2024-5-24 16:54 |

Yesterday, rumors abounded in the crypto sphere that United States regulator the Securities and Exchange Commission (SEC) has begun discussions to approve Ethereum spot ETFs in America, as it did for Bitcoin ETFs back in January.

Then, hours later, the SEC issued an official notice that it had approved for trading the Ethereum spot ETF filings from many of the major asset management players: BlackRock, Fidelity, Grayscale, VanEck, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise, respectively.

Ethereum has been tearing up the headlines ever since – but what does the news actually mean?

How the ETH spot ETF approval will affect the crypto spaceAccording to Matteo Greco, research analyst at digital asset and fintech investment business Fineqia International, this marks a pivotal moment – and not just for Ethereum, either.

The approval of ETH Spot ETFs marks a pivotal moment for digital assets, bridging the gap between digital and traditional finance.”

Indeed, Bitcoin has for years been considered slightly set apart from other cryptocurrencies. The ‘crypto version of gold’, as it’s often known, is in a class of its own and often considered closer to traditional finance than any other digital coin.

In this way, one could argue that the Ethereum approval is the first ‘real’ sign of cryptocurrency approval from the SEC. As Greco says:

While BTC stands as the most prominent digital asset, its unique consensus mechanism sets it apart in regulatory classification. Conversely, ETH shares its consensus mechanism with the majority of digital assets, opening the door for numerous others to be integrated into financial products, provided they meet specific criteria such as liquidity and customer protection. This approval signifies the official recognition of digital assets as a distinct asset class by traditional finance actors and regulators. It sets a precedent for the potential inclusion of various assets into financial products in the US and beyond.”

How the ETH spot ETF approval will affect the Ethereum priceThe future also looks bright for Ethereum specifically, according to experts. For example, analyst Gautam Chhugani of asset management firm Bernstein recently predicted that Ethereum would soon reach a new all-time high of $6,600 after a spot ETF was approved by the SEC.

Meanwhile, founder of the Digital Assets Council of Financial Professionals Ric Edelman, has said that:

Just as we have seen massive asset flows into spot bitcoin ETFs, which debuted only a few months ago, we will likewise see substantial flows into these new products.”

Fineqia’s Greco disagrees somewhat with Edelman, saying that it will take time and not be quite that simple.

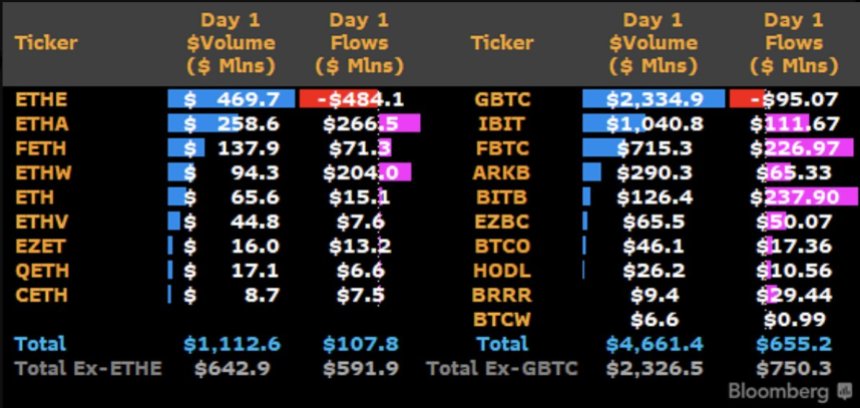

Unlike BTC, these products are expected to take weeks to commence trading, contrasting with BTC’s immediate trading post-approval. Additionally, a conversion from the Grayscale Trust Ethereum (ETHE) to an ETF may initially lead to outflows. However, once outflows stabilize, a more consistent net inflow similar to BTC’s pattern may emerge.”

As for specific figures, he demurs:

Estimating figures is complex; while BTC attracted $12 billion in approximately 3.5 months, projecting a similar magnitude of net inflow for ETH, adjusted for market cap, could result in $3 billion to $5 billion in one quarter. However, due to differences in asset characteristics and potential investor cohorts, precise estimates are challenging. While there may be significant overlap, investor demographics for ETH may differ from those for BTC, leading to varying correlations.”

Others still are not so bullish. Some, like Jan3 CEO Samson Mow, reckon that those who expect Ethereum’s price to imitate Bitcoin’s after its SEC approval will be sorely disappointed. Mow posted on X this week that they would “massively underperform” and that “this is the last chance to sell ETH above 0.05 BTC.”

Source: @Excellion How the ETH spot ETF approval will affect the BTC priceFor now, Ethereum’s SEC nod will likely do little to affect the mighty Bitcoin’s price. However, according to Greco, it could have quite a profound impact in the longer term:

Over time, it’s plausible that BTC’s dominance in the crypto ETP space will decline, mirroring the evolution seen in the broader digital assets landscape. Initially, BTC held a monopoly, followed by ETH adoption and the emergence of various other digital assets. Despite BTC remaining a key player, its dominance diminished. Similarly, with the introduction of BTC ETFs bringing in approximately $12 billion in net inflow, the regulation and issuance of other assets, starting with ETH, are expected to attract additional investments in altcoins. This trend could lead to a gradual decrease in BTC dominance in the long term, akin to market trends observed previously.”

The negative side of the SEC approvalBut there is still work to be done, according to Coinsensys, which is famously in a legal process to sue the SEC currently.

The company said on X today that Consensys welcomed today’s decision “as a step in the right direction”, but commented that “this seemingly last-minute approval is yet another example of the SEC’s troublesome ad hoc approach to digital assets”.

Source: @CoinsensysThey also added:

Today’s approval signals that the SEC views that ETH is a commodity and not a security – contrary to the position it continued to take prior to the events of this week… We will continue to fight for definitive regulatory clarity in our case and we are pleased to see the tremendous bipartisan Congressional effort seeking to provide clear and sensible regulation.”

The post Experts on: What the SEC Ethereum ETF approval will do for ETH, other cryptos and the BTC price appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|