2019-7-19 09:47 |

The latest results released by the Futures Industry Association (FIA) show some extremely encouraging signs. Not only is the traditional futures industry growing exponentially, but 2018 saw a record number of contracts changing hands globally. Futures and options climbed by 20.2 percent from the previous year to 30.28 billion contracts, an all-time record.

The global futures industry is a multi-trillion-dollar one and demand keeps on rising. But it’s also an industry that’s rife with inefficiencies, middlemen, hefty commissions, and decidedly favorable conditions for institutions and the ultra-wealthy.

Everyday retail traders get an extremely raw deal they want to try their hand trading these markets. If ever there were a space primed for disruption, it’s futures.

Thanks to the power of blockchain technology, traders have been buying and selling cryptocurrency futures contracts without the need to be an accredited investor or use an expensive broker. But we’re still testing the waters as far as futures trading and the blockchain go.

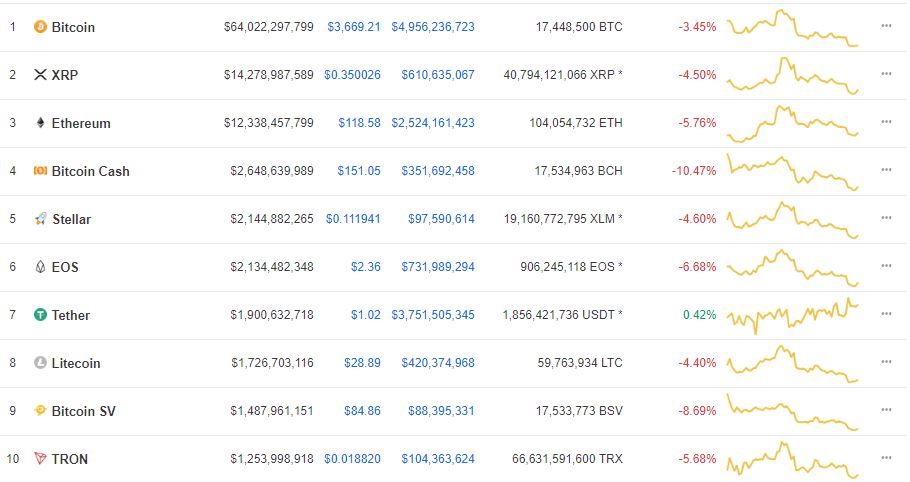

Taking Futures Trading to the Next LevelTraders can currently trade cryptocurrency futures on many different pairs, from BTC against the USD to ETH against the GBP. But, there still are no exchanges that allow cryptocurrency futures traders to trade traditional futures markets as well. So, why not–and what if there were?

By adding traditional futures markets like gold, bonds, stocks, and indices, to cryptocurrency trading, exchanges would be effectively taking the cryptocurrency game to traditional retail traders. We’re talking abou the self-directed trader who currently trades his or her favorite markets without a financial advisor while paying high brokerage fees.

Out of all millennial retail traders worldwide (cryptocurrency’s largest target), around 72 percent describe themselves as “self-directed investors.” This means that they don’t rely on a financial advisor, trader, or broker to invest their money or offer advice. With this new demographic more willing to trade online in new ways, cryptocurrency futures exchanges can tap into a massive and expanding market.

Not only would the cryptocurrency industry be tapping into the multi-trillion-dollar futures industry, but it would be disrupting the status quo and giving traditional retail traders a better deal.

Giving Opportunity to Retail TradersAllow me to reiterate. We’re not talking about market caps in the millions or billions here–we’re talking about the trillions of dollars. Allowing for the trading of traditional futures markets on cryptocurrency exchanges has the potential to bring more fiat on-ramp and make crypto potentially huge, onboarding traditional retail traders.

Not only will they benefit from lower commissions (or even zero) on the markets they’re comfortable trading, but they’ll also get exposure to cryptocurrency trading for the first time.

The types of markets that can be added has almost limitless potential. Alongside cryptocurrency pairs, traders can speculate on gold, stocks, oil, indices, forex, and more–all the time taking market share away from the enormous futures industry. This will help cryptocurrency exchanges grow and reach more types of traders.

Even if they were only able to unlock a minute percentage of the trillions of dollars generated from the billions of contracts registered by the FIA, they could give traders the potential to make enormous gains!

Giving Cryptocurrency Traders Exposure to Traditional FuturesAt the same time as bringing fiat on-ramp and widening the pool of traders, cryptocurrency futures exchanges will also be allowing everyday crypto traders who previously had restricted access to get in on a trillion-dollar market. For the very first time.

This would mean unlocking a ton of value that’s traditionally been held in paper contracts and only available for a select few to trade. Crypto traders of all styles in all places can get their feet wet in an entirely diverse and burgeoning industry. It’s impossible to understate the potential of marrying traditional futures trading with the crypto industry. This revolution is just getting started.

The post What trading traditional future markets in crypto means appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Vice Industry Token (VIT) на Currencies.ru

|

|