2018-10-27 16:04 |

Latest Ripple News

Finally, it has been confirmed that institutions are pouring in and buying XRP in droves. Through XRP II, a subsidiary of Ripple, which remains a software company offering solutions to banks, the company sold $98.06 million worth of XRP. That’s more than 4.5 times the amount purchased in Q2 2018 ($16.87 million). While this is stellar performance for an asset that is yet to find support from CoinBase or CoinBase pro, odds are we might see some movements in Q4 that would spur demand for XRP lifting it above $1.

Changelly, an exchange that many consider an alternative to ShapeShift because users need not to register, have partnered with SimplexCC opening doors for more than 3.5 million users to buy XRP using their credit or debit cards. Though SimplexCC services fees are slightly high because they charge extra for their fraud prevention services, it’s convenient and operate under EU regulations as a financial institution. Then again, at the end of the day XRP would benefit from extra demand which is beneficial for traders while at the same time deepening coin liquidity stabilizing price as a result.

CoinBase which is a trusted US based crypto exchange was earlier this week given the green light by the New York FDS to offer custodial services for the top six digital assets including XRP. This led to speculations that the exchange could end up listing XRP satisfying the demand of their 3 million customers across the US.

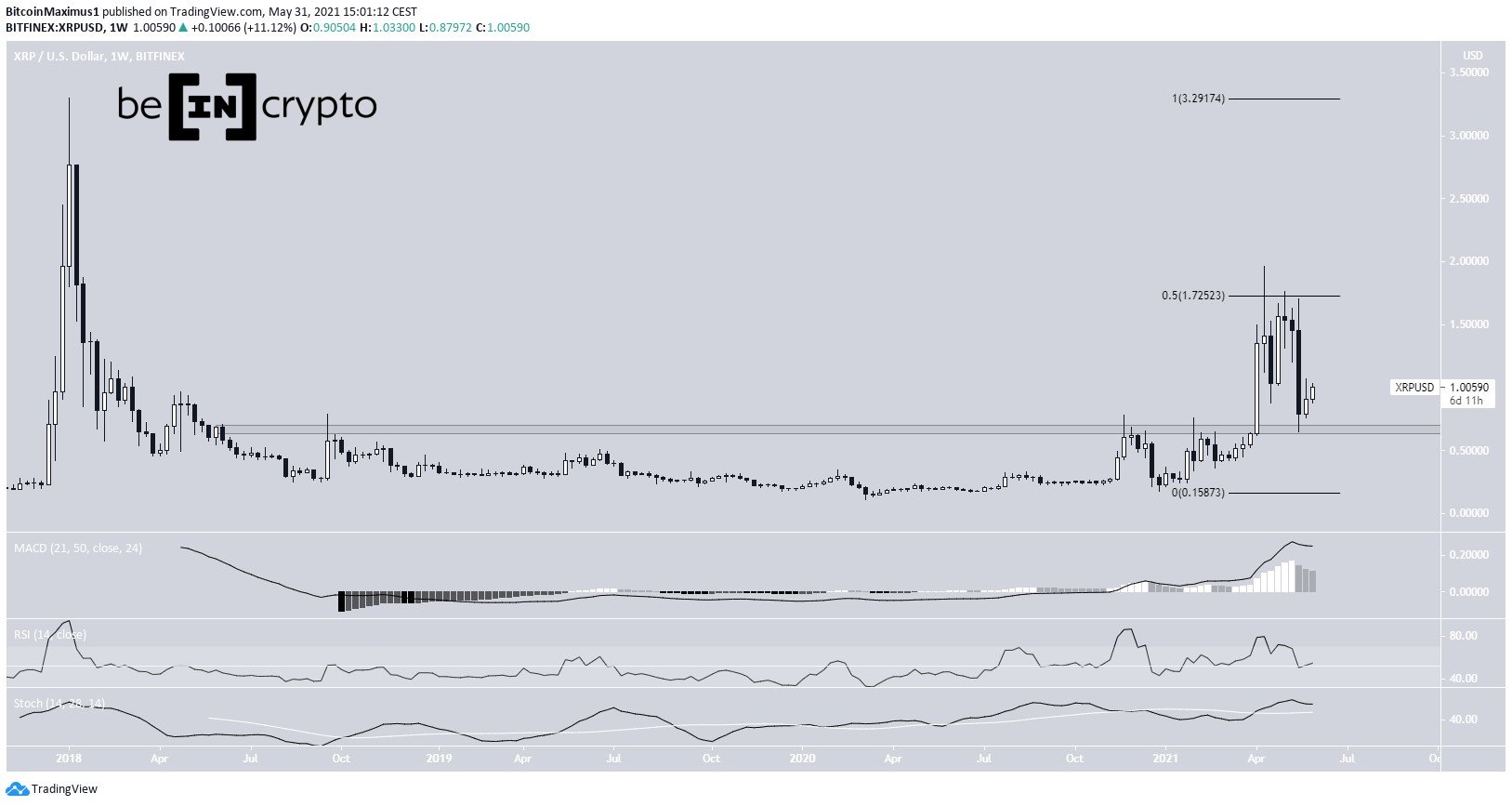

XRP/USD Technical AnalysisOverly, XRP prices are stable but bullish. In the last one month, it is down 20 percent—because of the sharp drops from Sep 2018 highs but pretty much unchanged in the last day and week.

Trend: Flat to Bullish

We maintain a bullish outlook from a top down approach especially when we consider the strong surges by week ending Sep 23 that led to break outs above key resistance levels effectively cementing bullish stands. Aside from this, there are visible XRP higher highs should we connect Sep and Oct 2018 lows.

Volumes: Tapering

Before Oct downturns, market participation shot in the lead up to week ending Sep 23 where between Sep 18 to 23, volumes spiked lifting prices as a result. Regardless of recent declines, buyers are in control because are yet to reverse those rapid gains. Besides, a simple Fibonacci retracement between Sep high low hints of possible resumption of trend since prices are trending at around key correction levels between 50 percent and 78.6 percent.

Candlestick Formations: Ranging Market

After events of Oct 15, XRP has been ranging as accumulation above 40 cents continue. Therefore, as long as prices are within Oct 15 high low or above 35 cents to 40 cents, there is an opportunity for buyers to ramp up ad discount with stops at the 78.6 percent Fibonacci retracement level at 40 cents.

ConclusionDespite lower lows, all our indicators and accompanying price formation points to increasing bull momentum. Once there are conclusive breaks above 55 cents, risk-averse traders can begin loading up on dips as they eye $1 or $1.65.

All Charts from Trading View

This is not Investment advice and opinions are those of the author. Do your own Research.

The post XRP/USD Price Analysis: XRP Bullish as Institutional Demand Jumps 450% appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|