2022-7-7 17:23 |

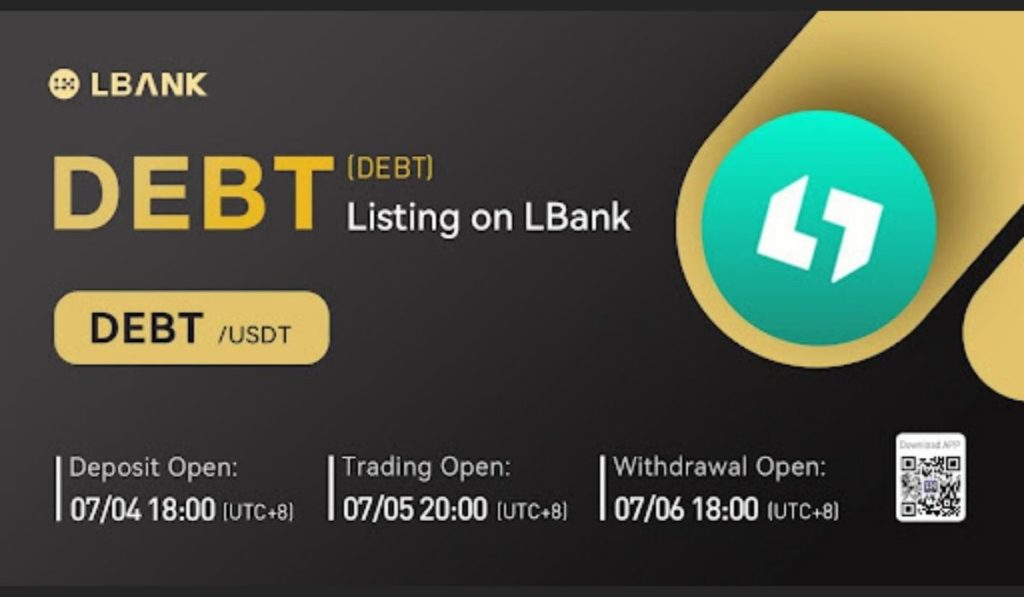

On July 5, 2022, DEBT was listed on LBank Exchange, a trading platform for digital assets.

DEBT Box provides a growing variety of token projects related to real-world commodities as a decentralized eco-friendly blockchain technology initiative, allowing users to become miners and get rewards from various asset classes. On July 5, 2022, at 20:00 (UTC+8), its native token DEBT was launched on LBank Exchange, furthering its global reach and assisting it in realizing its objective.

Welcome to DEBT BoxThe DEBT Box is a cutting-edge, decentralized, environmentally friendly blockchain network of anonymous software developers that works together to form a blockchain ecosystem. Users can build a portfolio of blockchain miners using the exclusive software developed by DEBT’s Box. By acquiring and administering various software node licenses, they can profit from a variety of asset classes while remaining at home in comfort and ease.

By supporting the production of tangible physical commodities like gold, silver, crude oil, natural gas, agriculture, real estate, royalty cash flows, and more, DEBT Box stabilizes its ecosystem with a growing list of token projects that are connected to real-world commodities through blockchain. Additional projects will be announced.

In order to promote real-world initiatives that create income, the DEBT Box ecosystem supports the physical production of these goods. The financial help, technological advancements, and operational support provided by Digital Licensing Incorporated are beneficial to these actual commodities production ventures.

One DEBT Box project is called Black Gold (BGLD), which is backed by and connected to the actual production and sale of crude oil. Users grant permission to Digital Licensing Incorporated, the permissioned administrator of the DEBT Box ecosystem, to support oil industry projects within the exploration, drilling, and physical production of crude oil with certain key advantages by purchasing a Black Gold software license and becoming a BGLD node operator. Software license holders receive BGLD tokens in exchange for their support of the blockchain.

In addition to BGLD, there are other stocks like GROW and NATG that are backed by high-yielding agriculture and are connected to the actual production and sale of natural gas, respectively. Soon, other initiatives like BLOX, REV, and DLS will start up.

DEBT TokenFor the DEBT Box ecosystem, which includes a growing range of token projects, the DEBT token serves as both the main support and utility token. There will be a swap pairing for each project with the DEBT token. Other efforts in the ecosystem discourage frequent trade by being deflationary and using transfer fees to fund the network. A token holder will therefore be urged to convert the value of their project token to the DEBT token before transferring and using it for trade and liquidity. As new projects enter the ecosystem and token projects mature, DEBT will generate demand thanks to its central position on the platform.

According to BEP-20, there are 50 million (50,000,000) DEBT tokens available overall. The quantity of tokens in circulation is determined by the fictitious, license-based regulations and schedule, with all tokens being produced and placed into the Ecosystem Growth Initiative (EGI) pool.

On July 5, 2022, at 20:00 (UTC+8), the DEBT token will be published on the LBank Exchange; at that time, investors interested in DEBT Box investments will be able to easily buy and sell DEBT there. Without a doubt, the addition of the DEBT token to the LBank Exchange will aid in the company’s further business growth and increase market awareness.

origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|