2020-10-3 17:32 |

While Bitcoin is holding $10,000 firmly, it did slide to nearly $10,400 on Friday following the news of President Donald Trump testing positive for coronavirus.

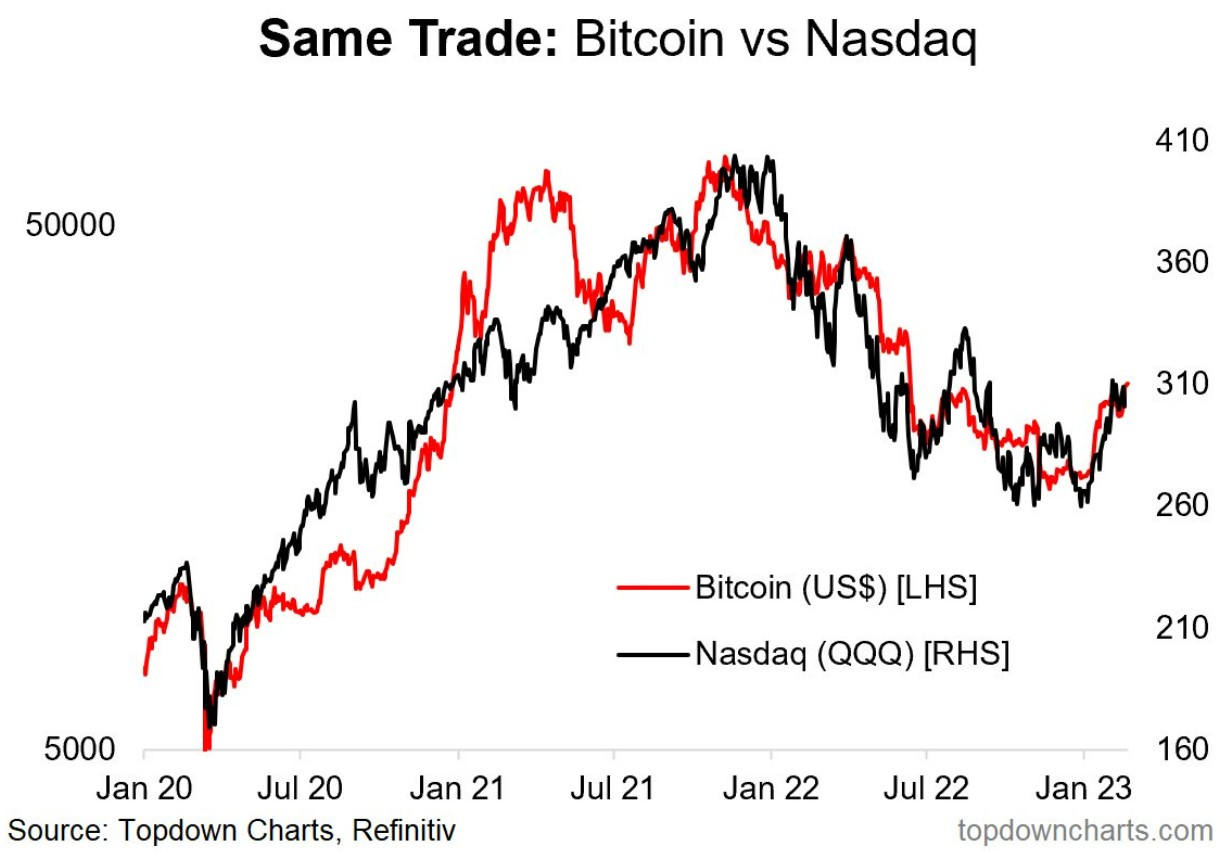

And so did the stocks by 1%. This has been because of Bitcoin’s correlation with the S&P 500, which is just above +47%.

This, according to some means, BTC is “a mature, highly-correlated asset that does poorly during episodes of political uncertainty.”

While gold did exactly the opposite of Bitcoin’s, uptrending to $1,917 and its one-month correlation with BTC declining to -20% down from the peak of +76.3% on Sept. 19, as per Skew, today, the precious metal moved back under $1,900.

Bitcoin, meanwhile moved above $10,550 today, trading in the green.

Also, as trader Qiao Wang said, “Bitcoin is up 44% in the single most politically uncertain year of my life outperforming virtually every single macro asset class.”

The markets, in general, are uncertain and directionless ahead of elections in the first week of November, which means October is expected to be choppy.

“We need more clarity on the election cycle and additional stimulus to help get things moving again in equities — and also in Bitcoin,” said Meltem Demirors, chief strategy officer of CoinShares. “Bitcoin has stayed range-bound despite a slew of positive news, largely because there is not enough inflation due to weak aggregate demand. We need Bitcoin’s behavior to match its narrative before we see a breakout.”

For the leading cryptocurrency, in the last few days, several incidents curbed its upside but didn’t drag it on the downside either. The third biggest $281 million KuCoin exchange hack and CFTC bringing criminal charges on popular crypto derivatives platform BitMEX only added pressure to the market sentiments, which have turned to “fear” this month.

In the near term, bitcoin is expected to stay range-bound. But an environment of limited upside for equities and bonds could benefit the digital asset, as per Bloomberg Intelligence analyst, Mike McGlone.

“Bitcoin is unique due to its limited supply, which unlike most assets isn’t influenced by prices, tilting the bias toward appreciation,” said McGlone. Moreover, it “appears as the leader in the early days of a paradigm shift toward digital money and stores of value. It may fail, but we see that as unlikely.”

He further said the coin is “growing up fast,” with many of its adoption indicators positive.

Over the past three months, the long-term supply bands in HODL waves that show BTC supply shift over time have been growing, signaling Bitcoin’s use as a store of value – a positive sign for the long-term health of the network.

The percent of BTC supply held for at least one year also continues to grow, going to its highest level since 2012 at over 63% on Sept. 30th. Additionally, the number of addresses holding at least 0.1 BTC had a noticeable uptick since March, suggesting more users might be joining the largest network.

Bitcoin (BTC) Live Price 1 BTC/USD =10,542.7801 change ~ 0.58Coin Market Cap

195.11 Billion24 Hour Volume

47.76 Billion24 Hour Change

0.58 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Is Bitcoin’s Store of Value Narrative Really in Danger with its Correlation with Stocks on Rise? first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|