2020-9-1 22:35 |

Warren Buffett has made another major investment shift, one that reduces Berkshire Hathaway’s dependence on the U.S. economy. This news followed the Federal Reserve’s policy announcement to “push up inflation,” which is seen as bullish for bitcoin, with some predicting that the price of the cryptocurrency will soon reach an all-time high.

Buffett Reducing US DependenceWarren Buffett’s Berkshire Hathaway has invested over $6 billion in Japan’s five biggest trading houses. The company has taken a 5% stake in Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp. The stakes could rise to 9.9%, the company said on Sunday, Buffett’s 90th birthday. Reuters described:

The investment will help reduce Berkshire’s dependence on the U.S. economy, which in the last quarter contracted the most in at least 73 years as the Covid-19 pandemic took hold.

“Buffett’s choice in Japan, however, surprised market players as trading houses have long been far from investor favorites,” the publication added. Tokyo-based Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities, pointed out that “it is un-Buffett-like to buy into all five companies rather than selecting a few.”

Most of Berkshire’s operating businesses are American. The company owns more than 90 businesses outright and invests in dozens of companies, such as American Express Co., Bank of America Corp., and Coca-Cola Co. Moreover, Berkshire has a roughly $125 billion stake in Apple Inc. (APPL), accounting for about 43% of its total portfolio.

Berkshire Hathaway CEO Warren Buffett turned 90 on Sunday.Berkshire already made a surprise investment move about two weeks ago when it invested in Barrick Gold. Crypto exchange Gemini founder Cameron Winklevoss tweeted on Sunday:

When Buffett buys stake in gold mining company you know he knows something’s up … inflation is coming. He’ll find Bitcoin in a decade. It took him until 2016 to find APPL, but now it’s his biggest investment ever.

Many people joined into the discussion, pointing out that Buffett is already 90 so it will be difficult for him to find Bitcoin during his lifetime. Overall, the opinions are split, with some believing that the Berkshire CEO will eventually buy bitcoin while others say he will never do so in his lifetime.

“Not sure Buffett is ready to wade into Bitcoin just yet,” global macro investor and Gold Bullion International co-founder Dan Tapiero tweeted last week. “Perhaps his younger deputies might be. BRK [Berkshire Hathaway] is a public company so difficult for them to take too many non-equity outlier positions. In 2-3 years, I think it’s possible they could allocate.”

The Oracle of Omaha has repeatedly said that he will never own bitcoin, calling the cryptocurrency “rat poison squared,” as he does not see any value in it. He was gifted a bitcoin in February by Tron founder Justin Sun during a dinner which Sun won for $4.57 million at a charity auction. However, Buffett later said that all cryptocurrencies gifted to him were immediately regifted to his charity.

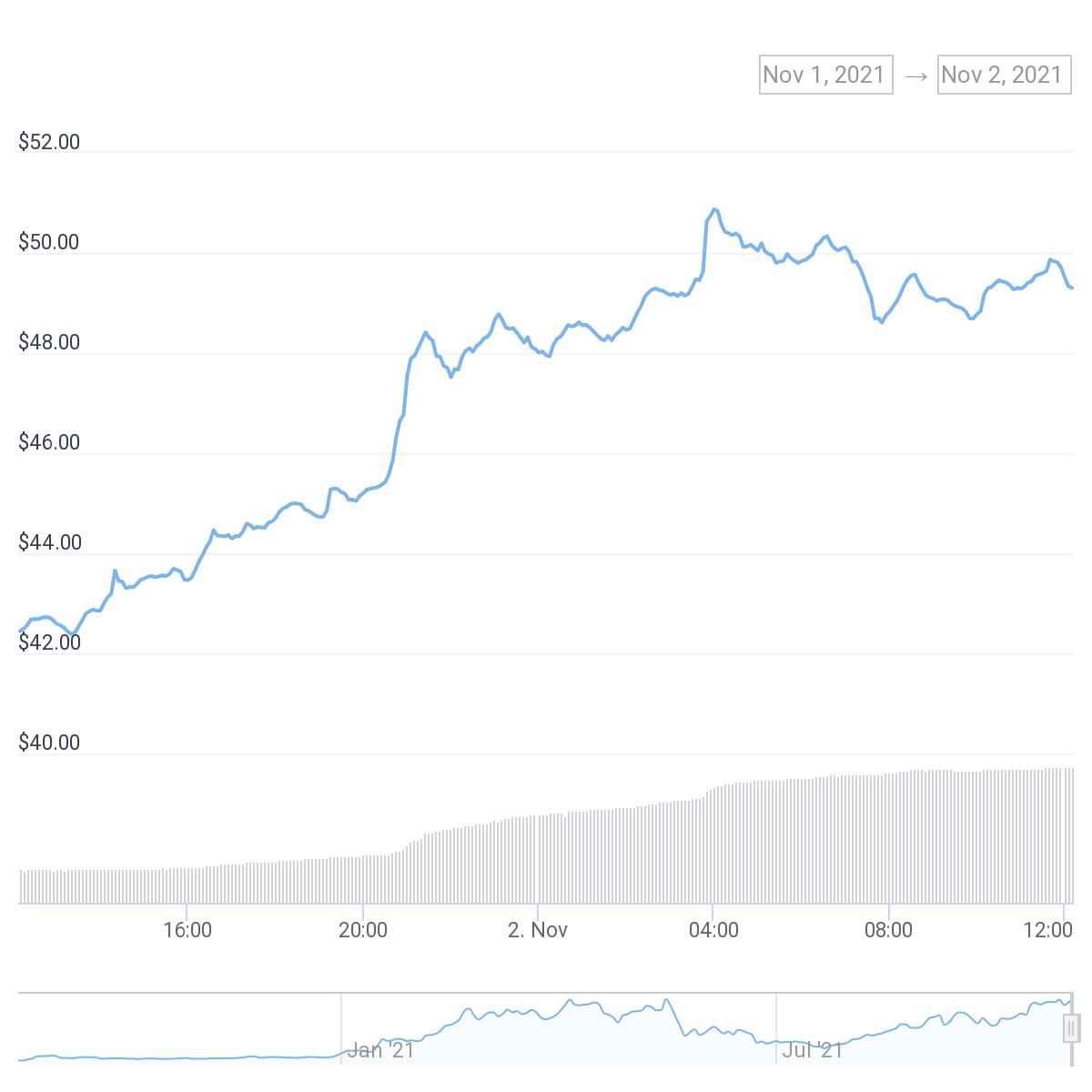

Some people are more optimistic about the prospect of Buffett investing in bitcoin. Popular television personality and bitcoin proponent Max Keiser, for example, believes that Buffett will panic-buy bitcoin at $50K just like gold bug Peter Schiff and veteran investor Jim Rogers will do. Commenting on Buffett’s new investments in non-U.S. companies, he tweeted Monday:

Buffett’s move into Japan, along with his gold investment, confirms he’s getting out of USD bigly … Bitcoin – gold – silver will all make new ATH [all-time high] in the near term.

Many people on social media believe Buffett anticipated that inflation was coming to make the move that reduces his company’s reliance on the U.S. economy. The Federal Reserve announced a major policy change last week to “push up inflation.” Several experts expect bitcoin to benefit from this policy shift as well as from the weakness of the U.S. dollar and the political uncertainty surrounding the U.S. presidential election.

Devere Group CEO Nigel Green believes that bitcoin will break out this year, as news.Bitcoin.com reported. Responding to the Fed’s inflation policy shift, the founders of Gemini Exchange explained how bitcoin will “ultimately [become] the only long-term protection against inflation,” potentially driving the price of the cryptocurrency above $500K.

Meanwhile, to hedge against inflation, several companies have already begun reducing their cash holdings and moving their reserves into bitcoin. Among them is the Nasdaq-listed Microstrategy, which recently moved $250 million into bitcoin, and Canadian restaurant chain Tahini’s, which moved all of its cash reserves into the cryptocurrency.

Do you think Buffett will ever buy bitcoin? Let us know in the comments section below.

The post Warren Buffett Shifts Funds From US Amid Inflation Fears, Bitcoin’s New All-Time High Expected appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|