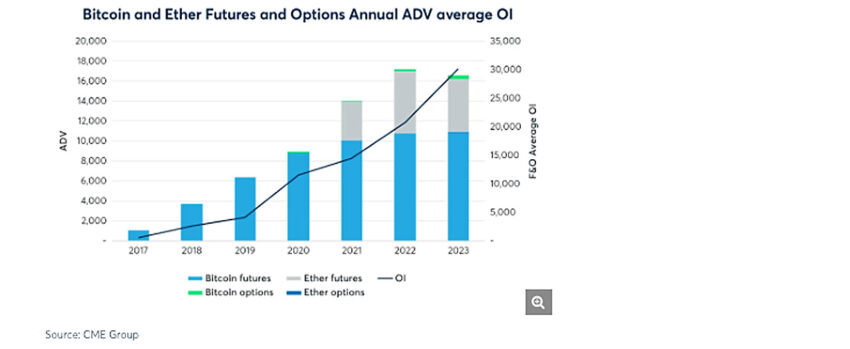

Clearing less in its first week than competitor CME/CBOE did in the first 24 hours of its own bitcoin futures product, this development cast doubt on Bakkt’s strategy. However, the CME/CBOE futures contracts are settled in fiat only and Bakkt offers daily futures in addition to the monthly futures options that are more standard.

Still, it has become clear that the Bakkt business model could use some modification, and this may be what has motivated it to offer options contracts.

Options contracts differ from the standard futures contract in that a future involves a commitment between two parties to sell an asset for a predetermined price at a specific date. As the name would imply, however, parties in an options contract have the option to sell before this agreed-upon date, although they are also welcome to sit on the assets for the duration.

The post Bakkt to Launch Options on Bitcoin Futures in December appeared first on Bitcoin Magazine.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|