2018-11-20 20:52 |

Two interesting developments have slipped past the sector this week. Although crypto bathed in a sea of red, the remittance and settlement tokens – XRP and Stellar Lumens (XLM) – are doing well, relatively speaking. And as discussed in a moment, the circulating supply may have a lot to do with their strength against a weakening Bitcoin.

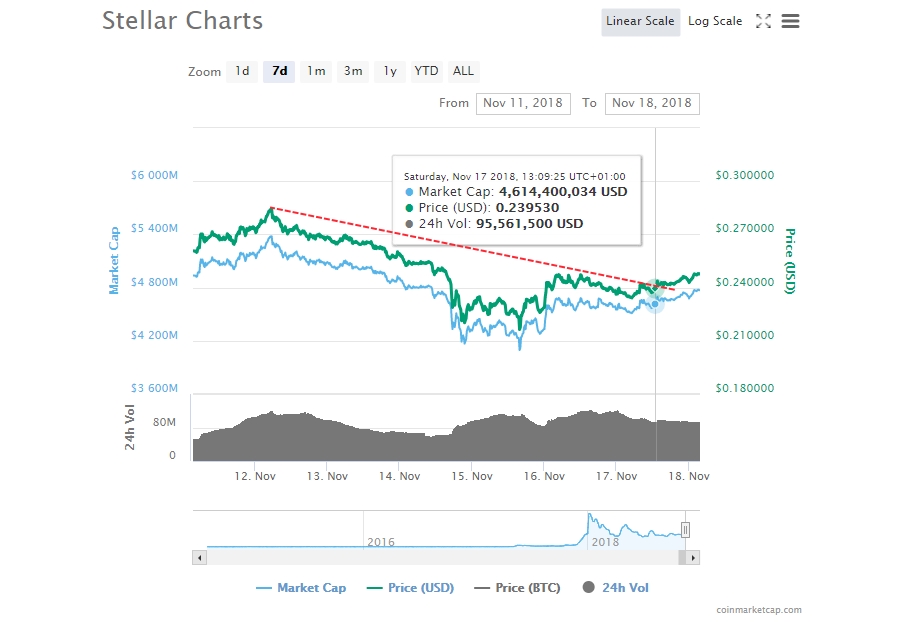

Neither XRP or XLM escaped last week’s Bitcoin Cash (BCH) fork wipeout. That said, they were two of the least affected coins. XRP lost roughly $2bn between Wednesday evening and the end of Thursday, in what works out as an 11% fall. Stellar’s total value fell by 13%, a drop of about $500m, over the same timeframe.

Both made strong recoveries over the weekend, recouping almost all the losses incurred at the end of the week. Even though both have been affected by this week’s mass sell-off, the amount lost is little compared to some of the other coins in the top-ten.

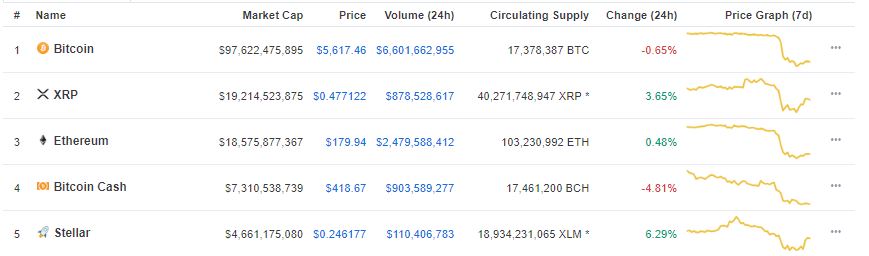

By Tuesday morning, when the market was down to a 14-month low, and losses were at their most acute, XRP had lost little more than 15% of its value; XLM by 22%. For perspective, Bitcoin (BTC) – normally treated as the de facto stablecoin – saw 22% of its value wiped; Ether (ETH) took a 30% hit and Bitcoin Cash, a further 48%.

Unlike XRP and XLM, none of these other coins saw much – if any- of their value recover over the weekend. For a brief spell early this morning, Stellar Lumens also became the fourth largest cryptocurrency, overtaking Bitcoin Cash.

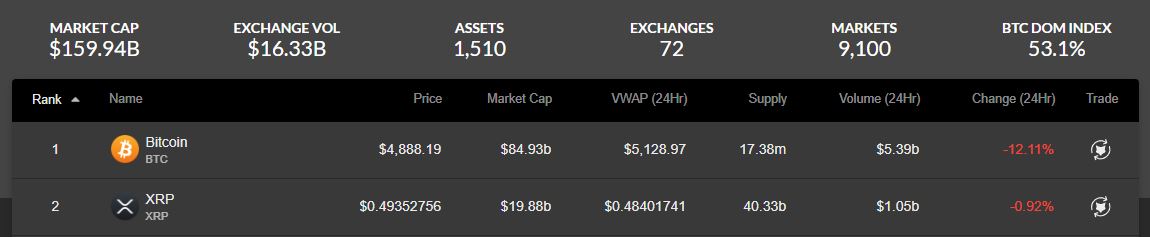

XRP, meanwhile, has moved up and solidified its position as the second largest cryptocurrency by market cap.

Its drop was nothing compared to Ether’s, and what started off initially as a half-billion-dollar lead quickly widened. XRP’s market cap is currently $4bn larger than ETH, at the time of writing; the gap was approximately $3.5bn yesterday afternoon.

What’s behind the XRP XLM action?The reason behind why XLM and XRP are doing so well may have something to do with the fact that remittance and settlement tokens are the most likely candidate for mass adoption, at least early on. At a crypto conference today in London, attended by representatives from the Bank of England and the Financial Conduct Authority (FCA) as well as Ripple, panel discussions reportedly looked at how crypto could be used for international payments.

I'm at a crypto event with reps from the Bank of England, HM Treasury, FCA, Ripple, and Prime Factor Capital. You think crypto is going away? These people are discussing how to implement it now. #crypto #bitcoin @ripple @bankofengland @TheFCA @hmtreasury

— Tim Copeland (@Timccopeland) November 20, 2018

XRP and Stellar lumens Circulating Supply TheoryThis may not be the only reason, however. The portion of XRP and Stellar Lumens in circulation is far lower than with other token-classes. Ripple Labs owns more than half of the XRP supply. Although part of Stellar’s custodial mandate is to distribute the vast majority – 95% – of XLM tokens, the company still controls more than 80%. of the supply.

According to Nelson Ryan, the head of Asia Pacific at The Reserve, an investment bank, this explains why XRP’s and XLM’s price movements have been more stable than those of other virtual currencies. “Both XRP and XLM have a lower portion of their total supply in circulation,” he said. “[This] could be a contributing factor in why they have not been as heavily impacted by current market conditions”

Tokens held in reserve keep price fluctuations stable. Other cryptocurrencies, which have a majority in circulation, don’t have this luxury. Bitcoin is known for its stability, but a wipeout like this week’s will still affect the price. Mostly because most are in circulation and can be sold, at any time; Ripple and Stellar are unlikely to liquidate the majority stake in the asset they created.

The author is invested in BTC and ETH, which are mentioned in this article.

The post Why Are XRP and XLM Outperforming The Rest Of The Market? appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Stellar (XLM) на Currencies.ru

|

|