2020-8-20 07:00 |

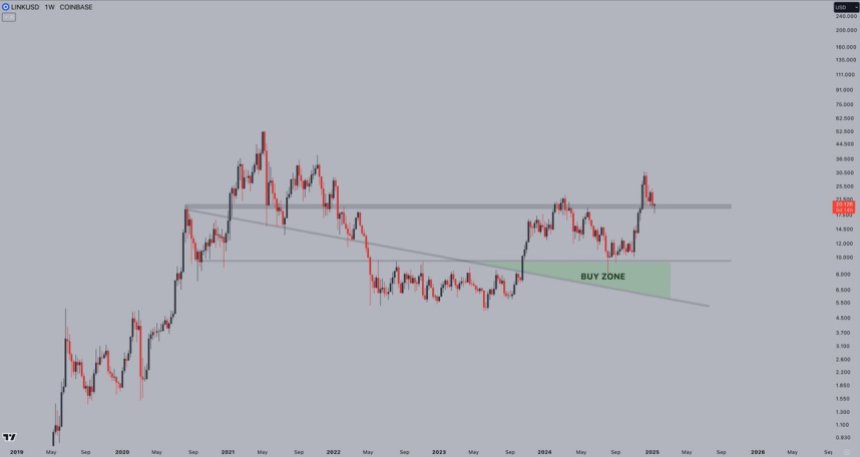

Chainlink has witnessed some intense volatility in recent days, with its strong macro uptrend stalling after it set fresh all-time highs of $20.00 earlier this week.

Part of this recent strength has been fueled by an influx of publicity from mainstream media outlets that have covered the cryptocurrency’s meteoric rise, as well as attention from social media stars like Barstool Sports founder Dave Portnoy.

Some believe that these are tell-tale signs of a top, but on-chain data regarding the cryptocurrency’s underlying strength seems to suggest otherwise.

While looking towards one historically reliable metric, it appears that LINK’s recent lows of under $15.00 may mark a long-term bottom and that the crypto’s trend is beginning to shift back into buyers’ favor.

Chainlink posts strong price action as analysts eye further upsideAt the time of writing, Chainlink is trading up just under 4% at its current price of $16.80.

This marks a notable upswing from daily lows of under $15.00 that have been tapped on multiple occasions.

The cryptocurrency’s ability to form a strong base of support at these lows is a positive sign that suggests upside may be imminent in the near-term.

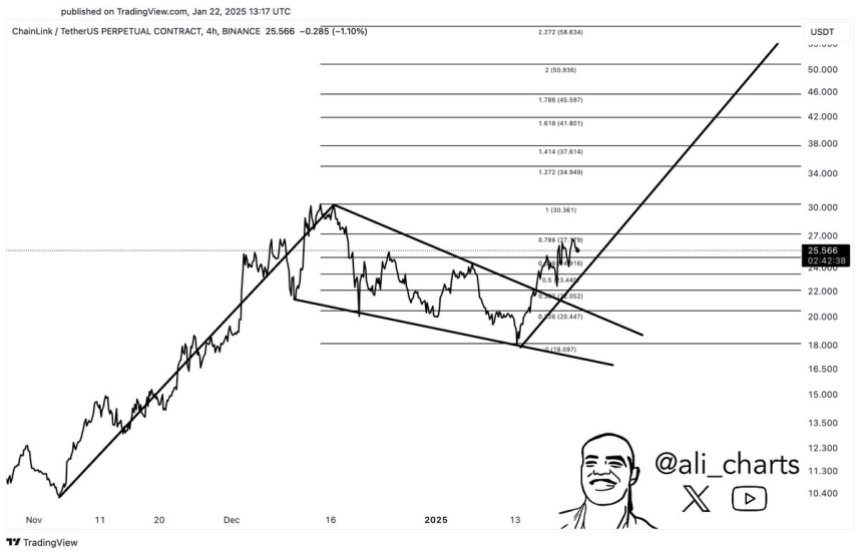

As seen in the below chart from TradingView, throughout the past 24-hours, LINK’s price tapped the $15.00 level on three occasions. Each time it incurred a notable influx of buying pressure that helped it rebound.

Chart via TradingView.Despite showing signs of short-term strength, it still has a long way to go before it can reclaim its all-time highs of $20.00, which sit just under 20 percent above where it is currently trading.

These highs were tapped on two brief occasions, with each one resulting in a swift rejection. A firm break above this level may mark the start of Chainlink’s next leg higher.

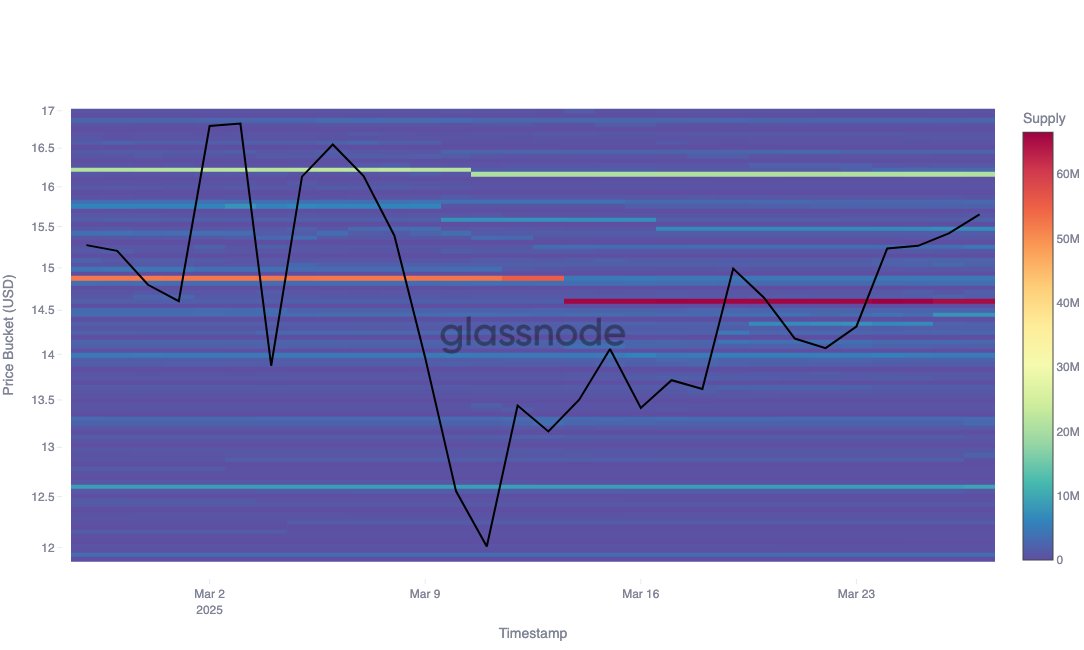

On-chain data shows that LINK may be kicking off a fresh uptrendData from the blockchain analytics platform Santiment indicates that Chainlink’s recent downturn may be fleeting and followed by a bull-favoring trend reversal.

While looking towards the cryptocurrency’s Token Age Consumed indicator, a sharp spike in this metric can be seen over the past couple of days. Santiment spoke about this in a recent post, saying:

“Coinciding with the bottom of LINK’s rare major 16% drop (which many are referencing as THE dip buy opportunity), the largest token age consumed spike in 3 months occurred ~7 hours ago. Price is volatile, as is the corresponding result of these spikes.”

Data Source: SantimentThey further went on to add that “token age consumed spikes often precede price direction changes,” with this spike’s positioning at the bottom of the selloff indicating that Chainlink may now be able to resume its uptrend.

The post This on-chain metric suggests Chainlink is ready to extend its uptrend appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) íà Currencies.ru

|

|