2026-1-19 07:53 |

Bitcoin (BTC) and gold moved in opposite directions as tensions over tariffs escalated between US President Donald Trump and the European Union.

While the precious metal rallied to fresh record highs amid rising geopolitical uncertainty, the leading digital cryptocurrency slipped. This contrasting move mirrors past patterns observed in October and has reignited debate over what could come next for both assets.

US–EU Trade Tensions Rise After Trump’s Latest Tariff MoveOn January 17, 2026, President Trump announced a 10% tariff on Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland, effective February 1. The tariffs will rise to 25% on June 1 and stay in effect until the United States secures an agreement to purchase Greenland.

Meanwhile, representatives from the eight countries affected by the new US tariffs met for emergency talks on Sunday. In a joint statement, President Costa and President von der Leyen said the EU “stands in full solidarity” with Denmark and the people of Greenland, signaling a unified political response to Washington’s latest move.

Furthermore, the Financial Times reported that the European Union is weighing a broader countermeasure package that could include tariffs worth up to €93 billion ($107.71 billion) or restrict US companies from the bloc’s market.

Tariff Shock Drives Investors to Gold as Stocks and Bitcoin Turn LowerMarkets reacted quickly to the tariff news, but in opposite ways. Gold prices surged to $4,690/oz in early Asian trading hours today, marking a new all-time high (ATH).

Silver prices also rose to a record price of over $94/oz. In contrast, stocks opened lower.

BREAKING: Stock market futures officially open for the first time since President Trump announced 10% tariffs on 8 EU countries, demanding an acquisition of Greenland:

1. S&P 500: -0.7%

2. Nasdaq 100: -1%

3. Dow Jones: -0.5%

4. Gold: +1%

5. Silver: +3%

It’s going to be an…

Bitcoin also moved south alongside broader risk assets. BeInCrypto Markets data showed that BTC dipped below the $95,000 level.

At the time of writing, the asset was trading at $92,574, down 2.67% over the past 24 hours. The total cryptocurrency market capitalization fell by nearly $98 billion during the same period.

The price drop triggered a wave of liquidations across the crypto market. Over the past 24 hours, total liquidations reached $864.35 million, with long positions accounting for more than $780 million of that figure.

“Bitcoin falls nearly -$4,000 as $500 million worth of levered longs are liquidated in 60 minutes,” The Kobeissi Letter wrote.

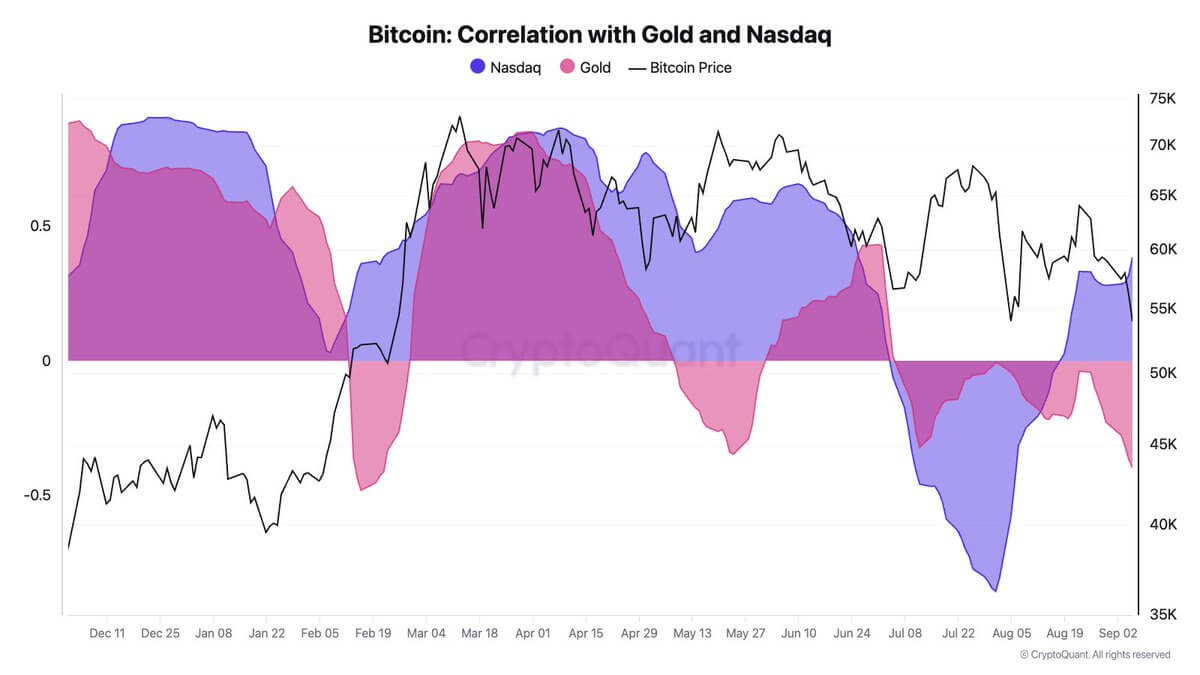

The contrast between gold and Bitcoin amid this tariff-driven turmoil exposes key differences in how markets view these assets. Gold’s long-standing role as a store of value during periods of economic and geopolitical stress remains largely undisputed.

Bitcoin, often described as “digital gold,” continues to trade like a risk asset in moments of heightened uncertainty, with price action closely tied to broader market sentiment rather than immediate safe-haven demand.

What’s Next for Bitcoin in January?Analyst Timothy Peterson offered insights on Bitcoin’s lagged response to Trump’s announcement. He noted that despite 24/7 trading, Bitcoin’s price did not react for about 36 hours, only dropping once institutional trading began in Asia.

“This illustrates how most intraday ‘news’ about price movements is usually an irrelevant storyline told after the fact. Not only that, you had plebs leveraged up, despite more than a full day’s warning that this was coming (This is the third Trump tariff announcement, Bitcoin wrecked every time.) Speechless,” he added.

Furthermore, Crypto Rover warned that this week “could shake the entire market,” citing a convergence of major policy developments that may trigger volatility across stocks and cryptocurrencies.

“EU tariffs threaten trade flows worth nearly $1.5 trillion,” he said. “If the EU starts building trade deals with countries that the US is also sanctioning, the US risks being pushed out of key trade routes. That would be: Bearish for global risk sentiment, Bearish for US stocks, Bearish for the dollar.”

Rover mentioned that the Supreme Court’s upcoming decision adds another layer of uncertainty, as a ruling either for or against the tariffs could unsettle markets. He noted that both scenarios are likely to pressure stocks and cryptocurrencies.

Amid this backdrop, experts remain divided on how Bitcoin could perform. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, suggested that the Bitcoin-to-gold ratio is more likely to continue declining toward 10x, a move that would signal sustained outperformance by gold, rather than rebound toward 30x in Bitcoin’s favor.

“Everyone expects Bitcoin to follow gold’s lead and rally to new highs. But the market has given speculators way too much time to buy. What’s far more likely is that Bitcoin’s failure to match gold’s gains undermines its narrative as digital gold, resulting in a spectacular crash,” economist Peter Schiff posted.

Veteran trader Peter Brandt noted that US dollar–denominated assets could underperform physical commodities. He also expressed uncertainty over Bitcoin’s role in this shift and predicted that altcoins would lose significant value.

“Gold will return to the world’s most dependable store of wealth. USD denominated assets will lose value to physical commodities — which, BTW, may or may not include Bitcoin. Altcoins will become more worthless than USDs,” the trader commented.

Despite this, optimism remains in some corners. Some analysts still expect Bitcoin to catch up to gold.

“Gold added roughly $10 trillion in marketcap last year. It wouldn’t surprise me if some of that profit is rotated/diversified into bitcoin,” a market watcher remarked.

Global M2 expansion is already being priced in by gold and silver

Both metals moved first as liquidity accelerated, while Bitcoin is still lagging below the trend

Historically, $BTC catches up late in the cycle, not early

We are going higher pic.twitter.com/CJOaVl8bIi

With trade tensions escalating and risk appetite deteriorating, the market will soon reveal whether Bitcoin can catch up or if gold remains the undisputed safe-haven standard.

The post Gold Hits Record High as Bitcoin Falls on Escalating US–EU Tariff Tensions appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) на Currencies.ru

|

|