2021-1-31 12:32 |

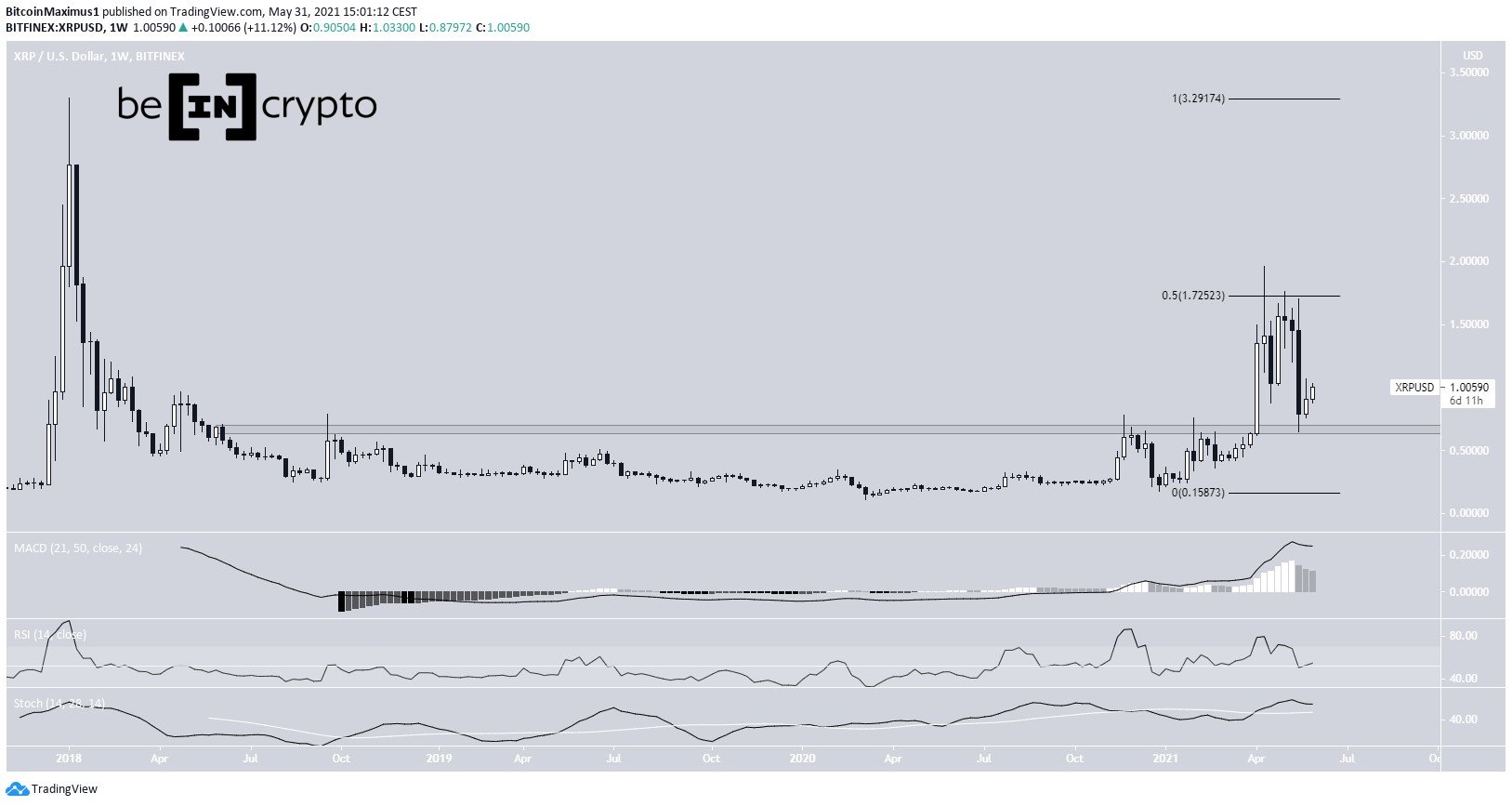

The last few months have been very challenging for XRP holders. The cryptocurrency plummeted in price while the other top cryptocurrencies by market cap experienced price growth not seen in years.

XRP’s price collapse was due to charges brought against Ripple Labs and two of its executives in December. The SEC charges include the sale of over $1 billion in unlicensed security based on their sales of XRP. The SEC alleges that XRP is a security, a designation not assigned to the top two cryptocurrencies, Bitcoin and Ether.

This announcement led to an over 50 percent price decrease as many platforms that utilized RippleNet and XRP suspended operations over these allegations. These platforms are unregulated by the SEC and want to remain that way. As such, these allegations might bring them under US jurisdiction if they participate in the sale of securities to users. Even regulated firms like Grayscale, the largest digital asset manager in the cryptocurrency space, reduced XRP holdings following this announcement.

Ripple is Fighting BackMany stakeholders in the XRP ecosystem were extremely upset with these allegations. Some filed petitions filed alongside lawsuits. Some were against the SEC for waiting seven years after the launch of XRP to take action. Others sued platforms like Coinbase for allowing the unregistered sale of securities.

Aside from all the drama surrounding these charges in late 2020, Ripple has legally responded to the accusations. In the filing, they claimed that the charges are based on ‘an unprecedented and ill-conceived legal theory – with neither statutory mandate nor congressional authorization”.

Ripple Says XRP is Not a SecurityThe Ripple Labs legal team states that XRP is not a security. They ground this on the fact that ‘XRP performs a number of functions that are distinct from the functions of “securities” as the law has understood that term for decades. For example, the token functions as a medium of exchange […] It is not a security and the SEC has no authority to regulate it as one”. Ripple Labs, Brad Garlinghouse and Christian Larsen claim that since the token functions as ‘currency’ providing a means to store and transfer value, the SEC does not have jurisdiction over it as a security.

However, Ripple Labs and the two other defendants allegedly sold over $1 billion of XRP to fund their operations and for personal reasons. This has never traditionally been possible from a privately issued ‘currency’. For now, XRP will remain in limbo, but it should be very interesting to see how the SEC responds.

The crypto community, however, seems glad to see Ripple responding officially, if the price is any indication.

The post XRP Surges 50% After Ripple Files SEC Response appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|