2020-8-10 23:00 |

Despite the parabolic performance in some altcoins, Bitcoin is stagnating around the high-$11,000s. As of the time of this article’s writing, BTC is trading for $11,600. This comes after it was rejected last week at the $12,000 level yet again, marking a loss for bulls. Analysts say that Bitcoin managing to hold the $11,500 level would bolster the medium-term bull case dramatically. One trader went as far as to say that the cryptocurrency closing the weekly candle at $11,500 could leave bears without much hope. He isn’t the first commentator to have placed such emphasis on that specific level. A trader recently went as far as to say that $11,500 is literally Bitcoin’s most important level ever. Bitcoin Holding Above $11,500 Into the Weekly Close Will Be Pivotal

A cryptocurrency technician noted on August 9th that Bitcoin closing $11,500 when the weekly candle closes today will be pivotal for the bull case. “11500 is a major weekly level. If it closes today above that, then what hope do bears still have?” The analyst said.

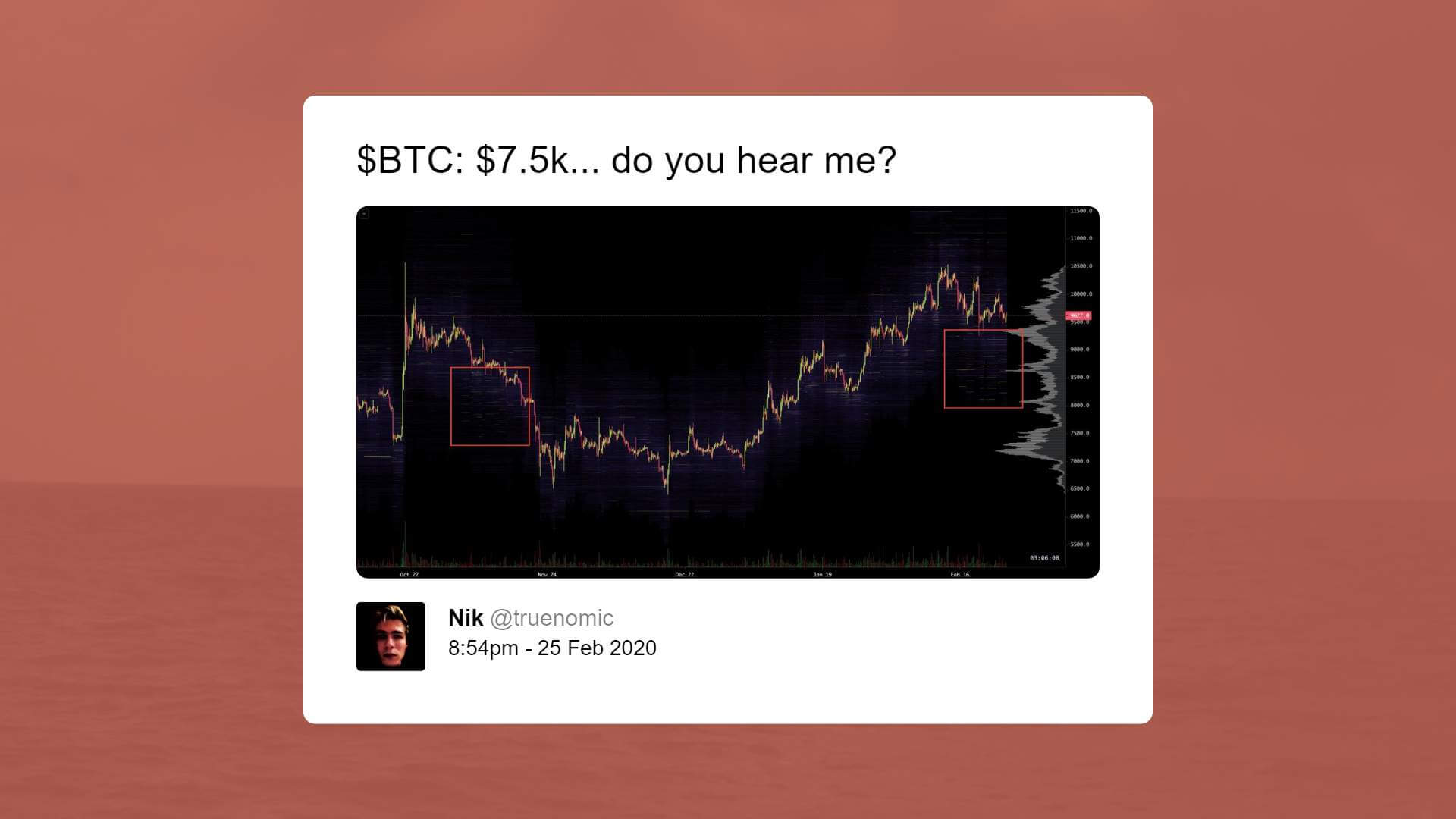

Corroborating his optimism, he pointed to how BTC interacted with that specific level in 2019. For context, the cryptocurrency was rejected cleanly at that level on two separate occasions in mid-2019, leading to the bear market to $6,400.

Chart of BTC's price action (short-term and long-term chart) by trader Byzantine General (@ByzGeneral on Twitter). Chart from TradingView.comBitcoin managing to close above $11,500 would mean that it has set a new higher high on a long-term scale, ending the macro downtrend that is still technically intact.

He isn’t the first commentator to have assigned such importance to $11,500.

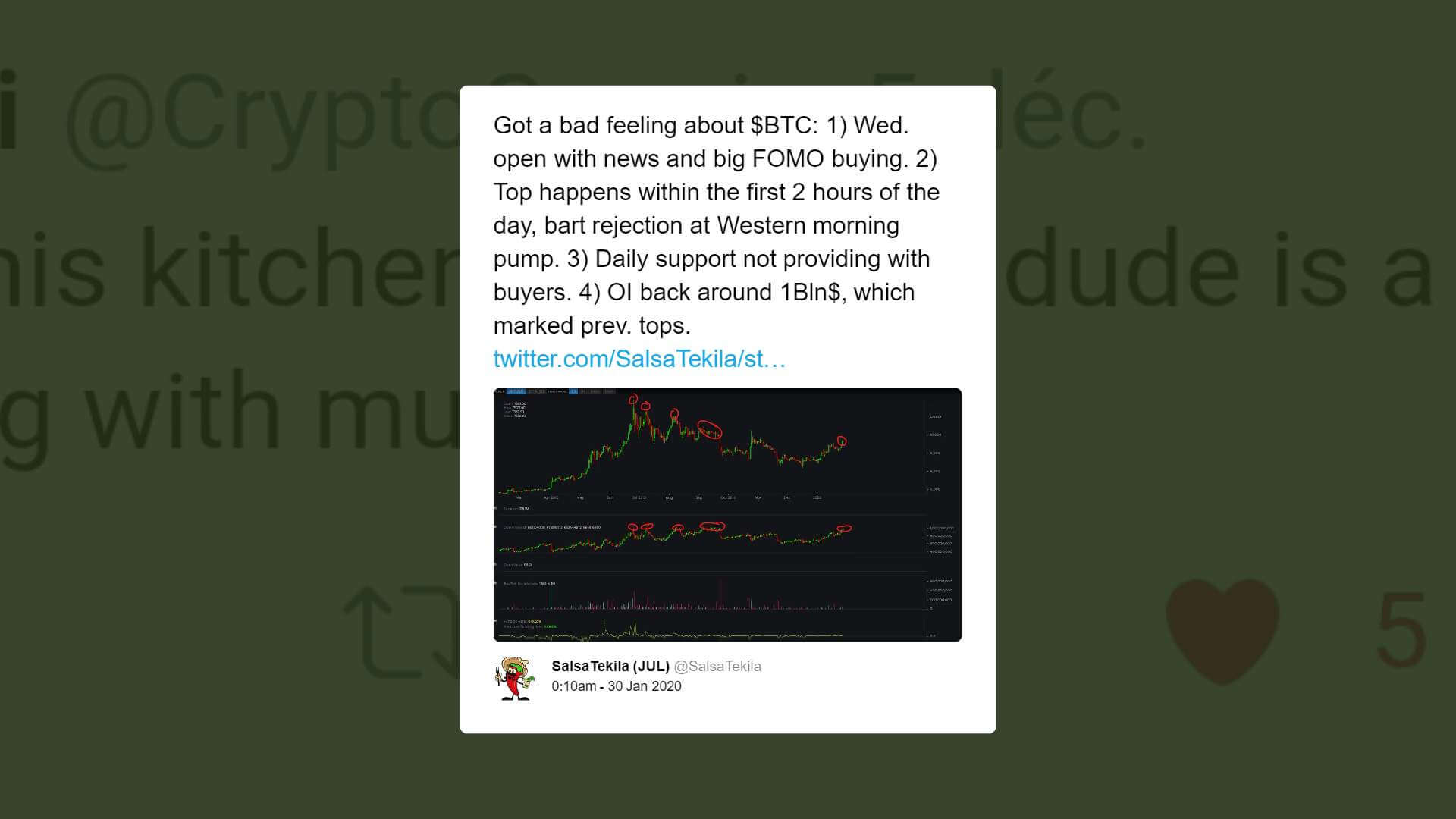

As reported by Bitcoinist previously, one trader said that $11,500 is literally the “most important level for Bitcoin” ever. Like the aforementioned analyst, the trader identified how Bitcoin has previously interacted with the pivotal horizontal region.

Chart of BTC's macro price action over the past three years with analysis by crypto trader Inmortal Technique (@inmortalcrypto on Twitter). Chart from TradingView.com Will It Happen?Analysts are optimistic that Bitcoin will hold $11,500 into the weekly close in approximately five hours as of this article’s publishing.

Ki Young Ju, the chief executive of CryptoQuant, remarked on August 9th that on-chain data is currently suggesting Bitcoin is in a formation to move higher. He noted that per his company’s data, there is a decreasing number of BTC being sent to exchanges, suggesting investors expect the asset to soon rally.

“BTC inflow to spot exchanges keeps decreasing. It’s time to place your bets. Good to long here, IMAO.”

#BTC inflow to spot exchanges keeps decreasing. It's time to place your bets. Good to long here, IMAO.https://t.co/zRhgE0duSX pic.twitter.com/l0tPjGvEPu

— Ki Young Ju (@ki_young_ju) August 9, 2020

With altcoins rallying, analysts have suggested that Bitcoin may obtain a slight spot bid as profits from these investments cycle into BTC.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com What Hope Do Bears Have If Bitcoin Holds $11,500? Analyst Asks origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|