2023-8-1 16:40 |

On-chain data shows a pattern in the stablecoin shark and whale holdings that may suggest the Bitcoin rally could make a return in the near future.

Stablecoin Sharks & Whales Have Been Accumulating RecentlyAccording to data from the on-chain analytics firm Santiment, the sharks and whales of the major stablecoins have been increasing their reserves while Bitcoin has been struggling recently.

The “sharks” and “whales” are two of the largest cohorts in the sector, with investors belonging to the former holding at least $100,000 and at most $1 million worth of the asset, while the latter has wallet balances in the $1 million to $10 million range.

Due to such large holdings, these investors can potentially move around a large number of coins at once, something that can make them influential entities in the market.

In the context of the current discussion, the sharks and whales of stablecoins are of interest. In particular, the four largest players in the market are of relevance here: Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and Dai (DAI).

Santiment has used its “Supply Distribution” metric to track the holdings of these humongous holders and this indicator tells us about the percentage of the supply that each group in the market is holding right now.

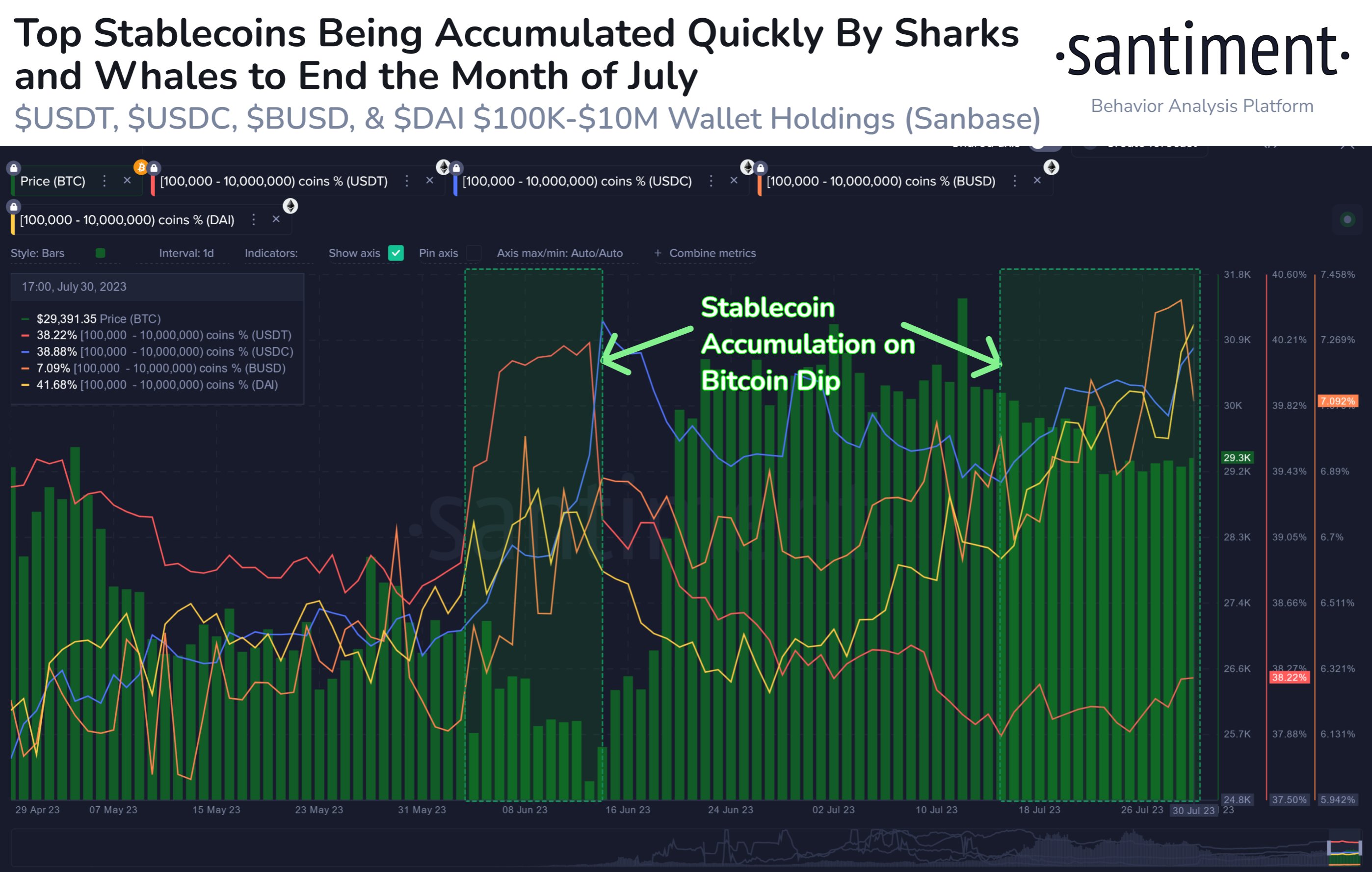

Here is a chart that shows the trend in this metric specifically for the sharks and whales of the top 4 stablecoins in the sector:

As displayed in the above graph, the holdings of these stablecoin sharks and whales have been on the rise recently. Interestingly, while this trend has formed, the price of Bitcoin has dipped below the $30,000 level.

A similar pattern in the supply held by these large investors had also formed last month, as these investors had been buying more stablecoins, while BTC had been on a decline.

What followed this period of accumulation back then was a sharp Bitcoin rally that had taken the cryptocurrency’s price above the $30,000 level.

An explanation of this curious trend may lie in what the holdings of these large stablecoin holders signify. Generally, these investors opt for stables whenever they want to exit volatile assets such as BTC.

Such holders, however, usually only seek to temporarily take shelter in these dollar-tied tokens, because if they wanted to stay away from the sector for extended periods, they would have exited through other means like fiat.

Thus, these investors would eventually shift their stablecoins into Bitcoin and others again, and with this exchange, provide a bullish boost to their prices. This is why the supply of these sharks and whales may be looked at as the available buying pressure that these humongous investors can put on the asset at any point they want.

From the chart, it’s visible that the BTC rally above $30,000 didn’t actually kick off from new money being pumped back into the asset by the sharks and whales, but rather the conversions that they made back into the asset, as their holdings decreased while the rally happened.

As the large investors of the major stables have again been accumulating recently, it’s possible that Bitcoin could see a bullish effect from this down the road once more, although it’s uncertain how long it may be before these investors deploy their stablecoins back into the market.

Bitcoin PriceAt the time of writing, Bitcoin is trading around $29,300, up 1% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|