2020-2-28 00:00 |

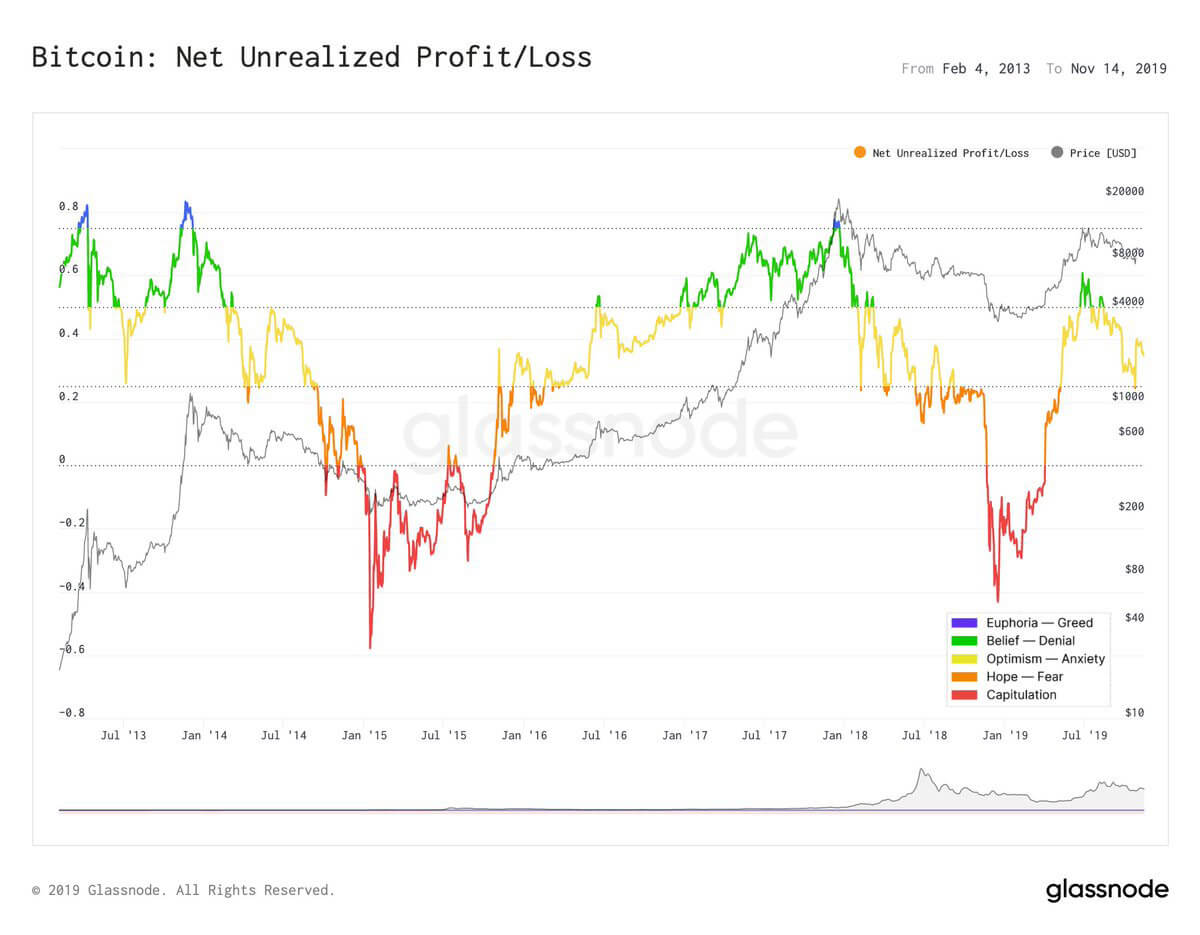

Bitcoin (BTC) has found some stability in the time followings its capitulatory selloff seen over the past few days, with bulls stepping up and ardently defending against a drop below $8,800 – which appears to have become a near-term support level for the cryptocurrency. Analysts are now noting that the ongoing pullback has led BTC’s price right to where it is “supposed to be,” with it still maintaining above a key growth curve that has been guiding its decade long uptrend. This comes as investors begin growing highly fearful, which is typically a bullish sign that can be used as a counter-indicator. Bitcoin Stabilizes Around $8,800 as Investors Grow Fearful At the time of writing, Bitcoin is trading down just over 1% at its current price of $8,880, marking a notable decline from daily highs of over $9,300. It is important to note that BTC has been able to find solid support within the mid-$8,000 region, with the cryptocurrency’s bulls posting a strong defense of this level during the intense overnight selloff. In the near-term, the crypto still remains in precarious territory despite its stability, with its ongoing downtrend doing significant damage to the highly bullish market structure that had been formed throughout the first two months of 2020. This recent movement has also done damage to the euphoria of many investors, with the crypto’s “fear and greed index” showing that investors are growing increasingly fearful. Mr. Anderson, a popular cryptocurrency analyst on Twitter, spoke about this in a recent tweet, saying: “BTC Fear & Greed: I would have expected an ‘Extreme Fear’ reading. Fear is reasonable at this stage. BTC is testing is Daily 200s and its 21-week ema w/ a monthly close this week as well. Expect turbulence up and down!” #BTC Fear & Greed I would have expected an "Extreme Fear" reading. Fear is reasonable at this stage.$BTC is testing is Daily 200s and it's 21-week ema w/ a monthly close this week as well. Expect turbulence up and down! pic.twitter.com/dI6abCB6p6 — Mr. Anderson (@TrueCrypto28) February 27, 2020 BTC Still Trading Well-Above Decade-Long Growth Curve It is important to keep in mind that Bitcoin is still trading significantly above a critical growth curve, with its current trading phase marking a bout of consolidation before it is able to begin climbing higher. Dave the Wave, another popular cryptocurrency analyst on Twitter, spoke about this in a recent tweet, explaining that it should “allay anxieties.” “Zooming out, price is exactly where it is meant to be [was predicted to be on the basis of the log growth curve and the lengthening cycle]. The macro picture should serve to allay anxieties [and restrain excitements] with the shorter term volatility,” he explained while referencing the chart seen below. Zooming out, price is exactly where it is meant to be [was predicted to be on the basis of the log growth curve and the lengthening cycle]. The macro picture should serve to allay anxieties [and restrain excitements] with the shorter term volatility…. pic.twitter.com/qv80Xqu3WT — dave the wave (@davthewave) February 27, 2020 If Bitcoin continues inching lower in the near-term, it is probable that investors’ fear will continue to mount, potentially acting as a bullish counter-indicator. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|