2025-2-4 13:29 |

Donald Trump’s decision to levy tariffs may have turned market sentiment linked to his pro-crypto promises, causing a steep drop in bitcoin (BTC) and majors in the past 24 hours.

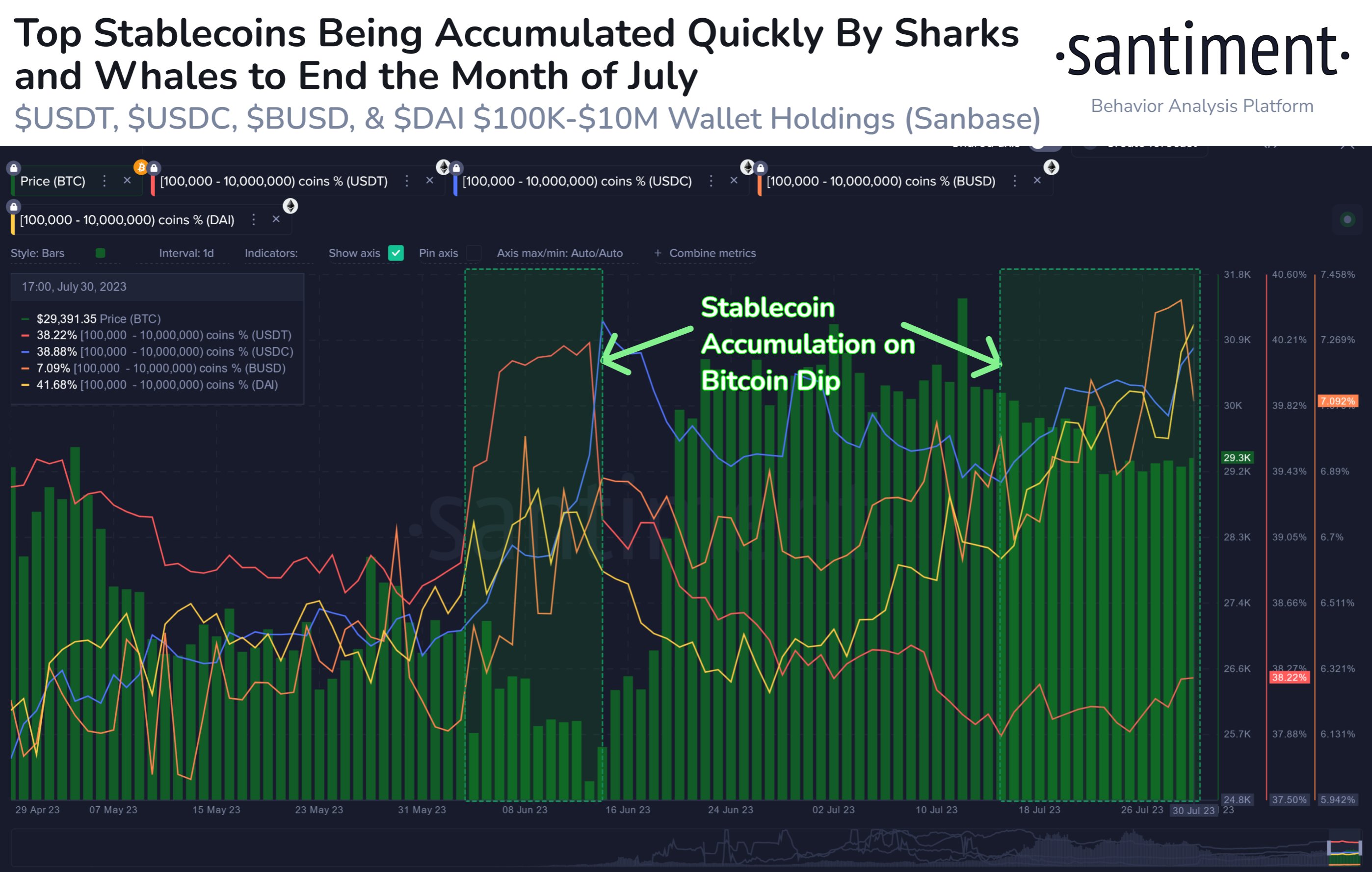

Traders believe Monday’s bloodbath could turn out to be a buy-the-dip opportunity for several reasons, stemming from the eventual growth of and demand for dollar-backed stablecoins.

“One bullish take is for stablecoins,” Peter Chung, head at Presto Research, told CoinDesk in a Telegram message.

“Treasury Secretary Scott Bessent has noted recently that Trump prefers tariffs over sanctions as a diplomatic tool, as the latter push countries away from the dollar, weakening U.S. financial hegemony. If that's the case, Trump would likely prioritize the Stablecoin Bill in Congress, as it would enhance the dollar's functionality, reinforcing its global dominance," Chung said.

Vincent Liu, chief investment officer at Kronos Research, mirrored the sentiment.

"With ongoing concerns over tariff escalations and currency volatility—illustrated by the Canadian dollar’s decline against the USD since tariffs were introduced—stablecoins pegged to major fiat could see accelerated adoption,” Liu said.

“As a hedge against economic uncertainty, they streamline global transactions, remove forex conversion hurdles, and provide a seamless gateway into crypto. In the long run, increased stablecoin adoption could enhance liquidity, attract institutional capital, and drive regulatory clarity. This evolution may position stablecoins as a cornerstone of the crypto economy, reinforcing market stability and fueling sustained growth,” Liu added.

A $2.2 billion flush from rypto futures since Sunday may also provide the bedrock for short-term respite. High liquidations can often signal an overstretched market and indicate the end of a price correction, making it favorable to buy after a steep fall.

Price-chart areas with high liquidation volumes can act as support or resistance levels where the price might reverse due to the absence of further selling pressure from liquidated positions.

However, if the market continues declining, those with short positions might see this as validation, potentially increasing their bets. Conversely, contrarian traders might view heavy liquidation as a buying opportunity, expecting a price recovery once the sell-off momentum wanes.

What Happened?Trump imposed a 25% tariff on goods from Canada and Mexico and a 10% tariff on imports from China over the weekend. The move seemingly started a trade war: Canada countered with a 25% tariff on $106 billion worth of U.S. goods, and Mexico is expected to implement similar measures.

Two-year Treasury yields increased, while the 10-year yield decreased, indicating concerns about short-term inflation. Asian markets fell on Monday, gold prices dropped, oil rose, and crypto market tanked.

Trump is also eying tariffs on goods imported from the European Union, which could come “pretty soon,” per the BBC. The EU said it would act as a collective and "respond firmly" if and when tariffs come in, indicating retaliatory taxes.

The core idea of tariffs is to make imports more expensive, thereby encouraging domestic production and reducing reliance on foreign goods. This is part of a broader strategy to use trade policy to leverage better terms for the U.S. in international trade negotiations.

However, tariffs increase the cost of goods exported to the U.S., which can hurt these countries' economies by reducing demand for their products. If one country imposes tariffs, others might respond with their own, leading to a cycle of escalating trade barriers.

Tariffs disrupt established supply chains, which are often globalized. Increasing costs or blocking certain goods can lead to shortages or higher prices elsewhere, prompting further protectionist measures from affected countries — leading to more disruption in financial markets.

The lack of forthcoming catalysts may mean crypto markets are stuck in a lull period, except for a strong, isolated catalyst that directly bumps up bitcoin.

“Sentiment has turned negative with little hope that things can turn around, except for a potential Bitcoin Strategic Reserve and more regulatory support from the government,” Nick Ruck, director at LVRG Research, told CoinDesk in a Telegram message.

“Although the market conditions are vastly different, tariffs from the previous Trump administration could be a showcase for tariff announcements, which were only short-term shocks to crypto prices while the general bullish trend remained intact,” Ruck added.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|