2019-9-11 22:15 |

Bakkt has announced that the Bakkt Warehouse, its qualified custodian arm, is now open for business.

The company has previously announced that the warehouse is protected by $125 million in insurance and leverages the same protections that are used by the New York Stock Exchange (NYSE). The Intercontinental Exchange (ICE) serves as a parent company for both Bakkt and the NYSE.

In the announcement, posted on September 9, 2019, the cryptocurrency trading platform noted the role that the warehouse will play in its soon-to-be-launched physically settled bitcoin futures product.

“It represents a milestone as we prepare for the launch of the Bakkt Bitcoin Daily and Monthly Futures contracts on ICE Futures U.S.,” Adam White, COO of Bakkt, wrote in the announcement. “The Bakkt Warehouse was built using the same institutional grade infrastructure, operational controls, and security protections that support the world’s most actively traded markets, including the New York Stock Exchange, and was designed to meet the highest standards of compliance and oversight.”

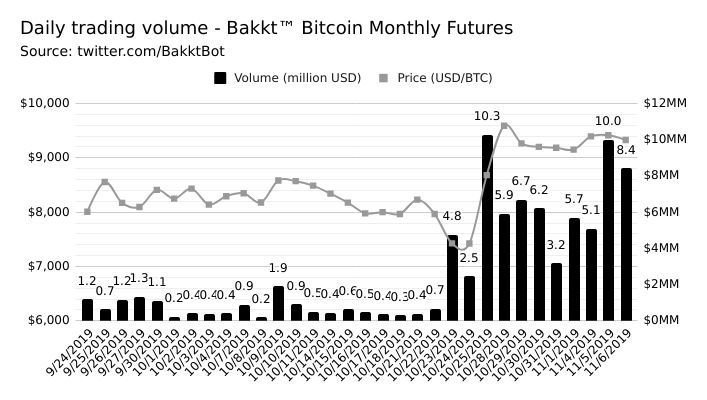

A lot of time and effort has been expended in getting the necessary regulatory greenlight for Bakkt’s physically-delivered bitcoin futures products and there has been equivalent hype surrounding its launch. Bakkt has announced that its futures platform will go live on September 23, 2019, after it gains the necessary approval to operate as a custodian company from the New York State Department of Financial Services.

The post The Bakkt Bitcoin Futures Warehouse Is Live appeared first on Bitcoin Magazine.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|