2024-3-5 18:30 |

Steering through a sea of change in the crypto market, the investment game is experiencing a seismic shift. Spot Bitcoin ETFs already exist, signaling Bitcoin's leap into mainstream finance and knitting it closer to conventional investment fabrics. We'll look at the tip of the iceberg trying to imagine its true depth as well as the current correlation between Bitcoin, stocks, and Gold. We’ll attempt to figure out if the traditional market is really leading Bitcoin out of its decentralized place, or if there's still an avenue for hope that it can maintain its unique path.

According to the Kaiko data, Bitcoin's risk-adjusted returns were superior to traditional assets. Nvidia led with the highest returns on a risk-adjusted basis, while Bitcoin impressively trailed just behind, outpacing major traditional assets like the S&P 500, Gold, with its value surging over 160% in risk-adjusted terms.

Source: Kaiko ResearchMeanwhile, according to the IMF Crypto Cycle and US Monetary Policy study, 80% of variation in crypto prices and its increasing correlation with equity markets coincided with the entry of institutional investors into crypto markets since 2020. In particular, trading volumes by institutions on crypto exchanges grew by more than 1,700% (from roughly $25 billion to more than $450 billion) during the second quarter of 2020 and the second quarter of 2021. According to the study, the US monetary policy affects the crypto cycle, just like global equity cycles, but surprisingly, only the US Fed's monetary policy matters, not the other major central banks – probably because crypto markets are highly USD-dependent.

Furthermore, the 2023 Institutional Investor Digital Assets Outlook Survey indicates that 64% of investors are set to up their stakes in the crypto sphere within three years, allocating up to 5% of AUM to crypto. It said a number of institutions made investments for the first time over the past year, while others increased their existing investments. While the study highlights a surge in crypto commitment from 41% of asset managers, only 27% of asset owners seem to be ramping up their stakes.

Although Bitcoin was born from the idea of spreading power equally, recent studies indicate that it's slowly becoming dominated by a select few big players.

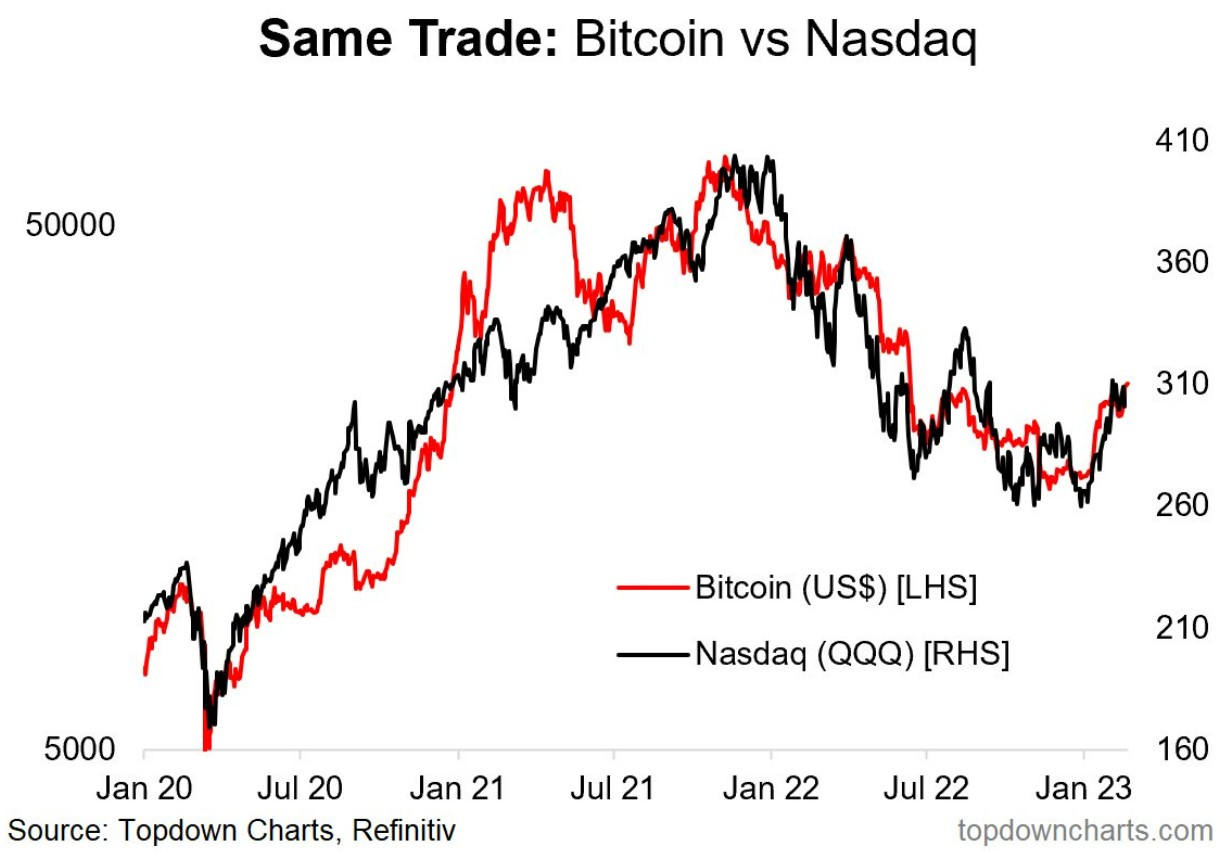

Changing Correlation DynamicsInterestingly, Bitcoin moves in sync with the S&P 500 and Nasdaq, with an impressive correlation. Meanwhile, the correlation between Bitcoin and Gold has sharply decreased recently, contrasting with claims that investors see crypto as a safe haven or hedge against inflation, a role traditionally played by Gold.

Source: TheBlockNotably, Bitcoin's correlation with Gold was positive at 0.83 on November 7, 2023, but decreased to -0.1 on January 10, 2024, before rebounding to a marginally higher positive level 0.14 on February 9, 2024. In the meantime, Bitcoin's relationship with the S&P 500 saw a negative correlation of -0.76 on November 11, 2023, and then hit a positive correlation of 0.57 in January 2024. Ths shift from negative to positive correlation points to Bitcoin's changing perception among investors.

The Nasdaq Composite, known for its technology and growth stocks, also displayed a variable correlation with Bitcoin. The negative correlation, of -0.69 on October 30, 2023, shifted to positive 0.44 in January. It seems traders are linking Bitcoin's rhythm to the tech sector's pulse, hinting at a new kinship in investment strategies.

When the correlation between Bitcoin and traditional equity markets like the S&P 500 and Nasdaq increases, while its correlation with Gold decreases, it suggests that Bitcoin is behaving more like a risk-on asset rather than a safe haven. When investors are feeling venturous, they often swing toward stocks and digital coins for the chance at juicier profits.

If institutional and retail investors are increasingly involved in both equity and cryptocurrency markets, their simultaneous buy and sell decisions could cause the price movements of these assets to align.

Spot Bitcoin ETFs getting the green light seem to be ramping up its charm for big-time investors, with a solid chunk already planning to boost their Bitcoin game. Bitcoin's move into ETFs might make it act more like stocks since those funds are big players in the stock world.

Amidst these developments, the essence of Bitcoin and other cryptocurrencies, free from the confines of traditional financial systems, could be undermined. Moreover, these shifts could expose Bitcoin to the very systemic risks from which it was designed to escape.

Closing ThoughtsAs we look at how spot Bitcoin ETFs might shake up Bitcoin's role in the market and its current tie to stocks, we need to keep a sharp eye on balancing our excitement for more big players jumping in and the possible growth with staying true to Bitcoin's core principle of not being centrally controlled. Bitcoin's move toward a more centralized investment scene could stir the market, offering bright opportunities, but also tough challenges ahead.

This is a guest post by Maria Carola. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|