2021-10-29 21:43 |

Key takeaways

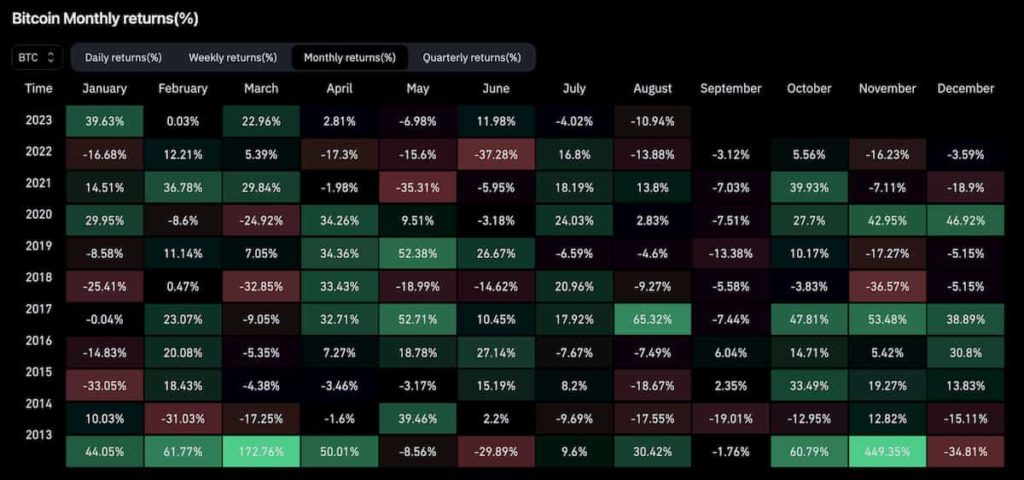

Institutions secure huge ROI following Bitcoin’s bullish October run.MicroStrategy has gained over $2 billion in October alone on its Bitcoin holdings.With the surge in the price of Bitcoin in October, many institutions that invested in the top cryptocurrency have recorded massive gains on their holdings.

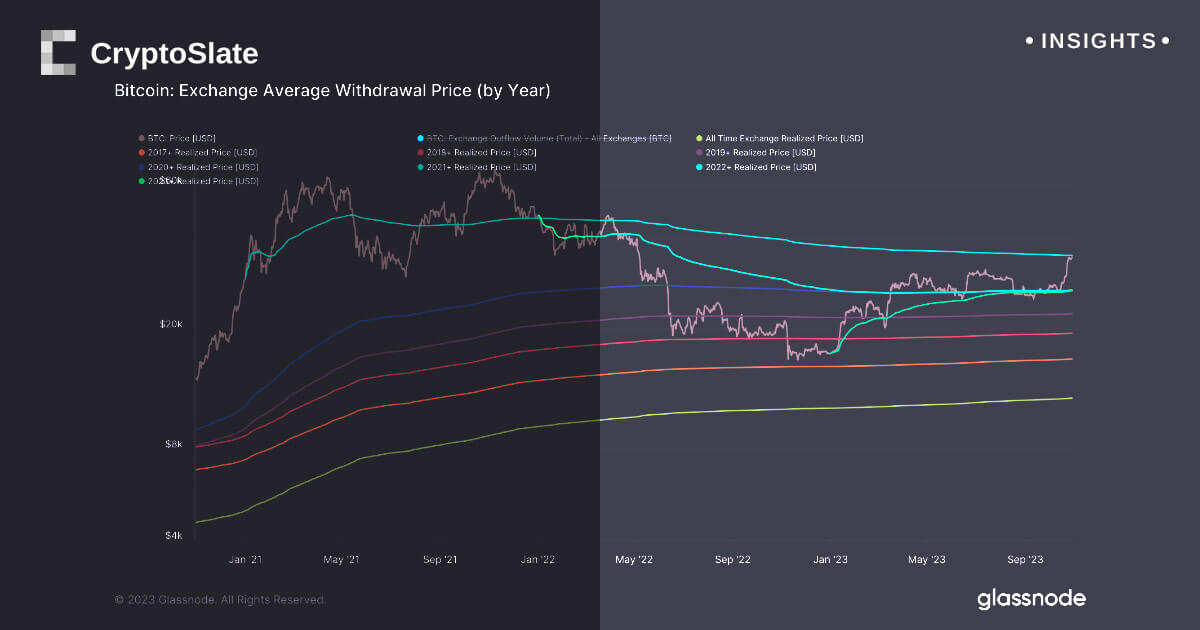

Worthy of note among them is MicroStrategy, the biggest institutional investor in Bitcoin whose around $3.16 billion investment in Bitcoin is currently worth over $7 billion, appreciating by around $2 billion in October alone.

Under the leadership of its CEO Michael Saylor, a staunch Bitcoin bull, the enterprise software company has acquired over 114,000 Bitcoins purchased at an average price of $27,713 per Bitcoin in the space of a little over a year. It first added the crypto-asset to its balance sheet last year when it announced purchasing 21,445 Bitcoins with an overall price tag of $250 million.

Since then, it has not relented in buying more to grow its stash. The company regularly raises funds by selling shares to purchase Bitcoins, as it plans to convert its whole treasury to a Bitcoin standard. Its most recent purchase was the addition of 5,050 Bitcoins, bought for about $243 million. The investment brought its total Bitcoin purchase in quarter 3 of 2021 to approximately 8,957 bitcoins for approximately $419.9 million in cash, at an average price of approximately $46,875 per bitcoin.

Saylor has revealed that the company does not plan on selling any of its holdings, but instead plans to add more. He has reiterated this repeatedly, noting that the company was in the market for the long-term as reflected in the kind of debt it was using to make its investments.

“We’re profitable, we’re generating a very healthy operating margin, and I’m very pleased with the stability and maturity of that business,” Saylor told Blockworks recently, adding that he was also not bothered by the regulatory environment for institutional investment in Bitcoin.

Similarly, Elon Musk’s Tesla who also holds Bitcoin on their balance sheet is deep in profits for their investment made earlier this year. Tesla owns 42,000 Bitcoin at an average cost of $31,700 per coin. At the current high point of the Bitcoin market, Musk’s wager had garnered realized and unrealized gains of almost 100%, or over $1.5 billion.

El Salvador, under the leadership of President Nayib Bukele, adopted Bitcoin as legal tender, and has been buying the cryptocurrency is as well in profit. Despite making its most recent purchase of Bitcoin this month, its total holdings of over 1000 Bitcoins are around 20 percent in profit. The country has even decided to invest some of its profits in building a veterinary hospital.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|