2023-4-27 13:45 |

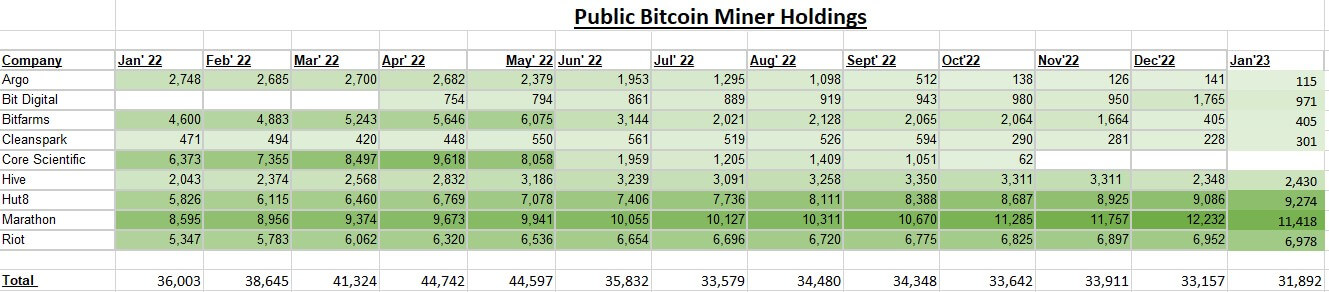

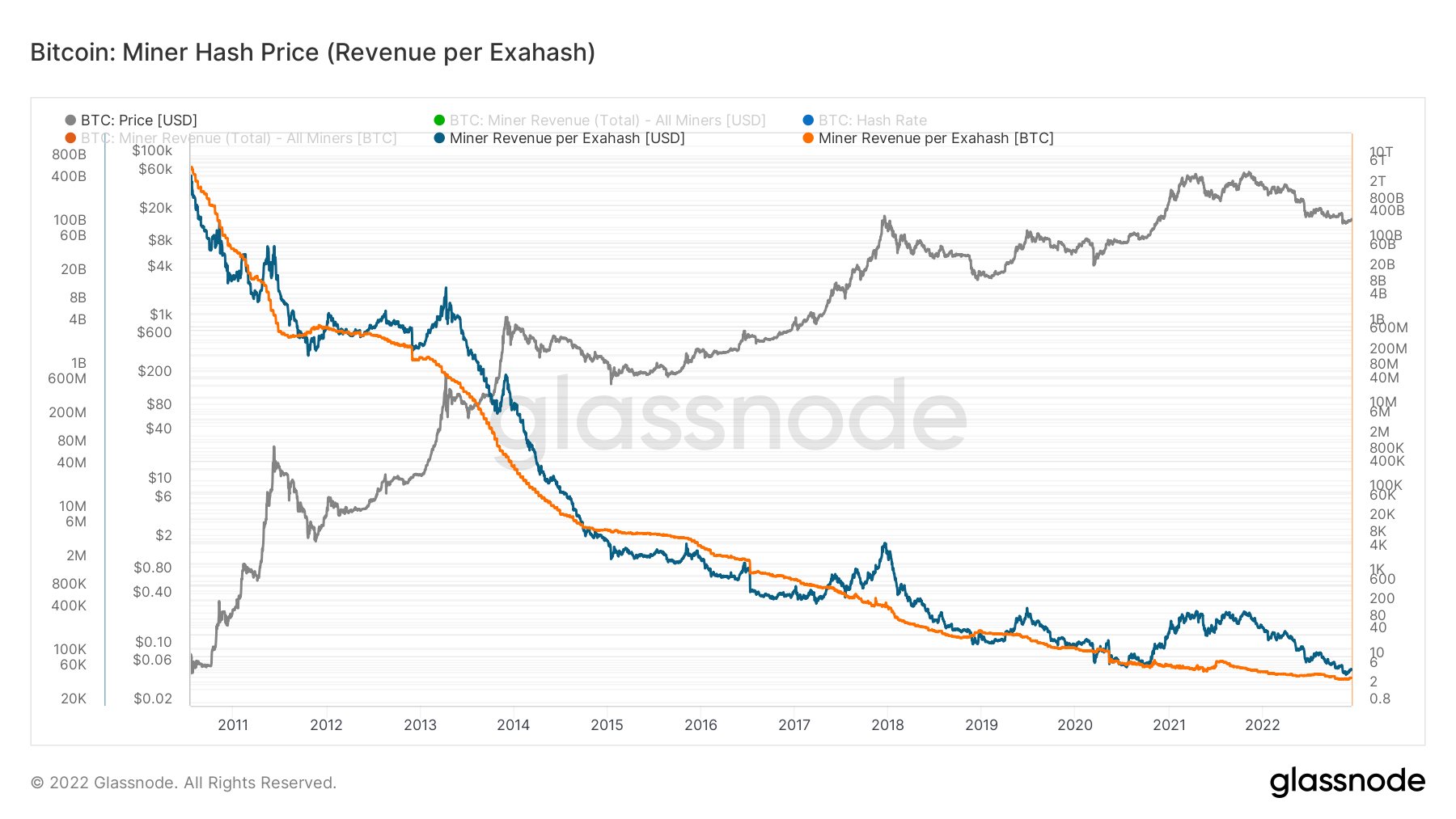

Quick Take Between the months of November 2022 and January, Bitcoin fell below $20k. According to the Difficulty regression model (The all-in cost to mine 1 Bitcoin), it was an unprofitable time for miners. Miners were distributing coins in excess of the mined supply, with Values > 100%, and depleting treasury reserves. Now, the miner supply spent indicates value = 100%; in the aggregate, a volume of coins equal to the total mined supply was spent. This is supported by the miner balance which is flat year-to-date. In Tuur Demeester’s latest report, CryptoSlate agrees that miner capitulation was last year, and miners are much stronger from a debt position point of view (See extract below). Difficulty Regression Model: (Source: Glassnode) Tuur Demeester’s: (Source: Adamant) Miner Wallet: (Source: Glassnode) Miner Wallet Spent: (Source: Glassnode)

The post Why the Bitcoin miner capitulation was in 2022 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|