2020-9-27 10:00 |

Ever since February, Bitcoin’s price action has been largely dependent on that of legacy markets. Markets like the S&P 500, the U.S. dollar, and gold have strongly swung the directionality of BTC and the rest of the cryptocurrency market.

The strong correlations that have formed have signaled to some investors that Bitcoin’s premise of being an uncorrelated asset is false.

But according to Willy Woo, a prominent on-chain analyst, BTC may begin to decouple moving forward. Here’s more on why he thinks so.

Related Reading: MicroStrategy’s Stock Continues to Soar After Bitcoin Purchase Bitcoin Could Soon Decouple From Legacy MarketsWilly Woo, a cryptocurrency on-chain and technical analyst, expects for Bitcoin to decouple from traditional markets due to fundamental trends. He expects for the cryptocurrency’s usage to drive prices higher as opposed to people realizing it is a hedge against certain geopolitical and macro trends:

“Bitcoin will decouple from traditional markets soon, but driven by its internal adoption s-curve (think startup style growth) rather than changes in perceptions as a hedging instrument by traditional investors. Fundamentals of user adoption have already broken all time highs.”

In terms of his near-term outlook on Bitcoin, Woo is optimistic.

Speaking earlier this week, the analyst remarked that on-chain and order book trends indicate that Bitcoin won’t move much lower than it did earlier this week.

There are also signs, he explained, of an imminent reversal as there has been a strong uptick in BTC that has recently changed hands.

“This latest pull back did not come with the usual movement of coins on-chain, the sell-off therefore was fueled from coins on exchanges. Without large volumes of coins moving from wallets I cannot see sufficient sell-side supply to push prices down with much gusto.”

Related Reading: Critical On-Chain Signal Predicts That Bitcoin’s Next Move Will Be Upward Not Everyone Is ConvincedWhile Woo is convinced that Bitcoin could begin to blaze its own path, not everyone is convinced.

Andrew Kang, the founder of Mechanism Capital, recently commented that should global markets “go the other way,” so will crypto:

“11/ But with BTC, and thus all crypto markets now tied to global macro, where DeFi prices go depend heavily on stonks and gold. If global markets rally, then probably all of crypto does as well. If they go the other way, then crypto probably will as well.”

11/ But with BTC, and thus all crypto markets now tied to global macro, where DeFi prices go depend heavily on stonks and gold. If global markets rally, then probably all of crypto does as well. If they go the other way, then crypto probably will as well

— Andrew Kang (@Rewkang) September 23, 2020

It isn’t clear which side of this debate is correct. However, a continued rally in the stock market is likely to help cryptocurrencies appreciate.

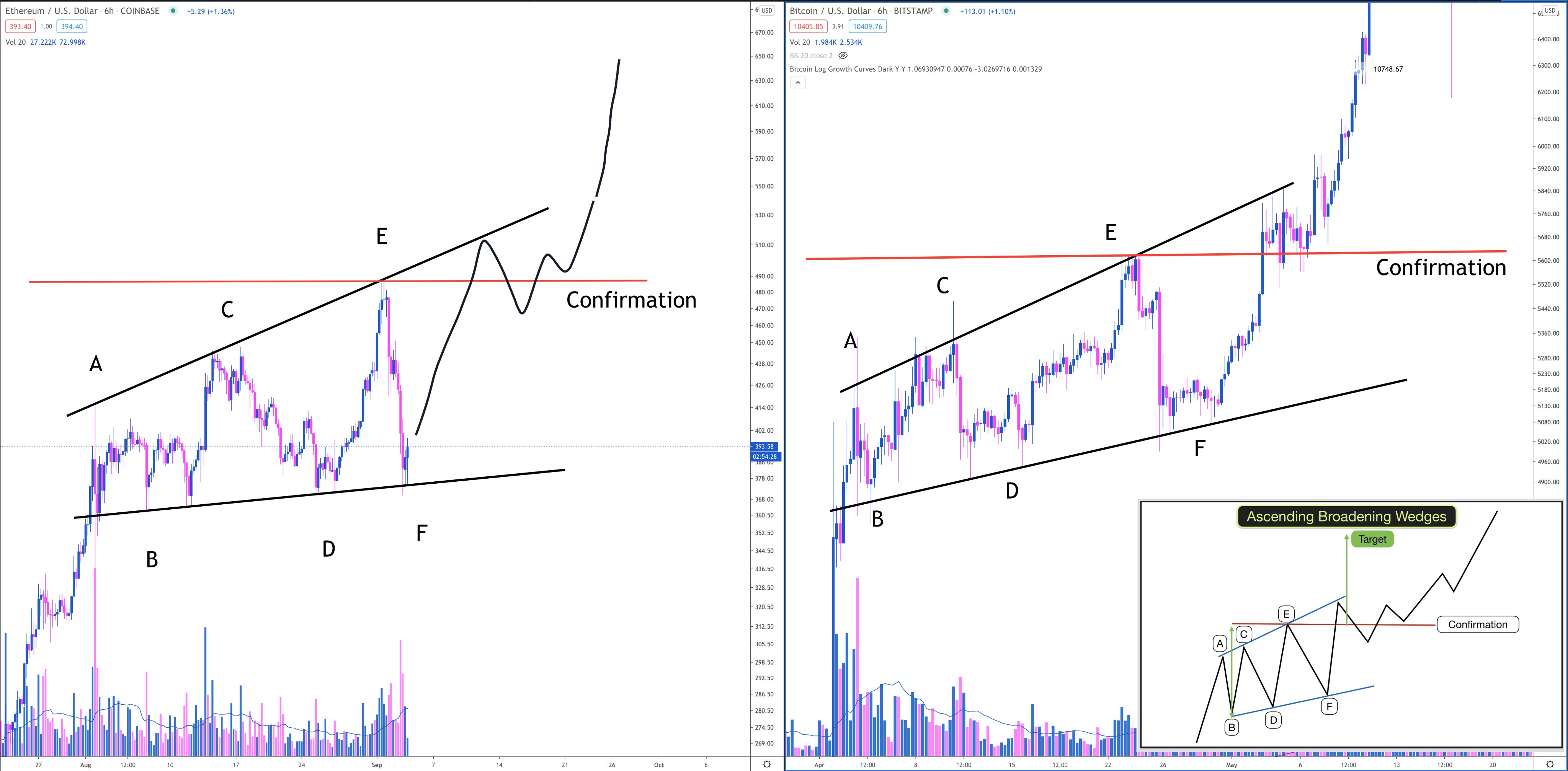

Related Reading: Ethereum Transaction Fees Surge to All-Time Highs After Uniswap Launch Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Top On-Chain Analyst: Bitcoin Is Primed to Decouple From Legacy Markets origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|