2024-6-21 06:16 |

Ethereum ETF Launch – When’s the Big Day?

Investors and traders are clutching their Ethereum wallets in anticipation of the launch of spot Ethereum ETFs. Bloomberg’s ETF guru, Eric Balchunas, has circled July 2nd on the calendar. This date could be a game-changer, opening up a fresh route for folks to dive into Ethereum.

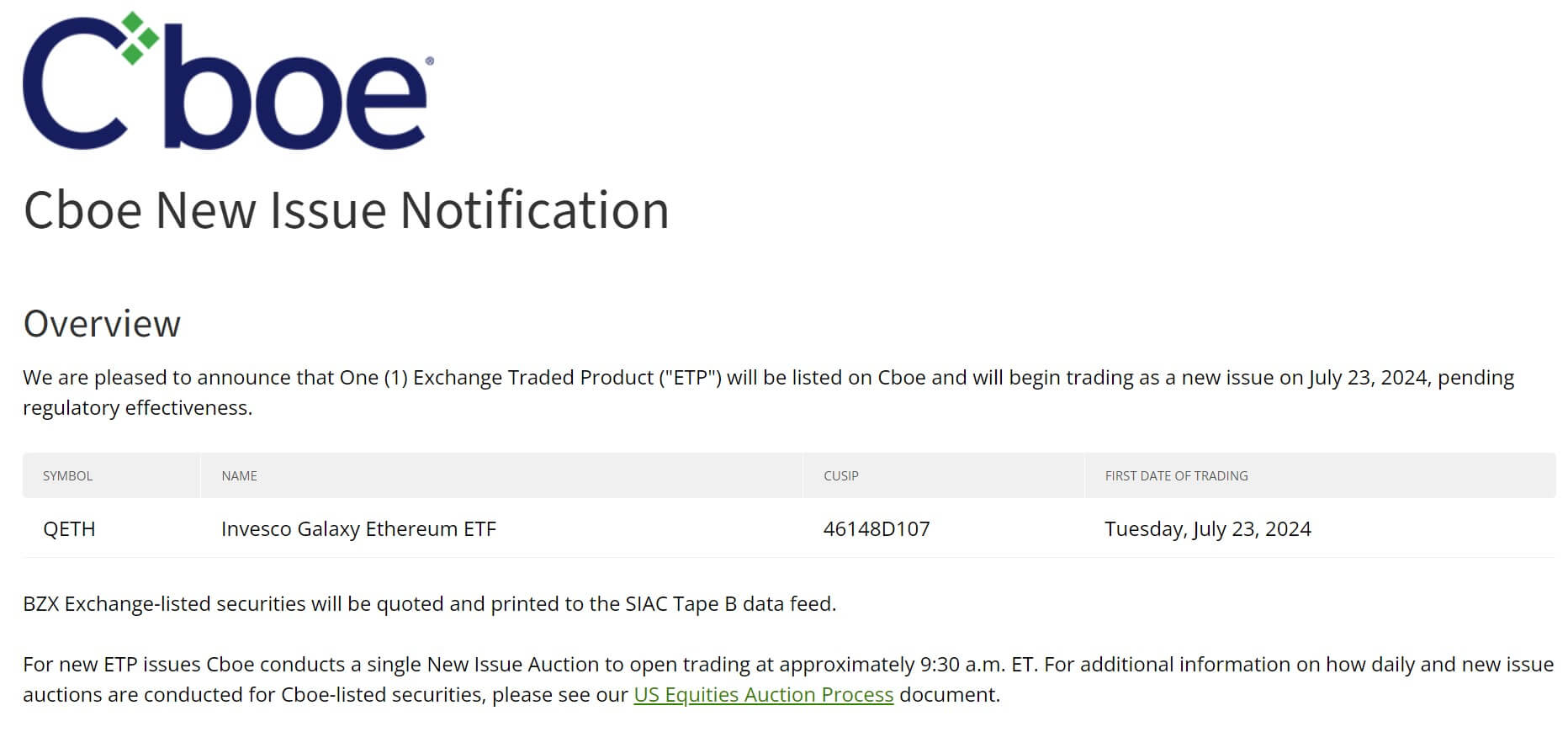

The road to getting these ETFs approved has been a wild ride. The SEC has given the green light to the 19b-4 forms for eight big players, including heavyweights like BlackRock, Fidelity, and VanEck. This stamp of approval is a big deal, letting these companies move forward with their ETF plans.

SEC Chairman Gary Gensler says Ethereum ETFs could be approved by September

The SEC has also tossed some light comments on the S-1 filings back to the issuers. This is a good sign that things are moving in the right direction. SEC Chair Gary Gensler hinted during a budget chat on June 13th that we might see these ETFs get the nod by September. Back on May 23rd, the SEC gave a thumbs-up to the 19b-4 filings from eight companies for Ethereum ETFs. This is a solid signal that these ETFs are just around the corner. Investors and traders are watching like hawks, knowing that the launch of Ethereum ETFs could shake up the crypto market in a big way.

Market ProjectionsGetting a grip on the market projections for the Ethereum ETF can be a game-changer for crypto traders and investors. Let’s break down VanEck’s price forecast and the expected institutional money flow.

VanEck’s Price ProjectionVanEck, a big player in asset management, has thrown out a bold prediction for Ethereum (ETH). They reckon Ethereum could hit $22,000 by 2030. This guess is based on Ethereum pulling in around $66 billion in “free cashflows.”

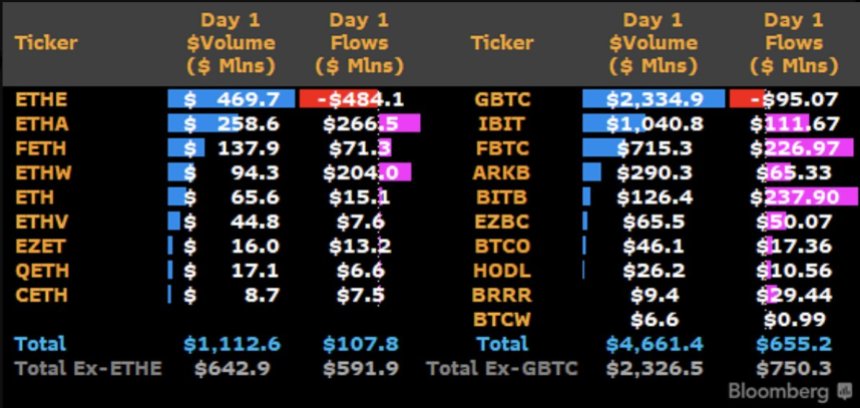

Institutional Capital InflowsThe launch of spot Ethereum ETFs is set to draw in a hefty amount of institutional cash. Geoff Kendrick from Standard Chartered thinks the inflows could be anywhere from $15 billion to $45 billion in the first year alone.

These numbers show just how much Ethereum ETFs could shake up the market. If you’re into crypto trading or investing, this is something you don’t want to miss.

Impact on ETH Prices Price Rally PredictionEveryone’s buzzing about the possible approval of spot Ethereum ETFs, and it’s got the crypto world in a tizzy. QCP Capital, a trading firm out of Singapore, thinks this could send ETH prices soaring. They’re talking a 60% jump, similar to what happened when spot Bitcoin ETFs got the green light back in January.

Market Reaction and Price FluctuationsThe market’s been all over the place since the news dropped on June 13th. ETH took a nosedive from $3,558 to $3,464, hitting its lowest point for the month. But it didn’t stay down for long, bouncing back up by 0.69% to $3,517.

Even with these ups and downs, the market isn’t exactly screaming “bullish.” It looks like ETH might still be stuck in a bit of a rut, influenced by some bearish vibes. Check out the recent price movements.

For traders and investors, keeping tabs on these shifts is key. Knowing how the market’s reacting can help you make smarter moves with your investments.

Approval Process Updates SEC Chair’s StatementsDuring a budget hearing on June 13th, SEC Chair Gary Gensler mentioned that the approval process for Ethereum ETFs is expected to wrap up by summer, with a likely nod by September. The timeline hinges on how quickly issuers respond to the SEC’s feedback. This has stirred up quite the buzz in the crypto world.

Price Impact and Market SentimentEven with worries about the drawn-out approval process for Ethereum ETFs, Gensler’s recent comments hint at a September green light, giving issuers more prep time. After the June 13th announcement about the potential approval, ETH’s price saw some ups and downs.

ETH’s price dipped from $3,558 to $3,464, hitting its lowest in June. But as of the latest update, ETH has bounced back a bit, up 0.69% to $3,517. Despite these price swings, the indicators didn’t show a strong bullish vibe, suggesting ETH might still be swayed by bearish trends. This mixed market sentiment highlights the cautious optimism about the potential Ethereum ETF approval.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|