2023-6-13 11:10 |

Multi-asset trading platform eToro announced early Tuesday that users in the United States could not open new positions for several crypto assets. This comes as a response to a multi-pronged assault on the crypto industry from the SEC.

eToro trading platform will halt purchases of Algorand (ALGO), Decentraland (MANA), Dash (DASH), and Polygon (MATIC) under its new policy with effect from July 12.

eToro Trading Platform Restricts Tokens to Play Safe With SECThe news comes after the US Securities and Exchange Commission (SEC) designated several crypto assets as securities instead of commodities following a lawsuit against crypto heavyweights Binance and Coinbase.

The exchange said, “eToro has a framework in place which reviews the cryptoassets we offer in light of the rapidly evolving regulatory landscape. Due to recent developments, we will be making some changes to our crypto offering for US customers.”

The lawsuit recently forced Robinhood, another major exchange, to review its token listings. Coinbase has held steady and has not expressed intentions of delisting assets for the time being.

From July 12, 2023, eToro trading platform customers in the US will no longer be able to open new positions in ALGO, MANA, DASH, and MATIC. However, customers can continue to hold and sell existing positions in these crypto assets.

If you want to know which platforms would help you execute intraday trades this year, do read:

9 Best Crypto Exchanges for Day Trading in 2023

eToro trading platform said, “We remain a supporter of crypto assets and believe in the importance of offering our users access to a diversified range of asset classes, which includes stocks, ETFs, and options.”

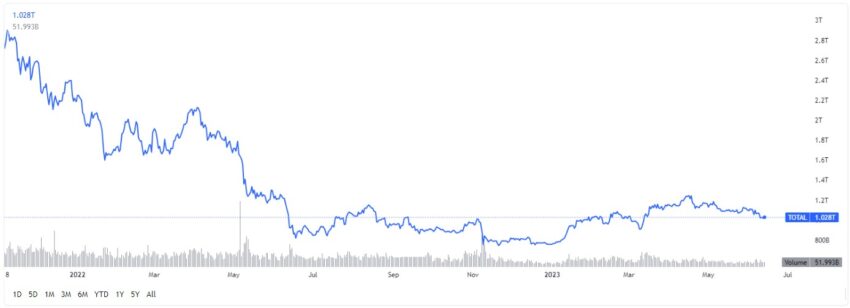

Price Reaction of Crypto AssetseToro’s restriction could potentially trigger some downward pressure on the sell-side of these crypto assets.

Cumulative crypto market capitalization and volume in dollar terms. Source: TradingViewAt press time, ALGO prices have increased by around 0.5% in the last hour. The asset remains about 4.0% up on the daily charts after losing over 16% over the previous seven days, according to CoinGecko data.

The price of Decentraland (MANA) has remained muted in the last hour, up close to 2% in the previous 24 hours and down about 24% in the last week.

Then, the price of DASH is up about 0.3% on the hourly chart. The token has surged over 2% in the last 24 hours while losing 25.4% over the previous seven days.

Lastly, Polygon’s MATIC is up about 0.4% in the last hour. It is up about 1.7% in the last 24 hours while losing 22.3% in the week.

eToro Owned Operating License in the USOn its website, eToro claims to offer many services through regulated companies to millions of people in more than 140 countries.

As a global entity, every company that is part of the eToro trading platform is said to follow various local regulatory frameworks. It is not surprising that there are differences in the services, protections, and limitations offered to users in different countries.

As for stock products, the SEC regulates ETFs and options in the U.S. The Financial Industry Regulatory Authority (FINRA) looks at the self-regulation of brokers and exchanges. eToro claims that it follows all SEC and FINRA regulations in the U.S.

In the U.S., eToro USA Securities Inc. is a registered broker-dealer with the SEC to trade in securities products and is a member of FINRA Securities Investor Protection Corporation (SIPC).

Meanwhile, crypto products offered in the U.S. are carried out through eToro USA LLC. This entity is not a registered broker-dealer, a FINRA or SIPC member, or registered with the SEC.

eToro USA LLC. is a Money Services Business (MSB) registered with the U.S. Financial Crimes Enforcement Network (FinCEN) and holds a money transfer license in some applicable U.S. states.

In December 2020, eToro was also quick to remove XRP trading on the back of the SEC lawsuit against Ripple Labs.

The post eToro Restricts Multiple Tokens for US Customers Following SEC Attack appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

eToro United States Dollar (USDEX) на Currencies.ru

|

|