2024-6-3 17:11 |

Chamath Palihapitiya, founder of Social Capital and co-owner of the Golden State Warriors, has recently expressed his opinion on Bitcoin’s value and potential trajectory.

The billionaire entrepreneur, who first invested in Bitcoin in 2012 and calls himself a Warren Buffett “disciple”, indicated that he sees the price of Bitcoin rising massively following the April halving event, with $500K being a realistic target for him.

The Opportunity For The Bitcoin Price In 2025Chamath Palihapitiya stated that Bitcoin has the potential to touch a cycle high of $500,000 per coin by October next year.

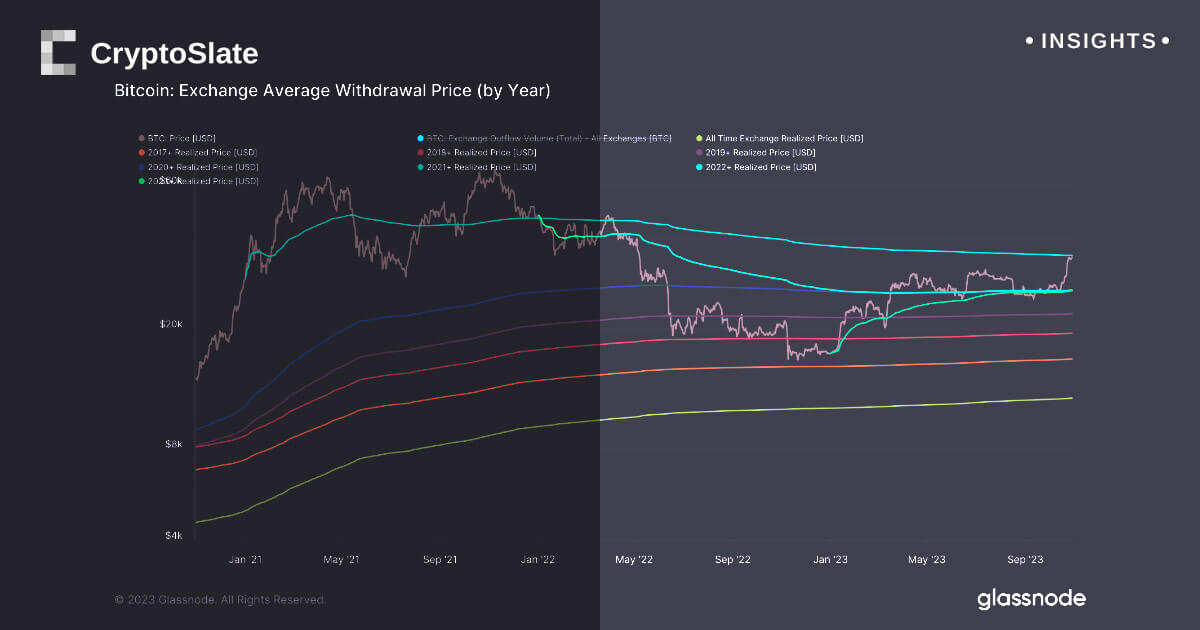

According to Palihapitiya, the main argument is Bitcoin’s historical pattern after halvings. The fourth Bitcoin reward halving in April slashed the new Bitcoin issuance rate to 3.125 BTC every ten minutes, triggering significant interest and speculation. Since then, Bitcoin has slipped from its highs, with some investors and pundits concerned that the days of stratospheric BTC prices are in the distant future.

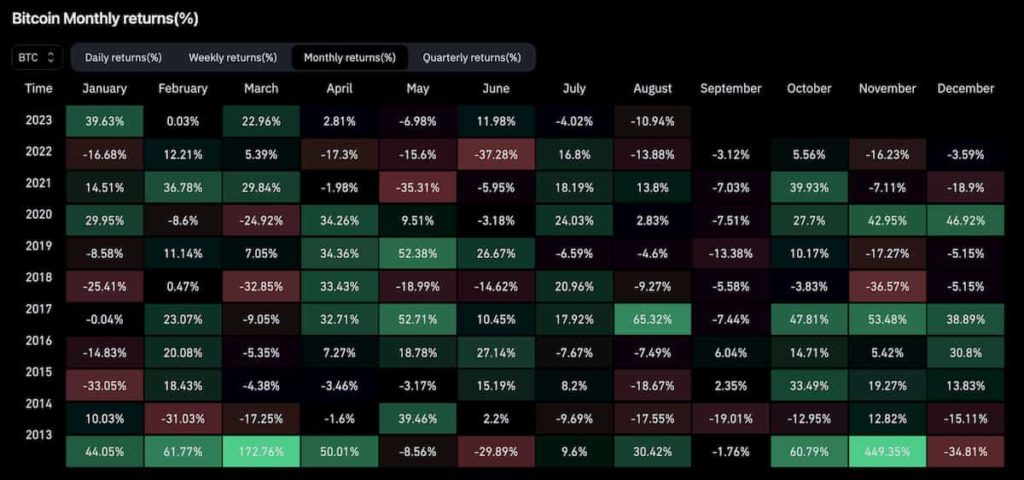

The former Facebook exec notes that the Bitcoin price parabolic breakout has always followed the quadrennial halving event, with most returns being realized 12 to 18 months after a halving. 18 months after the first halving in 2012, the price of Bitcoin saw massive 45X returns. The alpha crypto registered almost 28X returns post-2016 and an almost 8X return post-2020 halving. As such, it’s not a question of whether the BTC price will rocket after the April 2024 halving, but rather by how much.

The Bitcoin price action ahead post-halving will likely be different from past events. Before the previous halving, institutions were on the sidelines. Since then, we have witnessed greater demand than ever from institutional spot BTC ETF investors.

Commercialization Of BitcoinPalihapitiya thinks this halving is distinct from prior ones because of the dramatic increase in capital coming into the market because of the commercialization of Bitcoin after the January ETF approvals. So you have a reduction of supply due to the halving itself, coupled with increased demand from the spot exchange-traded funds — basic economic principles suggest this should result in a higher price ahead.

The combined capital in the 11 spot BTC ETFs has already surpassed 50% of the assets under management in gold, a feat accomplished in a fraction of the time it took for the precious metal to hit its current status over 20 years. Moreover, of the 21 million Bitcoins that will ever exist, around 5% currently belong to ETFs, as ZyCrypto reported previously.

While Palihapitiya warned that his analysis should not be deemed financial advice, the tech investor suggested that Bitcoin’s price could hit $500,000 by October 2025 if it mimics historical patterns displayed during the past post-halving cycles.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|