2024-11-15 18:49 |

As tech tensions between the US and China deepen, cryptocurrency could become a new frontier for competition.

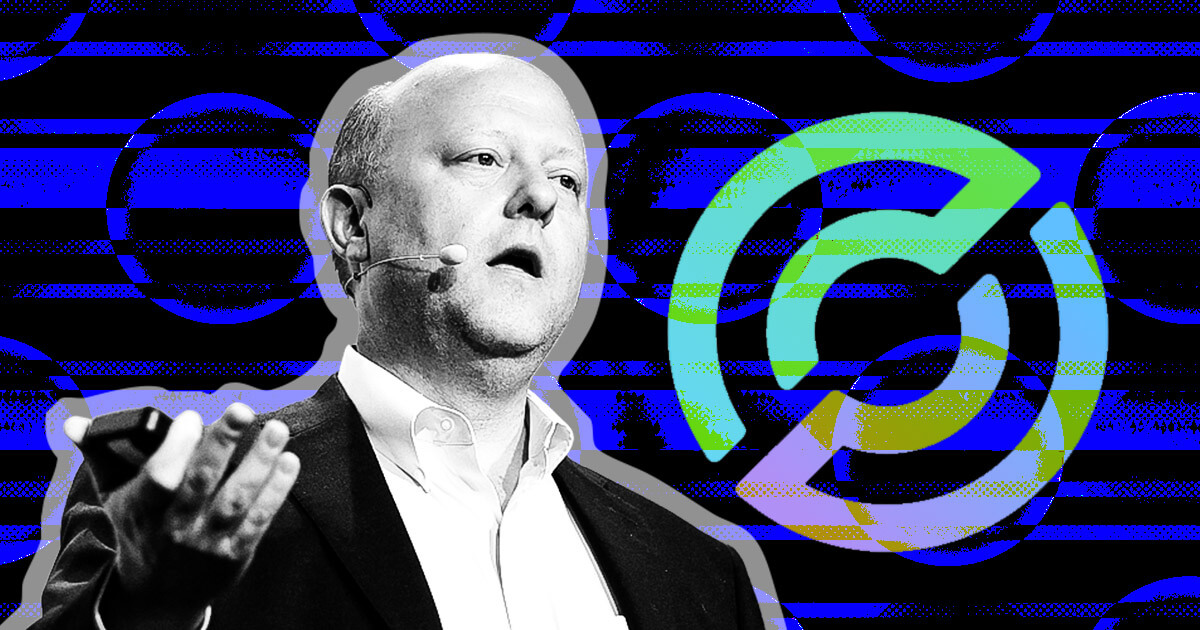

US President-elect Donald Trump’s pro-crypto stance, promising clearer regulations and potential industry support, may spur China to reconsider its approach to digital assets, according to HashKey Group’s chairman and CEO, Xiao Feng.

In an interview with the South China Morning Post, Xiao suggested that US leadership in crypto regulation could encourage Beijing to reduce its restrictions on digital assets, potentially advancing China’s acceptance of cryptocurrencies.

China’s cautious crypto approachThe Swift financial system sanctions imposed on Russia by the US and Western allies in 2022, in response to the Ukraine conflict, also play a role in China’s potential pivot toward crypto.

The move underscored the influence of global financial networks on geopolitical power, which may prompt Beijing to explore more independent, blockchain-based payment systems.

Despite its strict ban on crypto trading and mining, China could become more open to digital currencies if it can ensure financial stability and mitigate associated risks, according to Xiao.

Stablecoins as a bridge for cross-border tradeStablecoins, cryptocurrencies pegged to fiat currencies like the US dollar, offer a controlled entry point for countries like China that may consider cross-border digital transactions.

Xiao noted that stablecoins, including USDT and USDC, are gaining popularity for their low-cost, fast transaction benefits, particularly in cross-border B2C trade.

He shared insights from a survey in Yiwu, a major Chinese trading hub, where merchants reported increasing interest from international buyers in using dollar-pegged stablecoins for payments.

According to Xiao, stablecoins could be China’s starting point if it chooses to experiment with regulated digital assets.

Operating out of Hong Kong, HashKey has capitalised on the region’s permissive crypto policies, despite Beijing’s reticence.

Xiao’s background in traditional finance and public service in China has positioned HashKey as a major player in the Asian digital asset sector.

Since its founding in 2018, HashKey has expanded significantly, now employing over 300 people at its Hong Kong headquarters and additional staff in Singapore, Tokyo, Dubai, and Europe.

The company recently secured one of Hong Kong’s coveted crypto exchange licenses, solidifying its presence in the city’s burgeoning blockchain industry.

China’s potential shift to regulated digital assetsWhile China’s central bank and regulators have shown no signs of relaxing cryptocurrency bans, Xiao believes that external factors, such as the evolving US regulatory environment, could accelerate Beijing’s timeline for adopting digital assets. Xiao suggested,

China’s approach to crypto may shift faster if other nations, especially the US, streamline their crypto regulations.

Such a shift could see China adopt a regulated, stablecoin-focused model, mitigating risks while enabling it to engage in digital asset-based global trade.

Despite HashKey’s aspirations, the Chinese government remains firm on its stance against crypto, viewing it as a potential source of instability.

Hong Kong’s regulatory framework offers a glimpse of what a cautiously regulated crypto market could look like under China’s influence. With growing interest in stablecoins for international trade and the potential influence of the US’s pro-crypto policies, China’s crypto landscape could be primed for a transformation.

The post Trump’s crypto policies may inspire China’s digital asset growth, HashKey CEO suggests appeared first on Invezz

origin »Digital Rupees (DRS) на Currencies.ru

|

|