2021-9-24 11:25 |

Multi-asset trading platform eToro has launched a portfolio offering clients exposure to decentralized finance (DeFi) projects.

Announced on Sept 23, eToro’s “DeFiPortfolio” is an index-type investment comprised of 11 decentralized finance assets.

These are Ethereum (ETH), Uniswap (UNI), Chainlink (LINK), Aave (AAVE), Compound (COMP), Yearn Finance (YFI), Decentraland (MANA), Polygon (MATIC), Algorand (ALGO), Basic Attention Token (BAT), and Maker (MKR).

The new product offers an easy way to diversify and gain exposure to the decentralized finance ecosystem and automatically stay ahead of decentralized financial innovation through periodic rebalancing, eToro explained.

DeFi assets for the mainstreamPortfolios and Index products are growing in popularity as they allow investors to get broad exposure to one sector of the industry without having to research and buy individual assets.

eToro offers a wide range of portfolios. Its cryptocurrency index that contains more than 10 top crypto assets is up 368% over the past 12 months. It also offers “big tech” and “vaccine-med” portfolios for exposure to related stocks.

Head of portfolio investments at eToro comments, Dani Brinker, said DeFi is one of the most talked-about innovations in finance, before adding:

“By packaging up a selection of cryptoassets in a DeFi CopyPortfolio, we’re doing the heavy lifting and enabling our customers to gain exposure and spread the risk across a variety of cryptos.”

Initial investments for the product start at $1,000 and investors can access tools and charts to track the portfolio’s performance.

Notably absent from the selected DeFi assets was Curve Finance (CRV), Synthetix (SNX), Instadapp (INST), and SushiSwap (SUSHI).

There are a number of existing DeFi indexes available such as the DeFi Pulse Index (DPI), the Bitwise DeFi Crypto Index Fund, and the Bloomberg Galaxy DeFi Index launched in August.

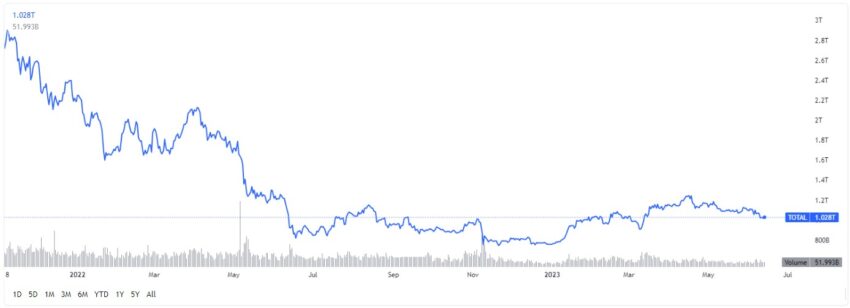

Ecosystem updateThe total value locked across the DeFi ecosystem is $172 billion according to DeFi Llama. It hit an all-time high of just over $190 billion on Sept 6 and is up more than 700% so far this year.

The leading protocol according to the analytics platform is Curve Finance with a TVL of $13.6 billion. Flash loan platform Aave is second with $12.9 billion locked and Compound Finance takes third place on the TVL charts with $10.8 billion.

The Binance Smart Chain ecosystem has $16 million of that total and PancakeSwap is its largest protocol with $5 billion in locked collateral.

The post Trading Giant eToro Launches DeFi Portfolio appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|