2020-5-7 19:00 |

The immense volatility seen by Bitcoin and the aggregated crypto market throughout 2020 has led to a major shift in dynamics seen amongst market participants, with many retail investors fleeing exchanges as they lose trust in centralized entities and begin adopting a long-term “hodl” strategy.

This has coincided with a major decline in legitimate trading volume on crypto exchanges throughout April.

Historical precedent suggests that this could be a warning sign for investors, however, as exchange volume declines have previously given significant insight into future price trends.

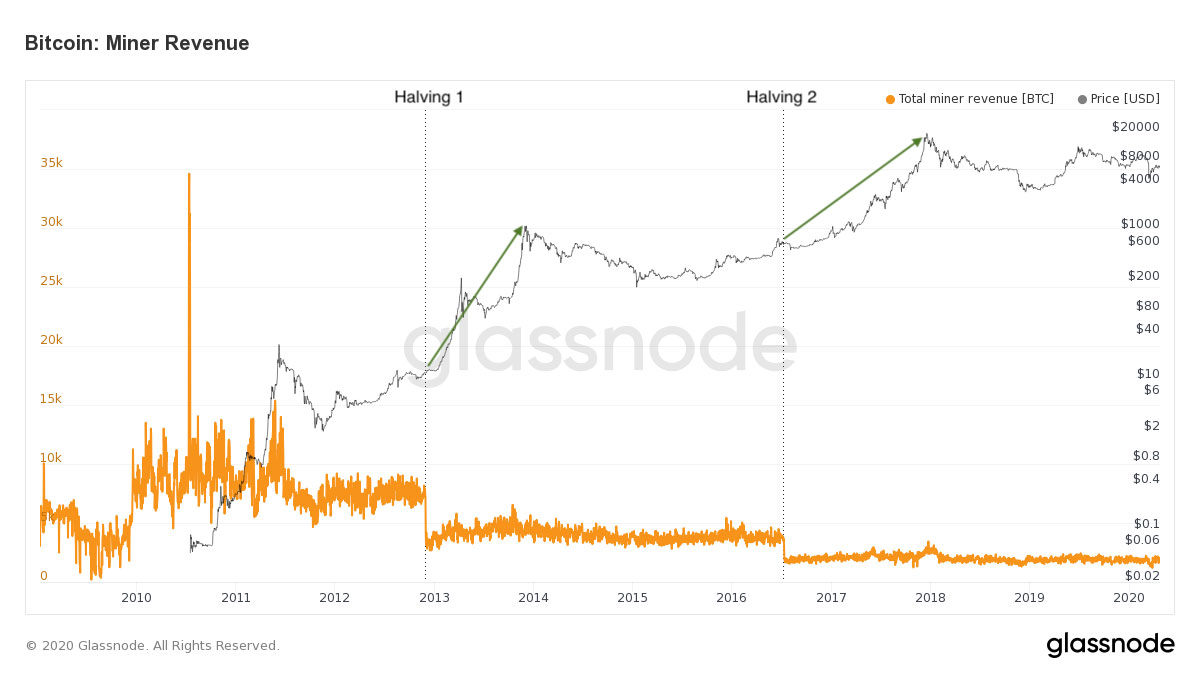

Crypto investors flee exchanges as trust in centralized entities degradesData from research and analytics platform Glassnode elucidates that crypto outflows from exchanges have been reaching unprecedented levels, with the balance of BTC on these platforms now hitting fresh six-month lows.

Image Courtesy of GlassnodeThis overwhelming decline suggests that traders are moving their Bitcoin to cold storage wallets – a sign that they are not planning to actively sell this crypto anytime soon.

Besides this being the potential result of investors taking a long-term approach to the market, it also may be the result of degrading trust in centralized entities.

As CryptoSlate reported last week, popular crypto platform BitMEX has been losing considerable market share in the time following the mid-March meltdown that sent Bitcoin to lows of $3,800.

Many analysts have since pinned the cause of this sharp plunge on a cascade of liquidations seen on BitMEX, with news surrounding this leading investors to grow wary of relying too heavily on centralized platforms.

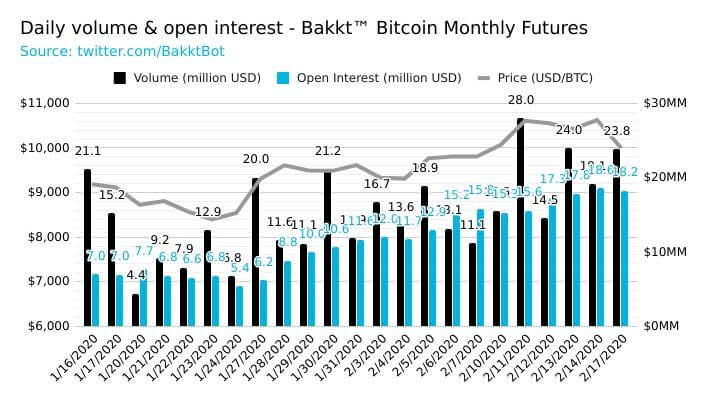

As a result, Bitcoin’s open interest on margin platforms has since dived towards all-time lows, signaling that active traders have also moved to the sidelines.

This volume trend seen on exchanges hints that a downtrend could be loomingCrypto exchanges have also seen a notable decline in legitimate trading volume throughout the last month, leading one researcher to conclude that this could be a grim sign for the entire market.

Larry Cermak spoke about this trend in a recent tweet, explaining that trading volume on top platforms declined nearly 30 percent between March and April.

“Legitimate volume on cryptocurrency exchanges has seen a steep decline in April, which has historically never been a good sign. Down 28.4% vs. March.”

Bitcoin’s spot volume largely remained under $200 million per day in April, via SkewAlthough trading volume is still up from where it was in January, sharp declines over a one-month period have historically marked the start of shifts in the market’s mid-term trend.

The post This crypto exchange volume trend could be a major warning sign to investors appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|