2026-2-9 11:00 |

Bitcoin traders are heading into a macro-heavy week, with four US economic events expected to shape sentiment across crypto markets.

With Bitcoin trading in a volatile range and macro narratives dominating market psychology, traders are increasingly treating economic releases as short-term catalysts that can trigger sharp moves in both directions.

Which US Economic Signals Should Bitcoin and Crypto Investors Watch This Week?A Federal Reserve (Fed) governor’s media appearance, key labor-market data, weekly unemployment claims, and January inflation figures could all influence expectations around interest rates and liquidity—two of the strongest drivers of Bitcoin’s price cycles.

This Week’s Major US Economic Reports & Fed Speakers. Source: MarketWatch Fed Governor Stephen Miran Interview in FocusMarkets will first look to comments from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9. Ahead of the 5:00 p.m. ET. appearance, there is already mixed sentiment across the crypto community, especially amid broader market caution.

Some market participants point to Miran’s relatively constructive view on stablecoins, arguing that regulatory clarity and dollar-linked digital assets could indirectly support Bitcoin by strengthening the broader crypto ecosystem and institutional participation.

Others see risk. Speculation that Miran could play a larger role in future Fed leadership has already coincided with bouts of volatility in both precious metals and crypto. This reflects fears that tighter policy could weigh on inflation-hedge narratives.

Positioning – when the rumor of Trump appointing Stephen Miran as fed chair BTC and metals started to fall. The market was positioned for lower rates and Miran is a Hawk – even more Hawkish than the present fed chair. The market sees this as having less inflation so inflation…

— Bob (@skytaleSythe) February 6, 2026At the same time, some macro analysts have described Miran as more dovish than many of his peers, citing past arguments in favor of substantial rate cuts to support the labor market.

Any signals in that direction could lift sentiment in risk assets, particularly Bitcoin, which remains highly sensitive to liquidity expectations.

US Employment Report Could Drive “Bad News Is Good News” NarrativeAttention will shift on Wednesday, February 11, to the US employment report, one of the most closely watched indicators of economic health and monetary-policy direction.

Forecasts suggest relatively modest job growth, potentially reaching 55,000 from the previous 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidity conditions for risk assets.

Recent labor-market indicators have already pointed to signs of slowing. Reports of rising layoffs and a slowdown in hiring have strengthened expectations that rate cuts could arrive sooner than previously anticipated.

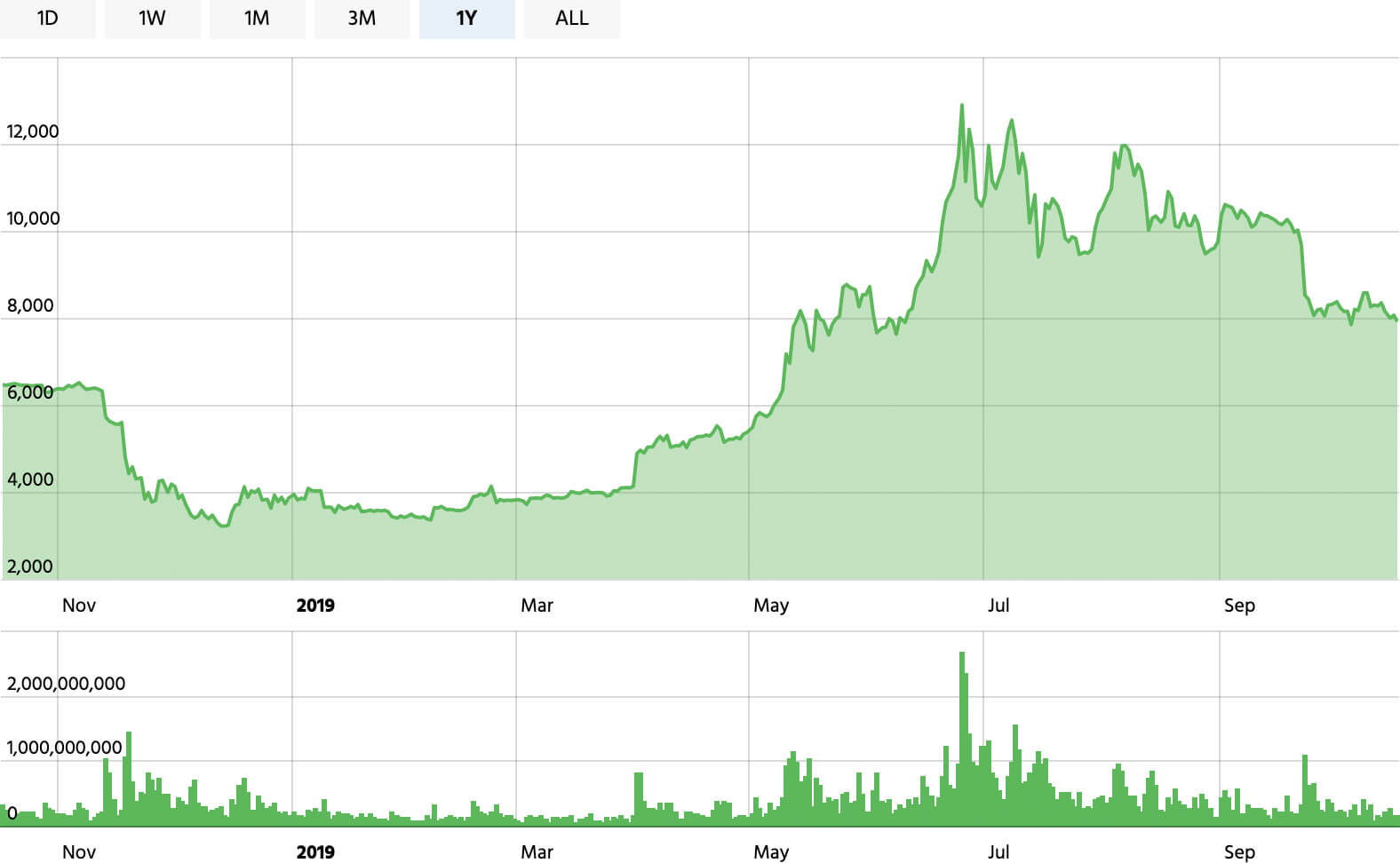

Interest Rate Cut Probabilities. Source: CME FedWatch ToolHowever, the employment report also carries downside risk. A sharp deterioration in job data could spark broader growth fears, prompting investors to move toward defensive positions. Such an outcome could trigger short-term selloffs in crypto, as seen during previous macro shocks.

🚨 IS THE FED ALREADY TOO LATE FOR RATE CUTS?

Truflation is showing US inflation near 0.68% while layoffs, credit defaults, and bankruptcies are all rising, yet the Fed still says the economy is strong.

If you look at the economy right now and compare it with what the Fed is… pic.twitter.com/OHCTpkTRYl

Thursday’s initial jobless claims release will provide a more immediate snapshot of labor-market conditions. As such, it could reinforce the narrative set by the employment and unemployment reports on Wednesday.

Recent spikes in claims have coincided with risk-off reactions in crypto markets, including liquidation events and rapid price swings. Some traders interpret rising claims as a signal that economic conditions are weakening enough to force monetary easing, a longer-term positive for Bitcoin.

📉💰 Money pressure is rising fast! Layoffs are surging, jobless claims climbing, retirement savings looking scary low, debt stressing relationships, and Bitcoin taking a hit. 🚨📊 This snapshot breaks down the real financial struggles many Americans are facing right now — and… pic.twitter.com/hilS5lEtiK

— Damon Carr (@DamonLamont12) February 6, 2026Others warn that in the short term, deteriorating employment data can unsettle markets, especially when liquidity is thin and leverage is elevated.

That dynamic has made jobless-claims releases a growing source of volatility, even though they rarely move markets in isolation.

CPI and Core CPI Seen as the Week’s Decisive CatalystThe most consequential data point may arrive on Friday, February 13, with the release of January’s Consumer Price Index (CPI) and Core CPI figures.

Inflation data remains the primary driver of Fed policy expectations and, therefore, a key determinant of crypto market sentiment.

Cooler-than-expected readings in recent months have supported risk assets by weakening the “higher for longer” rate narrative.

Another soft inflation print could accelerate expectations for rate cuts in 2026, potentially reinforcing bullish momentum in Bitcoin and strengthening the case for a move toward six-figure price levels over time.

However, sticky or rising inflation would likely have the opposite effect, pushing Treasury yields higher and pressuring speculative assets, including cryptocurrencies.

“If data comes in hot, rates will likely stay higher, and risk assets may struggle. If data cools, rate cut expectations could return, and markets may breathe. This week will tell us what comes next,” remarked analyst Kyle Chasse.

Taken together, the week’s events represent a concentrated test of the macro narratives currently driving Bitcoin: inflation, employment, and the timing of monetary easing.

While long-term adoption trends, such as ETF flows, institutional participation, and stablecoin growth, continue to underpin bullish projections, short-term price action remains closely tied to economic data.

The post 4 US Economic Events That Could Move Bitcoin This Week as Markets Watch the Fed appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|