2019-6-28 20:00 |

It has become more than apparent the recent Bitcoin bull run has seemingly come to an abrupt end. After surging in value for over a week on end, the dip has kicked in and there is no real sign of recovery as of yet. To add more fuel to the fire, it seems there are some interesting statistics involving Bitcoin which do not necessarily paint a bright future.

The Price Drop was ExpectedWhen any financial market gains tremendous value in a few short days, there will be an eventual correction. Bitcoin is no exception in this regard, as its value increased by $4,000 in less than two weeks. Losing over $1,700 of that value is somewhat normal, as it doesn’t even represent a 50% retrace. Given Bitcoin’s history of retraces, anything below 80% is nothing to be concerned about.

Based on the current market circumstances, it is not unlikely lower support levels will be tested fairly soon. There is a lot of selling pressure on BTC right now, although there appear to be more than sufficient buy orders to keep things afloat. Some may claim the price is being manipulated, albeit it is always difficult, if not impossible, to prove such claims.

Google Trends Look BleakOver the years, cryptocurrency enthusiasts have begun drawing correlations between Bitcoin on Google Trends and the BTC price. While those statistics have nothing to do with one another, it is still interesting to keep an eye on them. As of right now, the overall interest in Bitcoin has not spiked all that much, which comes as a bit of a surprise.

Even so, it seems unlikely that the situation will change until a new all-time high is recorded. That means one BTC will need to surpass a value of $20,000 and stay above that level for more than a few minutes on end. If and when that will happen exactly, is very difficult to determine under the current circumstances. It seems rather likely the BTC value will drop to $10,000 first and foremost, although anything can happen in this industry.

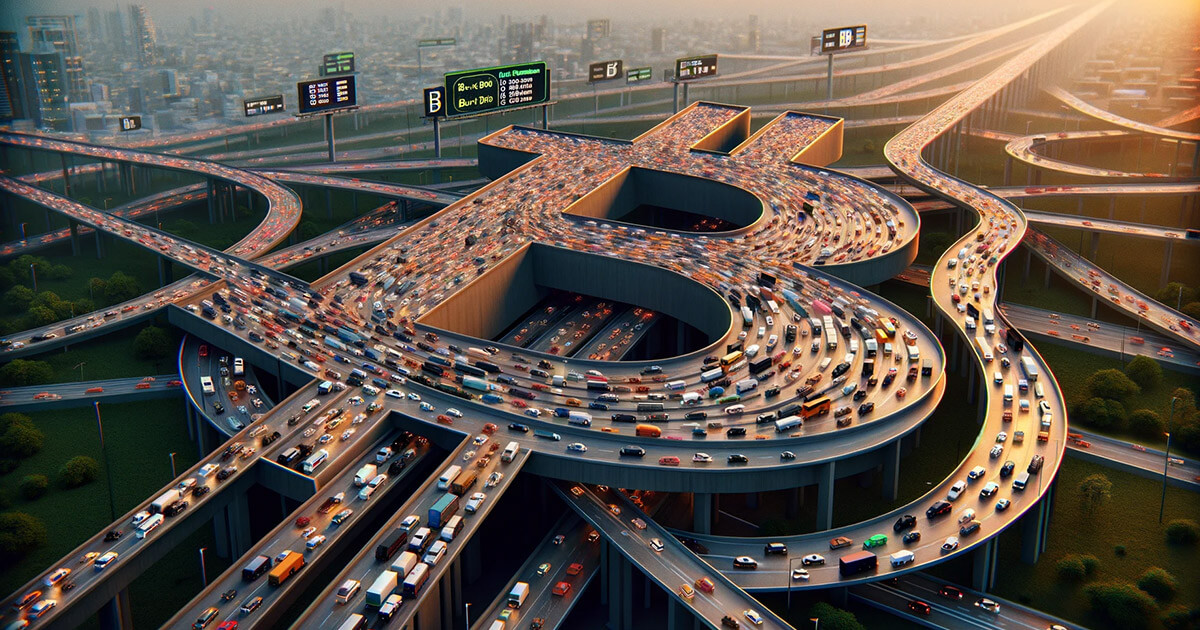

Rising Transaction Fees Remain ProblematicEvery single time anything happens to the Bitcoin price the associated transaction fees are on the rise. This bull run is no different, as the fees have being to climb well above the $4 level once again. While most people seemingly stopped caring about this particular aspect, it is not something that should be overlooked. Finding a solution to this ever-present problem has proven incredibly challenging, for obvious reasons.

The Mempool is Filling up QuicklyTogether with the rising transaction fee problem comes a hefty increase in overall network transactions. The number of unconfirmed Bitcoin transfers has been climbing for some time now and does not seem to come down whatsoever. Over the past 24 hours, this figure has not dropped below 50,000 which is rather worrisome. No one knows exactly where these transfers are coming from, yet the queue continues to fill up accordingly.

Disclaimer: This is not trading or investment advice. The above article is for entertainment and education purposes only. Please do your own research before purchasing or investing into any cryptocurrency or digital currency.

Image(s): Shutterstock.com

The post Top 4 Signs Bitcoin Will Likely Drop to $10,000 Soon appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|