2023-3-8 12:15 |

The Bitcoin price is under heavy pressure due to fears of “sticky” inflation and yesterday’s ultra-hawkish comments from U.S. Federal Reserve (Fed) chairman Jerome Powell. At press time, BTC was trading just above $22,000 and continued to show no strength yet.

At this time comes news that the US government is in the process of selling off some of its seized Bitcoin. Blockchain security firm PeckShield first reported that addresses associated with the US government transferred 49,000 BTC worth $1.08 billion today, which were seized from the Silk Road hacker.

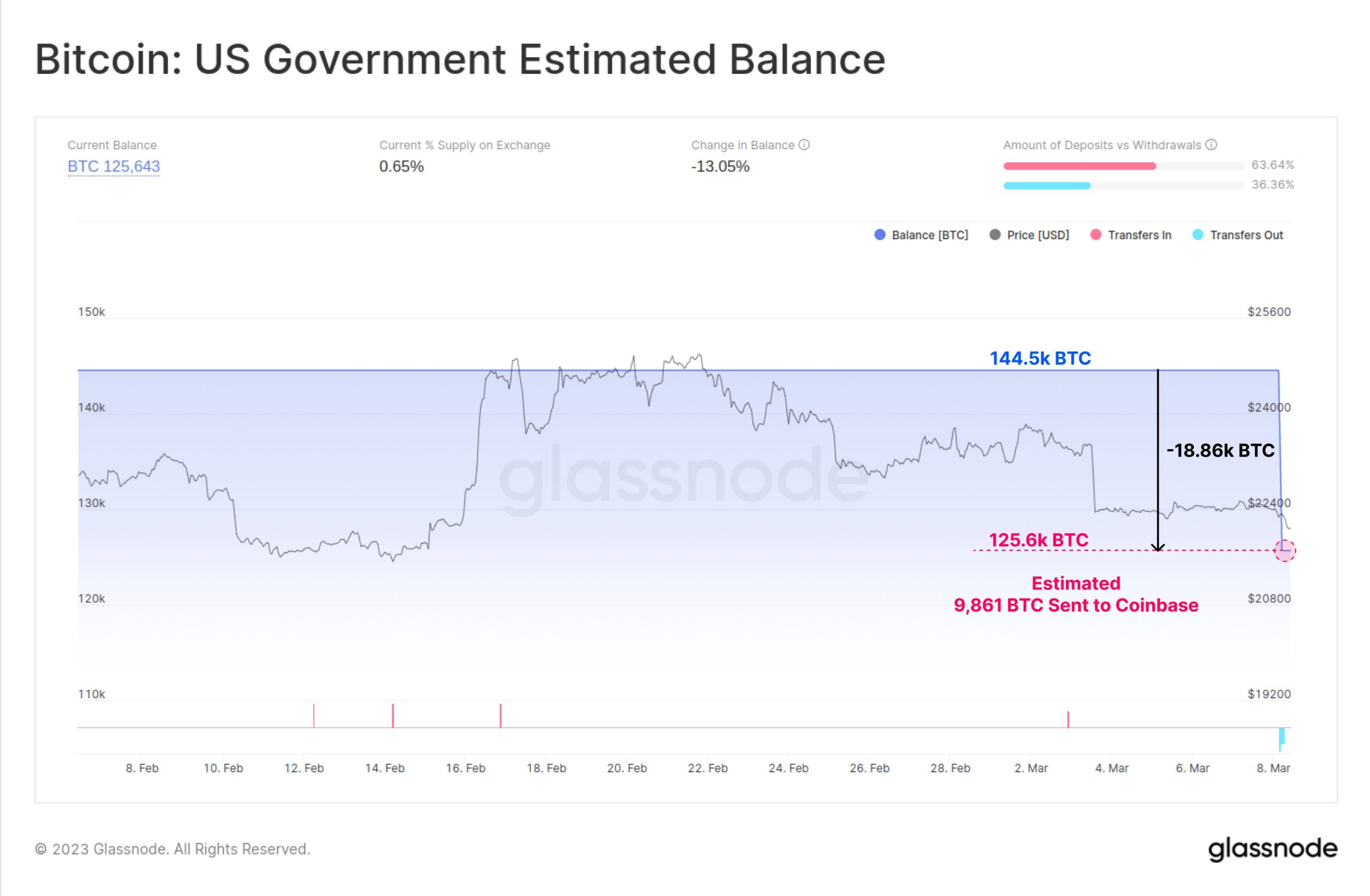

Of that total, 9,826 BTC worth $217 million were transferred to Coinbase and 39,175 BTC worth $867 million were transferred to two new addresses. On-chain data provider Glassnode confirmed this, adding that most (so far) appear to be internal transfers, but approximately 9,861 BTC were sent to a Coinbase cluster.

Glassnode also shared the chart below, displaying the estimated Bitcoin balance of the US government.

PeckShield also stated that about 51,351.9 BTC of Silk Road Crime Proceeds were seized by the US government in November 2021 and March 2022 and clustered into 2 addresses.

The seized Bitcoin from founder Ross Ulbricht’s legendary darknet platform “Silk Road” make up a large portion of the US government’s holdings. While Ulbricht was sentenced to life in prison without parole in 2015, he was ordered to pay $183 million in restitution related to Silk Road’s total sales.

Before the marketplace was shut down, Silk Road experienced a hack in which 69,370 BTC were stolen. The government seized these Bitcoins in November 2020, and Ulbricht relinquished all rights to the Bitcoin and used them to pay the restitution.

Will The US Government Impact The Bitcoin Price?A Bitcoin dump by the US government does not seem very likely according to current information. The 9,826 BTC presumably sent to Coinbase is too little to affect the price. The other funds moved appear to be internal transfers only.

Therefore, a warning of a dump is by no means appropriate. Moreover, it should be emphasized that the U.S. government usually chooses a different way to sell seized Bitcoin. Usually, the sale is done through General Services Administration (GSA) auctions, where confiscated Bitcoins are auctioned off in lots to willing buyers without affecting the price.

At press time, the BTC price had to fight off the macro economic headwinds and was trading at $22,025. The $21,900 price level continues to serve as the key support for BTC.

Should the level be breached to the south, a new lower low would be in play. Of particular importance then becomes the price level around $21,600 to write a higher low and maintain the uptrend in the 1-day chart.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|