2024-6-19 22:42 |

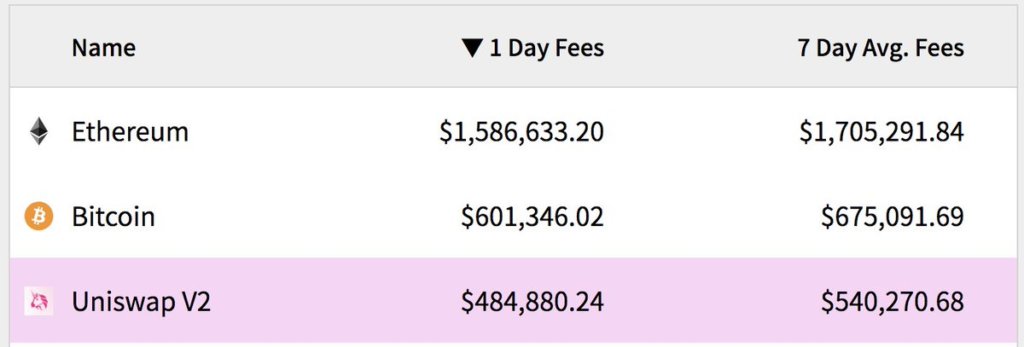

Uniswap has generated more than twice in fees compared to any other decentralized exchanges (DEXs) in the past 30 days, latest data from Token Terminal shows. With nearly $100 million in fees generated this past month, Uniswap DAO ranks highest… origin »

Bitcoin price in Telegram @btc_price_every_hour

Uniswap (UNI) на Currencies.ru

|

|