2020-7-11 05:00 |

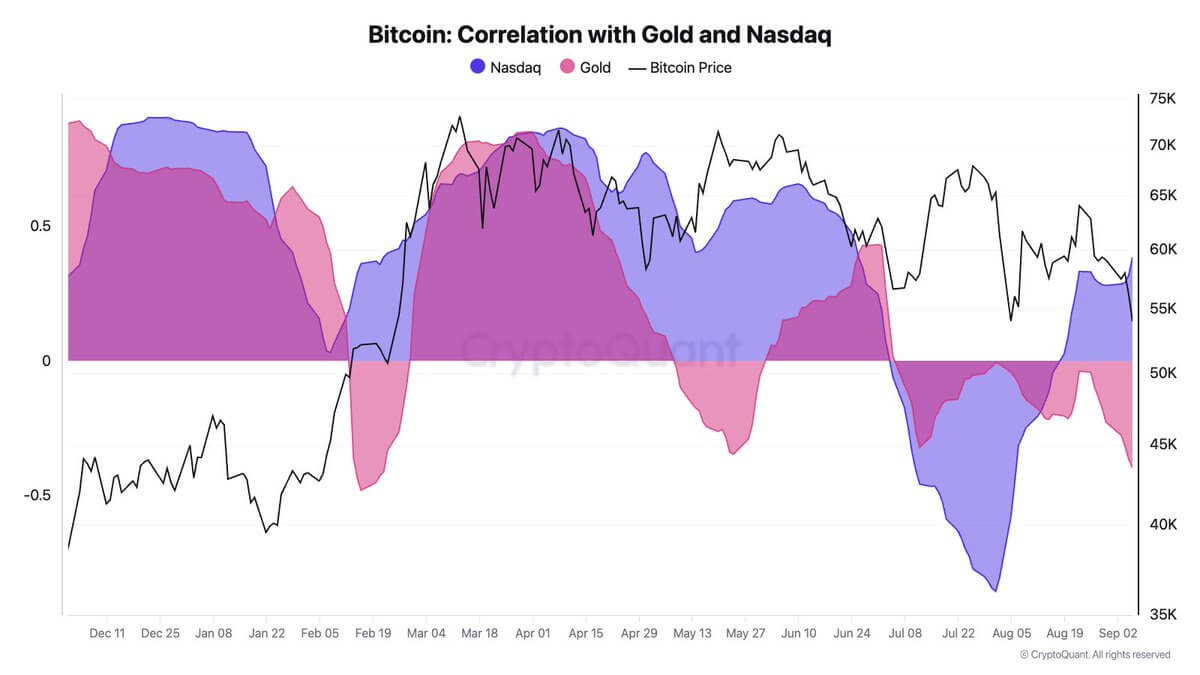

Bitcoin and gold have formed a striking correlation throughout 2020, although this has shown some signs of degrading over the past few weeks as BTC continues extending its multi-month bout of sideways trading.

Gold is also starting to move lockstep with the stock market, showing that traders are increasingly treating the precious metal as a “risk-on” asset rather than a “safe haven.”

One billionaire Bitcoin bull is now doubling down on his calls for investors to add both BTC and gold exposure to their portfolios.

However, he is now noting that most investors should hold more gold than they do Bitcoin, as the digital currency is still in its early adoption phase and can be prone to seeing immense volatility.

This is not an admission of him favoring gold over the crypto, but rather is just general advice for traditional investors who may not have an appetite for immense risk.

Galaxy Digital’s Mike Novogratz: Bitcoin Adoption Curve Remains SteepIn an interview with CNBC’s Fast Money from earlier this week, billionaire investor and founder of Galaxy Digital, Mike Novogratz, explained that Bitcoin’s growth has been plagued by a steep adoption curve.

He noted that, for the average investor, BTC is still hard to buy. This may have contributed to its stagnating price over the past couple of years.

“Bitcoin is still hard to buy… if it was easier to buy it would be a lot higher, and there are more and more people making it easier to buy,” he said.

He further added that a few parties that are helping to make it easier for non-crypto investors to foray into the market are funds, custody providers, and eventually, an ETF.

Why Novogratz Recommends Investors Hold More Gold Than BTCSome interesting advice Novogratz offered during the interview was regarding how investors should weight Bitcoin versus gold within their portfolios.

He explained that Bitcoin’s unpredictable nature and volatility means that the standard portfolio should be weighted more heavily with gold.

Despite this recommendation, he still believes that BTC will far outperform the precious metal in the years ahead.

“My sense is that Bitcoin way outperforms gold, but I would tell people to have a lot less Bitcoin than they have gold, just because of the volatility,” he explained.

If gold is able to extend its immense growth, it could create a tailwind that lifts the benchmark cryptocurrency as well, as both assets are underpinned by similar fundamental strengths.

Featured image from Unsplash. origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) на Currencies.ru

|

|