2023-9-19 23:11 |

The Securities and Exchange Commission (SEC) has upped the ante in its lawsuit against BAM Trading Services, which does business in the United States as Binance, with a court filing demanding the release of documents that the exchange has tried to keep hidden from the regulator.

The regulators view the release of the documents as a necessary and appropriate good-faith step on the part of BAM. But the exchange’s lawyers hotly deny the relevance and fairness of the SEC’s requests.

The SEC Seeks More Disclosures From BinanceThe financial watchdog has a keen interest in service providers that Binance may have turned to for wallet custody software and other help.

In the SEC’s view, BAM has been unresponsive when regulators have come forward with requests for information. For its part, Binance believes it is looking out for customers’ interests, and its own, by refusing to comply.

To the SEC’s frustration, crucial documents that might have cast light on this recalcitrance were sealed. Hence, it was hard to prove that Binance was not cooperating.

At the end of last week, the SEC finally got a federal judge to rule in its favor. Judge Zia M. Faruqui’s Sept. 15 court order required the unsealing of 16 documents and the partial unsealing of nine others.

The unsealed documents cast light on the legal maneuvers with which BAM has tried to keep its internal matters secret. And out of reach of the media, the public, and, above all, the regulators who would like to close down Binance for good.

Read more about the SEC’s long-running legal war against Binance and Changpeng Zhao here.

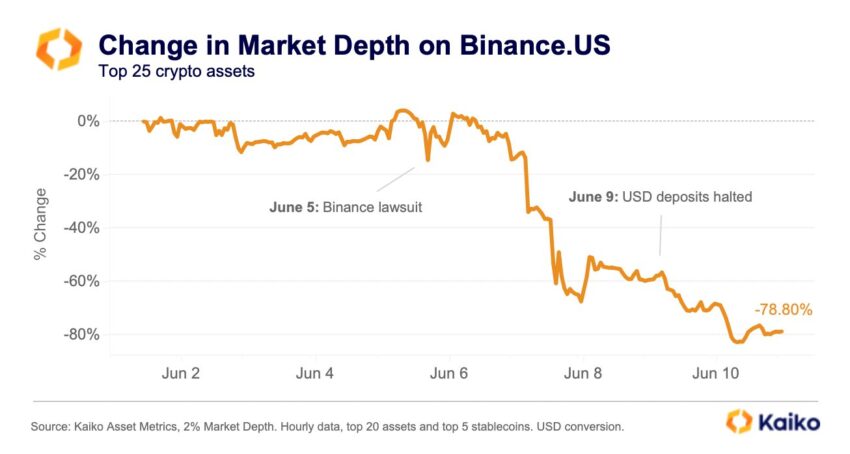

Binance’s troubles have escalated since its legal feud with the SEC took off. Source: Kaiko BAM Rejected “Oppressive” SEC DemandsOne of the most telling items unsealed by Judge Faruqui’s court order is “Exhibit 4.” This Exhibit is a July 5 filing in a Washington, DC, federal court by BAM’s lawyers at the white-shoe law firms of Wilmer Cutler and Milbank.

In the course of this 31-page filing, BAM’s attorneys reject the requests that the SEC has put forward.

The reasons for denying the SEC’s demands vary. But, in essence, BAM accuses the SEC of regulatory overreach. Its lawyers argue that the SEC has overstepped its jurisdiction and made requests that are vague, overbroad, and even “oppressive.”

Reading Exhibit 4, there can be little doubt that the exchange is jealous of its privacy. And does not want the SEC sticking its nose where it has no legal right to do so. In BAM’s view, the SEC has not only asked for documents relevant to its lawsuit. It has made a general request lacking any legal basis.

“BAM objects to the requests as overbroad and unduly burdensome to the extent that they purport to require the production of ‘all’ or ‘any’ documents where a subset of documents would be sufficient to provide the pertinent information,” the filing states.

A bit further down, the lawyers state BAM’s objection to “duplicative” requests. Not to mention, requests for documents that are no longer part of active BAM data systems.

Other documents that the SEC has asked for enjoy attorney-client privilege, the lawyers argue. Still others contain trade secrets, or personal information about present or former BAM employees. Hence, BAM is under no obligation to hand the items over to the SEC.

How Far Apart Are the Two Sides?BAM and its lawyers do not challenge the SEC merely on procedural grounds. Or on the grounds that the regulators seek documents containing sensitive personal data.

On the contrary, the two sides have serious disagreements over questions of legal and metaphysical truth.

Exhibit 4 makes clear just how far apart the SEC and the respondent are on the issues in the lawsuit. The two sides do not agree on basic matters of fact. As the following passage illuminates, what did or did not happen is subject to dispute.

“BAM objects to the Requests to the extent that they assume the existence of facts that do not exist or the occurrence of events that did not take place,” the filing states.

Will the courts, media, and public lend a sympathetic ear to BAM’s claims of overreach?

After a series of high-profile legal victories against the SEC, time will tell what effect these newly public documents have. Both inside and out of the courtroom.

The post Unsealed Court Filings Reveal Binance’s Legal Counterthrusts Against the SEC appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Aragon Court (ANJ) íà Currencies.ru

|

|