2026-2-11 08:54 |

The United States (US) Bureau of Labor Statistics (BLS) will release the delayed Nonfarm Payrolls (NFP) data for January on Wednesday at 13:30 GMT.

Volatility around the US Dollar (USD) will likely ramp up on the employment report, with investors looking for fresh insights on the US Federal Reserve’s (Fed) path forward on interest rates.

What to Expect From the Next Nonfarm Payrolls Report?The BLS reported early last week that it had postponed the release of the official employment report, originally scheduled on Friday, due to the partial government shutdown. After the US House passed a package on Tuesday to end the shutdown, the agency announced that it will release the labor market data on Wednesday, February 11.

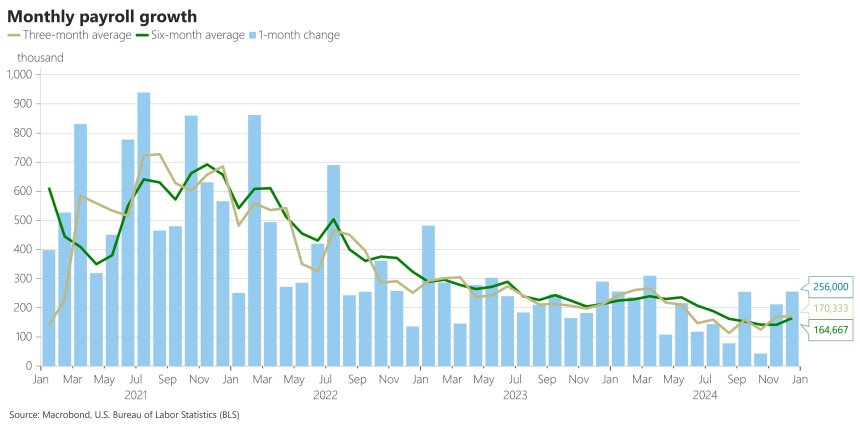

Investors expect NFP to rise by 70K following the 50K increase recorded in December. In this period, the Unemployment Rate is expected to remain unchanged at 4.4%, while the annual wage inflation, as measured by the change in the Average Hourly Earnings, is projected to soften to 3.6% from 3.8%.

Previewing the employment report, TD Securities analysts note that they expect job gains to have remained subdued in January, increasing by 45K.

“We look for private to add 40K and government to add 5K. We expect private sector strength to be concentrated in healthcare and construction. We look for the Unemployment Rate to show continued signs of stabilization, remaining at 4.4%. The low-fire, low-hire labor market remains. Average Hourly Earnings likely increased 0.3% m/m and 3.7% y/y,” they add.

How Will the US September Nonfarm Payrolls Affect Eur/USD?The USD started the month on a firm footing as markets reacted to the nomination of Kevin Warsh, who served as a Fed Governor from 2006 to 2011, as the new chair of the Fed. Meanwhile, the USD also benefited from the heightened volatility surrounding precious metals, especially Silver and Gold, and Stock markets.

In turn, the USD Index, which gauges the USD’s valuation against a basket of six major currencies, rose 0.5% in the first week of February. Fed Governor Lisa Cook said earlier in the month that she believes the labor market will continue to be supported by last year’s interest rate cuts.

Cook further noted that the labor market has stabilized and is approximately in balance, adding that policymakers remain highly attentive to the potential for a rapid shift.

Similarly, Governor Philip Jefferson argued that the job market is likely in balance with a low-hire, low-fire environment. The CME Group FedWatch Tool shows that markets are currently pricing in about a 15% probability of a 25 basis-point (bps) rate cut in March.

In case the NFP reading disappoints, with a print below 30K, and the Unemployment Rate rises unexpectedly, the USD could come under pressure with the immediate reaction, opening the door to a leg higher in EUR/USD. On the other hand, an NFP figure at or above the market expectation could reaffirm another policy hold next month.

The market positioning suggests that the USD has some room on the upside in this scenario. Investors will also pay close attention to the wage inflation component of the report.

If Average Hourly Earnings rise less than expected, the USD could find it difficult to gather strength, even if the headline NFP print arrives near the market forecast.

Danske Bank analysts argue that softer wage growth could negatively impact consumer activity and pave the way for a dovish Fed action.

“The Challenger report showed more job cuts than expected in January and the JOLTs Job Openings came in at 6.5m in December (consensus 7.2m). Hence, the US ratio of job openings to unemployed fell to just 0.87 in December. Such cooling is usually a good predictor for weakening wage growth and may be a concern for the private consumption outlook and, all else equal, supports the case for earlier cuts from the Fed,” they explain.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for EUR/USD:

“The Relative Strength Index (RSI) indicator on the daily chart holds above 50, and EUR/USD fluctuates above the 20-day Simple Moving Average (SMA) after having tested this dynamic support last week, reflecting buyers’ willingness to retain control.” “On the upside, 1.2000 (round level, psychological level) aligns as the next resistance before 1.2080 (January 27 high) and 1.2160 (static level). Looking south, the first key support level could be spotted at 1.1680, where the 100-day SMA is located, before 1.1620-1.1600 (200-day SMA, Fibonacci 23.6% retracement of the January 2025-January 2026 uptrend). A decisive drop below this support region could attract technical sellers and open the door for an extended slide.”

The post Fed Policy in Focus With 70,000 Nonfarm Payrolls Increase Expected appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Fedora Gold (FED) на Currencies.ru

|

|